Deal Flow Management Software for Investment Firms

Features, Development Options, Costs

ScienceSoft engineers tailored deal management systems that address the common drawbacks of off-the-shelf tools, such as generic features, pre-defined integrations, and limited control over software evolution. Our architects define the optimal technology stack and development path for each firm to ensure solution security, interoperability, and adaptability.

Deal Flow Management Software: Brief Overview

Deal flow management software is used to orchestrate and automate institutional investor workflows across deal opportunity sourcing, due diligence, fundraising, execution, and post-close analytics. It provides a centralized view of deal pipelines and includes collaborative deal handling tools.

- Key integrations: CRM, portfolio management software, opportunity distribution and market data platforms, regulatory databases, and more.

- Implementation time: around 7–15 months for core software modules.

- Development costs: $150,000–$2,000,000+, depending on solution complexity. Use our free calculator to estimate the cost for your case.

Why Investment Firms Choose to Build Proprietary Deal Management Solutions

Investment entities go for proprietary deal management software when off-the-shelf software products fail to support their complex, cross-border deal flows, non-standard private market vehicles, or unique digital development models.

- Tailored deal solutions can accommodate diverse asset classes, including special-purpose instruments, structured vehicles, or crypto derivatives and tokenized RWAs (if needed).

- Proprietary systems can be built to support regulations relevant to the firm’s activities, including local frameworks (e.g., SEC and FINRA for the US, MiFID II for the EU, CMA for the KSA) and domain-specific rules (e.g., AIFMD directive for the EU alternative funds).

- Unlike ready-made suites, tailored solutions can be integrated with any necessary software, including legacy tools, modern fintech services, and local data sources.

- Tailored deal management software gives the company full ownership over the automation logic, data models, and system security, meaning functional and technical upgrades can be implemented flexibly and without vendor-release delays.

- Investment companies increasingly favor proprietary software to leverage tailored deal automation features powered by artificial intelligence (AI). Tailored AI-powered systems can employ the models that are trained on or can securely access the company’s proprietary data. Empowered with firm-specific contextual feeds, the models can offer insight relevance rates that general-purpose intelligence cannot achieve.

Major ROI Drivers for Investment Deal Management Solutions

ScienceSoft’s consultants estimate that tailored software for investment deal flow management can drive to the following key operational benefits through dealing process automation:

Entities That Benefit From Tailored Investment Deal Systems

Core Features of Investment Deal Management Software

Below, ScienceSoft’s consultants shortlist the investment deal management solution capabilities we see the most demand for from institutional investors among our clients:

Partner network management

Using deal software, teams can organize and maintain the firm's network of potential investors, co-sponsors, lenders, legal firms, and advisors, applying custom partner hierarchies and multi-party relationship maps. The solution automatically aggregates counterparty data, runs KYC/AML, OFAC/PEP, and insider list checks, creates partner profiles, and populates them with deal-relevant details. Custom systems can support dynamic, graph-based visualization of partner connections, conflicts-of-interest detection, and analytics-driven partner triaging for outreach based on engagement potential.

Capital formation

Capital raising teams can generate pitch decks, offering memoranda, and term sheets from customizable templates. The software pre-checks the materials against the SEC Marketing Rule, publishes them across offering distribution platforms, and prepares tailored submission packages for target investors. Custom solutions can automatically process and register omnichannel investor commitments, validate subscriptions against internal eligibility rules and regulatory constraints (e.g., Reg D 506(c) for accredited investor verification), and issue subscription confirmations.

Deal solutions automatically capture multi-format data relevant to opportunity research from connected internal systems and third-party sources. They scrape the narrative content using optical character recognition (OCR), extract the required structured metrics, double-check data quality, and present insights in interactive screening dashboards. Teams can filter deal options based on custom criteria like analyst ratings, ESG exposure, or OFAC risk. The software may support multi-factor, cross-asset filtering and export opportunity lists directly to deal models.

Deal analysts can apply standardized modeling frameworks such as LBO, DCF, DDM, and Monte Carlo, or create custom statistical models with specific parameters and macro overlays (e.g., SOFR, FX rates) to project future deal performance. The software calculates the necessary yield and risk metrics and can run real-time what-if analysis, stress testing, and benchmark comparisons for asset fundamentals, capital structures, leverage scenarios, and exit strategies. It scores prospective deals based on firm-specific formulas and routes selected options for valuation.

Deal valuation and planning

Customized solutions can automate deal valuation based on established methods (e.g., DCF, GPC, NAV, replacement cost) or the entity’s proprietary models. They can automatically consolidate deal-relevant historical value feeds, market comparables, and independent appraisals and calculate deal value in compliance with ASC 820 and IFRS 13. For leveraged transactions, the software can calculate time-framed debt capital needs, repayments, and hedging amounts. Users can create tailored deal plans with key milestones across origination, closing, and post-close.

Due diligence and underwriting

Deal underwriters can create interactive checklists tailored to distinct asset classes and jurisdictions, with adaptable questions across financial, commercial, operational, legal, tax, and ESG assessments. They can auto-upload checklists and deal-source documents to secure, permissioned virtual data rooms (VDRs) and co-review potential deals with investment committee members and advisors. Custom systems can auto-validate due diligence submission and decision evidence packs, flag missing or inconsistent data, and gate underwriting sign‑off until critical issues are resolved.

Deal document management

Deal software automatically generates deal documents (NDAs, LOIs, purchase agreements, investors’ rights agreements, etc.) and routes them for review to the assigned parties based on preset approval chains. Users can apply tags and metadata for streamlined document organization and search. The solution can support automated document watermarking, multi-party e-signing, version tracking, and granular access control. Robotic process automation (RPA) can be applied to retrieve deal terms from finalized documents and write them to structured deal registries.

Deal execution and closing

Tailored solutions can automatically convert deal terms into role-specific execution tasks, assign task owners, and track completion milestones. They can compose closing document sets, capital call and ownership transfer instructions, deal metric packs, and compliant HSR files and submit them to the relevant deal participants and connected systems. Configurable alerts notify executives about pending deal tasks. Post‑close, the platform reconciles settlement data with deal facilitators and continuously tracks adherence to value-making, reporting, and exit cadences.

Deal flow pipeline monitoring

Deal stakeholders can trace collaborative activity logs and track staged deal pipeline progress (e.g., NDAs signed, due diligence completed, capital calls distributed) using interactive dashboards. The software calculates and forecasts metrics like deal velocity, throughput, approval cycle duration, average time‑to‑close, conversion rates by source, and pipeline value (by sector, fund, region, etc.). Custom solutions can run continuous pipeline diagnostics, identify bottlenecks in the deal-handling process and SLA breaches, and escalate issues to task owners and management.

Post-close deal performance oversight

Deal software monitors the performance of individual deals and deal portfolios (NPV, MOIC, DPI, TVPI, ESG impact, leverage utilization, debt paydown, NAV facilities, FX/IR hedge, etc.). It compares actual metrics to projections and flags areas of variance that require intervention. Predictive engines detect early signs of deal underperformance, exposure concentration, covenant breaches, and liquidity stress, enabling proactive action steps. Analytical dashboards offer an aggregated view of deal KPIs with slice-and-dice options for multidimensional data visualization.

Investor interaction and reporting

Proprietary deal platforms centralize investor data and documents, log investor communications, and track individual aspects, including channel preferences, subscriptions, contracts, and capital contribution behaviors. Relationship specialists can automatically generate tailored investor reports (investment performance snapshots, capital account summaries, distribution statements, ILPA and K-1 packages for limited partners, and more). The software enables report auto-localization, conversion to the chosen format and currency, and scheduled delivery through secure channels.

Convenient self-service options let investors self-onboard, manage account details, access offering documents, subscribe to investment products, and view investment statements. Users can communicate with investment professionals via in-portal live chat and virtual conferencing tools and securely delegate access to their advisors. Custom portals can accommodate live investment performance dashboards to introduce real-time reporting. Multi-factor user authentication with push notifications and single sign-on (SSO) can be applied to reduce logging friction without compromising data protection.

Custom compliance engines continuously validate the adherence of entity operations to internal Code of Ethics and required regulations, including local standards (e.g., federal AML/CFT and OFAC rules, SEC and FINRA provisions, MNPI policies, and ESG disclosure guidelines for the US). They automatically spot and report compliance breaches across areas such as investor KYC, advisor attestation, investment advertising, due diligence, fund transfers, and regulatory filings. Dynamic dashboards provide compliance teams with real-time visibility into risks, exceptions, and breaches.

Customized systems can automate end-to-end deal data governance, including data quality and security checks, in compliance with NIST, SOC 1/2, ISO 27001, SOX, CCPA, NYDFS, GDPR, and more. The data and the software are protected via role-based access controls, multi-factor authentication, data encryption, and other security mechanisms. The system maintains a complete log of deal details and user activities in line with regulatory guidelines (e.g., SEC Rules 204‑2 and 17a-4) and generates audit-ready governance reports. For firms dealing with crypto assets, we can build an immutable audit trail on the blockchain.

How AI Can Reinforce Deal Flow Management

A recent study by MarketsandMarkets revealed that AI-powered deal management capabilities bring, on average, 3.2x ROI within 18 months for B2B deal-makers. Higher offering success rates, faster deal cycles, and reduced late-stage deal failures are named the major ROI drivers.

Based on ScienceSoft’s discovery estimates, investment firms can drive a comparable payback by extending their deal management software with the following AI features:

LLM‑supported opportunity data compilation

Custom solutions can be powered by large language models (LLMs) to automatically retrieve deal-relevant information from multi-format documents, visuals, market studies, news, audio and video files (e.g., earnings call records). LLMs auto-parse the collected materials, extract and summarize key facts (fundamentals, risks, sentiment), and compile pre-assessment packages for deal analysts and underwriters. They can also enrich opportunity profiles with publicly available alternative data, e.g., by summarizing customer sentiment for retail or service-sector investing.

Intelligent deal performance modeling and analysis

Tailored machine learning (ML) models can be applied to analyze opportunity fundamentals, market conditions, and counterparty risks and capture latent deal performance signals that statistical tools may fail to recognize. ML algorithms can dynamically rank opportunities by expected return and risk and highlight the major drivers for deal success. ML can also be applied in post-close analytics to evaluate deal performance and market movements, and to spot emerging exposures. The algorithms learn continuously from new deal data, ensuring ongoing output refinement.

AI‑assisted and autonomous operations

Upon a request from deal stakeholders, generative AI copilots can quickly find task-relevant data, prepare offering and deal qualification materials, and draft reports. They can provide context-aware suggestions on the best-performing opportunities, promising markets to enter, optimal exit timings, and pragmatic pipeline refinement steps. Agentic AI can be employed to automate multi-step operations that require reasoning, such as analytics-based opportunity shortlisting, leverage requesting, and resolution of multi-party issues. We implement this feature with human oversight and approvals to prevent operational and financial risks.

Fraud and compliance intelligence

Deal solutions can incorporate ML-powered anomaly detection, advanced graph analytics, and generative AI to uncover complex fraud patterns and compliance risks. AI models can analyze real-time deal, counterparty, and fund movement activities and flag issues such as synthetic identities, manipulative advisory, document tampering, last-minute wire changes, and hidden affiliations and circular relationships that may indicate conflicts or sanctioned parties. Intelligent risk triaging and alerting help compliance teams focus on high-risk, time-sensitive cases.

Prioritize explainable AI for control and compliance

Deal AI models must provide clear rationales for their outputs to prove the relevance and compliance of intelligent insights. At ScienceSoft, we use AI interpretability frameworks (e.g., LIME, SHAP) to trace model logic and explain why AI behaves as it does. By applying model drift monitoring tools and rule-based guardrails (basically, AI self-checks against deal-making policies), we ensure models operate within compliance boundaries. In my experience, managing AI within a structured governance framework (e.g., one aligned with the NIST AI RMF) greatly simplifies explainability risk management and improves audit readiness.

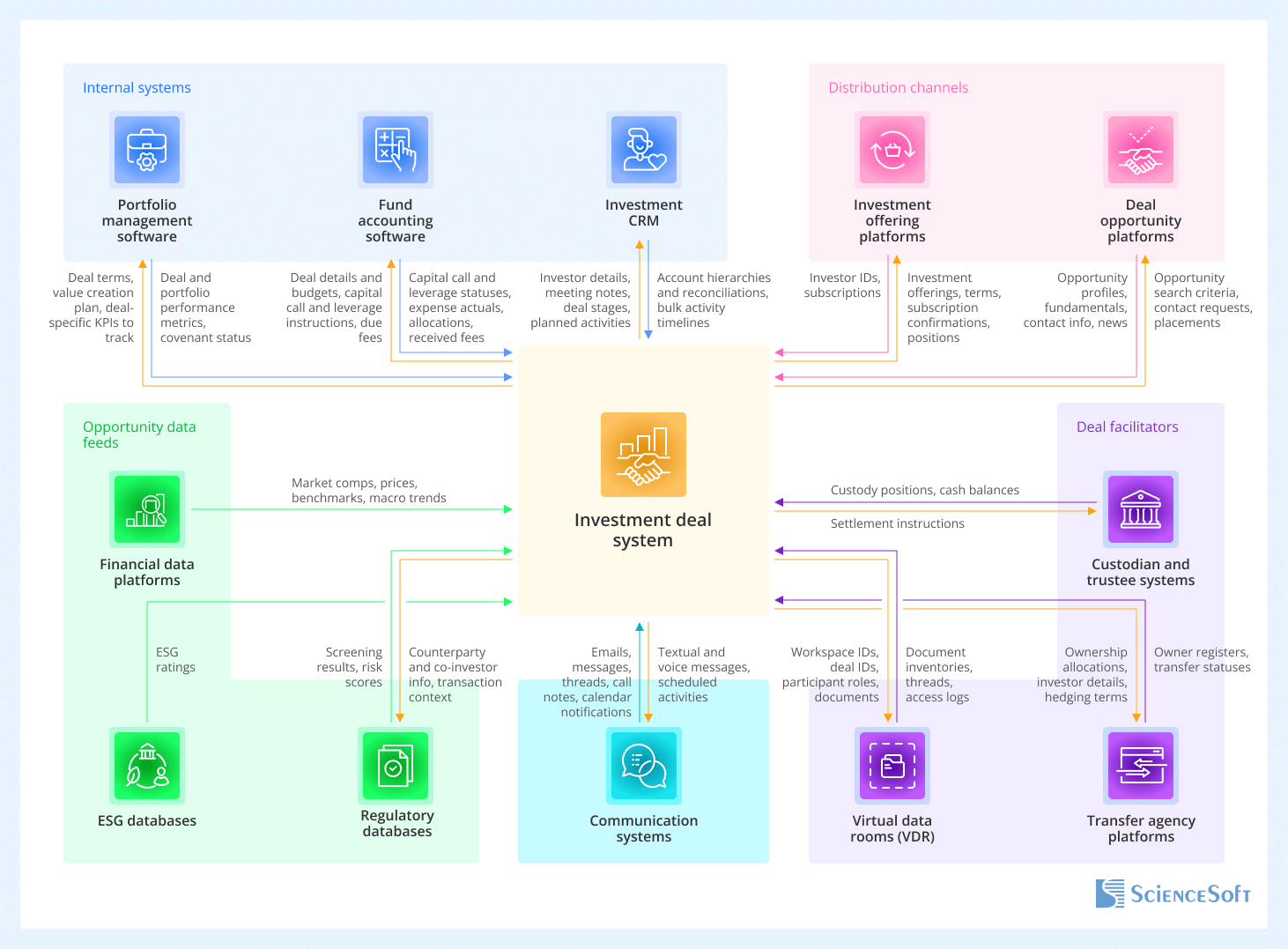

Important Integrations for an Investment Deal System

- Investment offering distribution platforms (e.g., fund websites and portals, third-party investment platforms, including alternative trading platforms) - to automatically distribute investment offerings and quickly process and confirm subscriptions.

- Deal opportunity data sources (e.g., referral networks, asset-specific databases (Crunchbase for startups, CoStar for real estate), advisors’ systems, alternative trading platforms) - to screen target market opportunities, aggregate asset and deal-relevant data, and quickly initiate deals.

- Financial and ESG data platforms (e.g., S&P Global, Pitchbook, Morningstar Sustainalytics) - to access the data necessary for dynamic deal valuation, due diligence, and investment performance modeling.

- Regulatory databases (e.g., AML/KYC databases, local OFAC databases, adverse media databases) - to check whether potential deal counterparties and co-investors satisfy the current regulatory requirements.

- Virtual data rooms (VDR) - to securely share deal documents, collaborate on due diligence, and track access logs and approval statuses.

- Transfer agency platforms - to align official shareholder and unit records with deal data and monitor transfer statuses.

- Custodian and trustee systems - to swiftly coordinate and reconcile deal settlements and monitor investor positions.

- Portfolio management software - to oversee post-close deal and portfolio performance and leverage these insights when sourcing and modeling new deals.

- Fund accounting software - to initiate capital call and debt financing activities and reconcile settlements, deal-related expenses, and capital utilization timelines.

NB: Entities focused on fund-based models, syndicated co-investing, and SPV deals may also need integration with fund administration and escrow systems to automate their non-standard capital call, distribution, and settlement activities.

- Investment CRM - to maintain a single source of truth for investor relationships and inform entity-wide investor interaction and marketing strategies.

- Communication systems (e.g., email, chat, business phone, working calendar) - to speed up deal-related communication and simplify adherence to communication plans.

Fully Custom vs. Platform-Based Deal Management Systems

There are two main approaches to building proprietary deal management solutions, and each has its benefits and limitations. Below, ScienceSoft’s consultants share a high-level comparison of the two.

|

|

Platform-based development |

Engineering from scratch |

|---|---|---|

|

Pros

|

|

|

|

Cons

|

|

|

|

Tech stack we use

|

|

|

The optimal path often lies in between

From my experience, most firms don’t need to go fully custom. Existing platforms like Dynamics 365 and Power Automate already have a good core for process automation, CRM, and data management. You can use these platforms for standard pipeline management, document controls, and investor relations. Add custom code only for your firm’s unique differentiators, like proprietary deal scoring algorithms or approval logic.

This hybrid path shortens the software’s time-to-launch and reduces TCO without locking you into the limitations of a single platform. Plus, basic security and compliance are inherited from the platform’s ecosystem, which also lowers the engineering overhead. In Microsoft-based setups, you also benefit from native integration with common business tools like Office 365 and Outlook. Consider lightweight Microsoft Azure Functions for streamlined custom development.

Developing everything from scratch is justified only when your operating model or data architecture is significantly different from what platforms can support. Examples include highly complex fund structures, special-purpose and emerging asset classes, and deeply embedded legacy systems that require unconventional integrations.

Best Practices for Deal Flow Management Software Development

Below, ScienceSoft’s consultants share best practices for creating reliable deal management software for investment firms. These apply regardless of your chosen development approach.

Reuse the logic for accuracy and faster development

You can split the core deal management logic into abstract components and reuse them across multiple software modules. This gets rid of the need to re-write similar logic flows several times and improves the accuracy and integrity of automated workflows. You can also configure selected updates to a shared logic to auto-propagate through the entire deal management system for streamlined maintenance and evolution.

Testing beyond the regular path gives a realistic picture

Deal software testing should verify non-standard metrics and scenarios, such as edge data quality, system performance under heavy loads, and partial failures in integrations. This helps confirm that the system will function correctly even in non-standard conditions. QA engineers at ScienceSoft aim for 90% or higher test coverage, including edge and corner cases, to ensure sufficient validation.

Communication between stakeholders should be open and regular

Complex projects that involve multiple stakeholders, such as deal management software development, may have issues due to inconsistent communication. Best practices here include documenting task owners and touchpoints, establishing clear meeting and reporting schedules, and setting up a shared knowledge repository to enhance progress visibility. Check ScienceSoft’s consulting project for an investment regulator who faced problems due to improperly organized communication between the development team members and investment stakeholders. ScienceSoft fixed it this way.

Costs of Investment Deal Flow Management Solutions

Developing deal management software for investment may cost from $150,000 to $2,000,000+, depending on the solution’s functional scope, the number and complexity of integrations, non-functional requirements (performance, scalability, security, compliance), and the chosen development approach.

Sample cost ranges

Here are ScienceSoft’s estimates for common deal flow software development scenarios:

$150,000–$350,000

Software built on an enterprise platform (e.g., Microsoft Power Platform, Dynamics 365) with some custom logic added via low-code tools.

- Focus on a single asset class and jurisdiction (e.g., US private equity, UAE real estate).

- Rule-based automation of core deal management workflows within standard platform modules.

- Integration with communication tools and corporate systems native to the platform vendor’s ecosystem (e.g., Outlook, Teams, SharePoint).

- Statistical analytics that rely on platform-supported tools (e.g., Power BI).

Operational costs: platform licensing fees.

$400,000–$800,000

Platform-based software with custom-coded modules for the company’s unique workflows.

- Support for 1–4 established alternative asset classes (e.g., private equity, private debt, venture capital) in a particular jurisdiction.

- Automation via pre-built and low-code workflows, custom rules, and integrated AI components.

- Integration with 5–15 corporate and external systems, including local financial data platforms and regulatory databases.

- Statistical and ML-powered deal analytics enabled via platform tools and custom algorithms.

Operational costs: platform licensing fees, optional extensions (e.g., AI/ML add-ons), cloud storage for custom components.

$800,000–$2,000,000+

Fully custom software engineered for multi-fund, multi-jurisdiction collaborative deal management operations.

- Support for 4–10+ alternative asset classes, including structured private market products or tokenized assets.

- Automation of multi-step workflows using conventional rules and tailored AI algorithms.

- Integration with 10–25+ corporate and external systems, including asset-specific distribution platforms and specialized databases (macroeconomic, AML, OFAC, ESG, etc.).

- ML-powered diagnostic and predictive analytics and intelligent optimization suggestions.

Operational costs: cloud storage for a custom solution.

Wondering how much your deal management software project will cost?

Use our online calculator to describe your needs, and we'll get back to you shortly with a tailored estimate. It’s free and non-binding.

Why Develop Deal Management Software With ScienceSoft

-

Since 2007 in engineering custom solutions for investment and wealth management.

- Among ScienceSoft’s clients is one of the top 3 global asset managers with $5T+ in AUM.

- Investment IT and compliance (SEC, FINRA, GLBA, SOC, etc.) consultants with 5–20 years of experience.

- 45+ certified project managers (PMP, PSM I, PSPO I, ICP-APM) with experience in large-scale projects for Fortune 500 companies.

- Principal architects with hands-on experience in designing complex investment systems and driving secure implementation of advanced technologies.

- 350+ software engineers, over 50% of whom are seniors or leads.