Real Estate Investment Management Software

Features, development steps, and costs

ScienceSoft’s clients get custom real estate investment solutions that address the functional, integration, and flexibility constraints of ready-made tools. We focus on software logic accuracy from day one, bake regulatory requirements into solution design, and apply API-first modular architectures to create interoperable software that will evolve in line with your business needs.

Real Estate Investment Software: Key Aspects

Real estate investment management software is used as a centralized platform for managing investor relationships, capital raising activities, portfolios, and deals. Such software automates processes like opportunity research, portfolio construction, deal execution, risk control, and reporting.

Custom real estate investment management software is the preferred choice for companies that want to orchestrate and automate multi-step workflows across proprietary capital formation, investment, and hedging strategies. Custom solutions can be built to support any required real estate types (residential, commercial, industrial, land), as well as emerging investment vehicles like tokenized real estate. They can be designed to cover the functionality of full-fledged property management software and provide a toolset for managing real estate capital projects.

Real estate investment firms often opt for custom software to implement artificial intelligence (AI) without the privacy and quality tradeoffs of market-available AI tools. Tailored AI solutions can autonomously screen opportunities, spot high-yield investments, handle due diligence, and suggest portfolio reallocations based on projected returns and market moves.

Another advantage of custom software is that it can be integrated with any required systems, including legacy software, third-party fintech tools, and IoT-supported asset tracking systems. Moreover, custom solutions can be natively designed in compliance with the local regulations (e.g., SEC for the US, CMA for the KSA). When your needs or regulatory rules change, such software can be quickly upgraded with new features or security measures.

- Key integrations: real estate brokerage platforms, market data platforms, asset tracking systems, custodians’ systems, and more.

- Implementation time: a pilot with core modules — 9–15 months on average; company-wide rollout — around 18–24 months.

- Development costs: $150,000–$3,000,000+, depending on solution complexity. Use our free calculator to estimate the cost for your case.

Companies That Benefit From Custom Real Estate Investment Software

Real estate developers

Real estate operating companies

ROI of Automation in Real Estate Investment Management

The Alternative Investment Management Association suggests that intelligent automation can become a key ROI driver for real estate investment firms, removing tedious routines and streamlining complex tasks that historically required deep human involvement. According to recent research by Morgan Stanley, traditional and AI-powered tools can fully automate 37% of REITs’ workflows across property management, trading, and investor administrative support.

In my experience, automated tools have the most visible impact on the speed and scale of real estate investing operations. Over the past few years, my investment clients and connections who had gone for intelligent automation in some shape or form have reported 2.5–10x faster servicing workflows, 30–75% higher operational efficiency, and as much as 50% employee time savings. For large investment managers with over 25,000 property units under management, freeing up so much human capacity can mean an up to 3x increase in capital formation.

Key Functionality of a Real Estate Investment Management System

Below, ScienceSoft’s consultants list the features of real estate investing software. Our team can engineer an all-in-one system from scratch or develop separate functional components to upgrade the software you currently use.

Adjacent modules

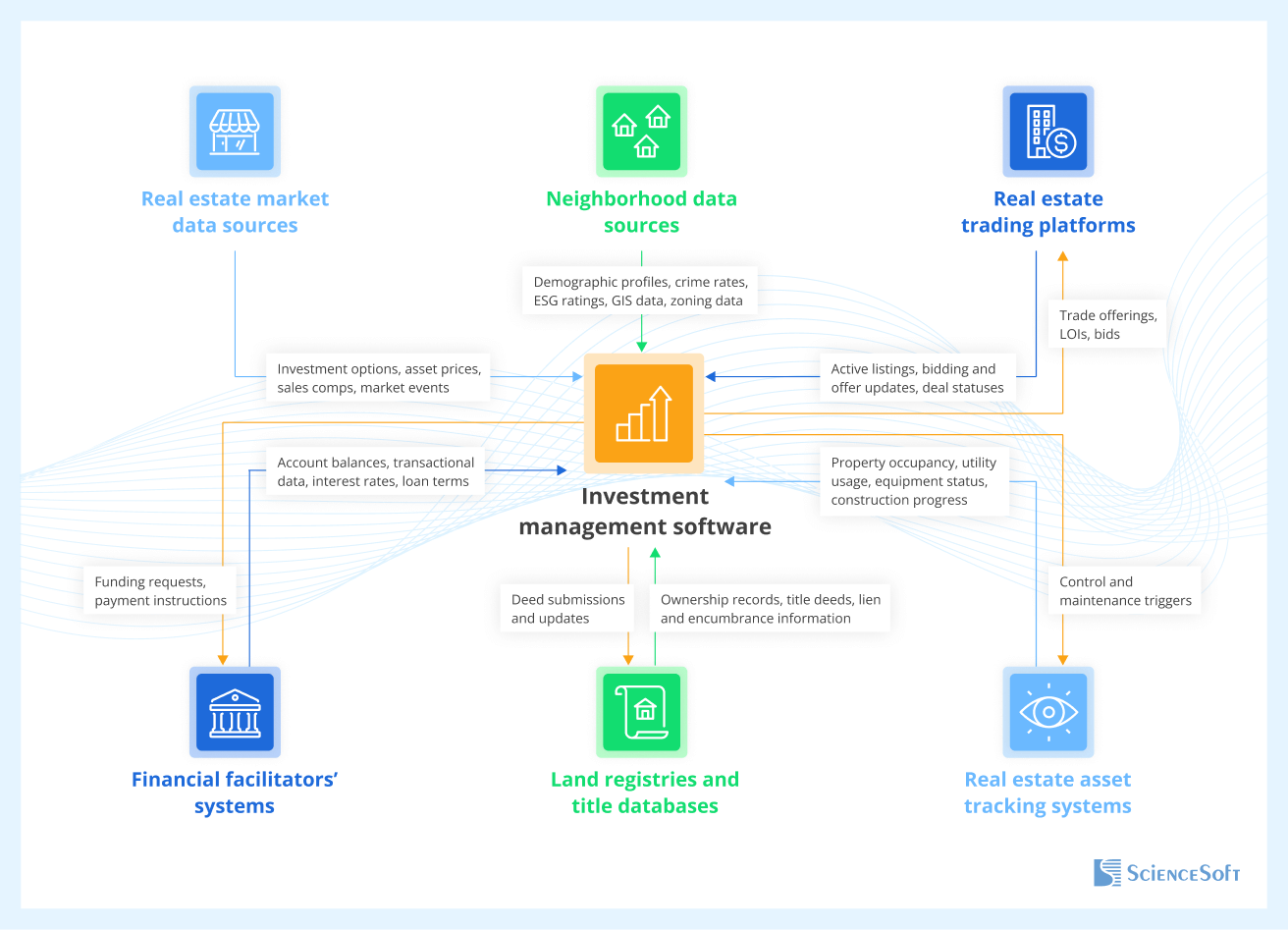

Important Integrations for Real Estate Investment Software

Real estate market data sources

E.g., MLS platforms (CRMLS, Bright MLS), aggregators (Zillow, Realtor, ATTOM), segment-specific databases (Bloomberg REIT & Real Estate Indices, CoStar for commercial property)

- To automatically fetch current market data for investment opportunity research, underwriting, asset and portfolio valuation, and risk prediction.

Neighborhood data sources

E.g., geospatial data platforms (Esri, MapInfo), socioeconomic databases (of census bureaus), ESG databases (GRESB, Sustainalytics)

- To quickly gather insights for accurate location scoring, off-market opportunity sourcing, fair property valuation, and predicting long-term real estate investment yield and risks.

Real estate trading platforms

E.g., brokerage platforms (eXp Realty, Compass), auction platforms (Auction.com, Bid4Assets), marketplaces (LoopNet, Fundrise)

- For streamlined real estate deal sourcing, origination, and execution.

- To track progress in deal execution and analyze investment outcomes.

Financial facilitators’ systems

Internal systems of custodians, banks, lenders, capital brokers, etc.

- To simplify and speed up capital raising, allocation, distribution, and loan repayment workflows.

- For streamlined reconciliation of real estate IBOR records against custodians’ records.

Land registries and title databases

E.g., federal and state registries, independent databases (ProTitleUSA, Cotality)

- For faster title verification and due diligence on real estate deals.

- To simplify the registration of deeds and transfer of title.

Real estate asset tracking systems

E.g., construction management systems, utility systems

- To continuously monitor real estate asset state, quickly reveal issues, and rapidly address them.

- For data-driven, proactive real estate management and identification of cost-saving opportunities.

The actual list of necessary integrations will vary for each company, depending on the firm’s needs and tool set. For example, you may choose to keep your current CRM or use a separate solution for property management. In such scenarios, specialized tools would require integration with your core real estate investment system to centralize operational data and avoid redundant manual entries.

Steps to Develop Real Estate Investment Management Software

Below, ScienceSoft’s Project Management Office shares a roadmap and best practices for implementing custom real estate investor software within predictable timelines and budget limits.

1.

Engineering software requirements

At this stage, investment IT consultants discover the real estate investment firm’s unique business needs and compose a software requirements specification (SRS).

- Make sure to interview the business users of the software (investor relations specialists, acquisition analysts, portfolio managers, property asset managers, etc.) alongside project sponsors. Doing this helps better grasp the employees’ daily operational needs and pain points that may require specialized software features. By understanding on-the-ground challenges, you ensure the software’s functional scope targets real bottlenecks from the start.

- By defining regulatory compliance requirements for the solution at this early stage, you ensure compliant software design from the outset. Missing this step may entail expensive rework at later stages, as some compliance mandates (e.g., providing audit trails for investment transactions and permissions for data access) are addressed at the architecture level. Compliance consultants at ScienceSoft analyze and map both the relevant data protection standards (e.g., GLBA, SOC 2) and domain-specific operational regulations (SEC, FINRA, SOX, etc.), including local ones like CMA rules for the KSA investment firms and niche ones like Reg CF guidelines for trading fractionalized real estate.

- Early auditing of the firm’s currently used software helps identify improvement opportunities and optimize the implementation strategy. For example, in a software project for a US hospitality investment manager, this approach helped ScienceSoft’s team reveal persisting issues in the client’s old reporting tool. Thanks to the quick fixes we introduced to that tool, the company got 2x faster reporting well before the new solution went live. A deep look into the firm’s IT landscape allowed us to plan a budget-friendly rollout roadmap: the new software was initially deployed on-premises to speed up business gains, then gradually transitioned to the cloud to cut its operational costs.

2.

Technical and UX/UI design

This stage focuses on designing software business logic and architecture, selecting the tech stack, and composing UX and UI prototypes for the real estate investment management system.

- Multi-functional real estate investment software typically offers vast opportunities for business logic reuse. For instance, the same property valuation models can feed both underwriting and risk analytics, yield calculation formulas might apply to different real estate asset classes with minimal tweaks, and back-office portfolio performance assessment logic can be reused in the investor portal dashboards. Sharing logic components where feasible is how ScienceSoft drives investment software accuracy, trims development efforts, and preserves the integrity of software logic during its future iterations.

- Software for real estate would benefit from modular architectures (SOA, microservices, modular monolith) that support logic reuse and enable independent development, scaling, and upgrading of functional components. Modular design lets you speed up delivery, ensure smooth software performance, and extend the solution’s useful life. Plus, modularity means you can establish fine-grained access controls, which is crucial for REITs and real estate investment advisors, who face heavy regulatory scrutiny. Hybrid architectures often strike the right balance: for example, latency-sensitive valuation processes can be kept in a modular monolith for speed, and investor reporting can be offloaded to microservices for cost-effective scalability. Check how ScienceSoft’s architects select the best approach for each particular case.

- The tech stack is one of the major points for project cost optimization. By using low-code platforms (e.g., Microsoft Power Apps), proven APIs (e.g., the MLS API for market data, the Attom API for property fundamentals), ready-made logic building blocks (e.g., QuantLib formulas, TensorFlow’s ML components), OOTB UI components (e.g., Zillow’s pre-built charts), and reusable deployment scripts, you can cut down on costly custom code and speed up development.

- Real estate investment processes are data-intensive and time-sensitive, so good UX/UI design must minimize friction at every step. Designing straightforward, linear workflows that let users switch effortlessly between deal docs, property data, and investment performance dashboards fosters operational efficiency. By applying adaptable layouts (context-aware interfaces, customizable dashboards, configurable modal windows, etc.), you can accommodate the needs of different user groups within a single platform without inflating design efforts.

Given the complexity of inputs and calculations in real estate investing, UX and UI design should be tightly aligned with back-end logic. Here at ScienceSoft, UX/UI designers always work together with data engineers to ensure the solution’s analytical models, dashboards, and document templates surface the right data mappings and calculations, with no disconnect between interfaces and source data.

3.

Project planning

Project managers map the scope of development tasks, define the resources needed to deliver real estate investment software, and estimate project timelines and budget.

- Developing a fully-featured real estate investment platform is typically a lengthy endeavor with a high degree of uncertainty. Applying an Agile project management approach allows you to accelerate delivery, adjust priorities on the fly, and adapt to changing requirements without derailing the entire plan. Over 90% of ScienceSoft’s investment software projects have been managed under Agile frameworks and were delivered within the agreed timelines and budgets.

- A solid risk response plan is a must to prevent project disruptions and software degradation during development. PMs at ScienceSoft proactively plan mitigation steps and contingencies for both known and potential risks, including regulatory shifts that affect digital investment operations and evolving investor expectations, which may entail changes in functional and UX/UI design.

It’s natural for stakeholders to request changes as they see the software take shape, but there’s a danger of new ideas diffusing project focus and slowing down progress. We’ve observed the consequences of poor change control in our practice: in one project, the investment market regulator had no formal mechanism to filter new requirements for their software, and the result was uncontrolled scope creep that derailed the schedule and budget (ScienceSoft’s PM consultants later stepped in to get the project back on track). The lesson is clear: agreeing on a change budget and a structured procedure for scope adjustments from the start will protect your project from runaway expansion.

4.

Development and testing

At this stage, developers code the back end of real estate investment management software (including specialized components like ML models for portfolio performance forecasting or smart contracts for real estate tokenization). They also create user interfaces and set up scalable data storage. Comprehensive testing is carried out to ensure the software functions as intended.

- Implementing DevOps (CI/CD pipelines with infrastructure as code, container orchestration, etc.) helps speed up development, testing, integration, and deployment operations. It also eliminates manual errors and minimizes bug and regression risks in production releases. Engineers at ScienceSoft selectively automate development tasks to optimize costs and prevent software quality issues. We also integrate security into DevOps at every development phase. Explore our DevOps best practices for deeper insight.

- At ScienceSoft, we tailor the QA approach for each project, yet apply the parallel testing strategy in all cases. By running QA activities in parallel with coding, you can catch and fix potential issues early, when they are easier and cheaper to resolve. In unit testing, prepare test data and scenarios that mimic real-world usage and aim at a test coverage threshold of 95%+ to ensure sufficient testing for edge cases (overlapping lease periods, tiered promote structures, etc.). For solutions that deal with sensitive data and transactions, security testing is a must to ensure there are no exploitable vulnerabilities left in the code and infrastructure.

- Well-organized collaboration between the project stakeholders keeps development efficient and transparent and prevents priority drift. In ScienceSoft’s practice, a formalized approach with clearly defined collaboration touchpoints, responsibilities, communication channels, and meeting cadences has always benefited complex investment software projects. We also set up regular knowledge sharing sessions to avoid the leakage of tacit development expertise.

5.

Integration and data migration

This is the stage where back-end engineers integrate the real estate investment management solution with the necessary systems. Additionally, you may need to migrate investment data from your existing system or spreadsheets to the new software.

- Most real estate data providers, brokerage venues, and finance facilitators offer ready-to-use APIs so that you can quickly integrate your investment management system with their platforms. If a certain system doesn’t have an API (say, if you plan to connect to your legacy in-house database of property appraisals), it’s possible to build custom connectors and dedicated ETL (extract-transform-load) pipelines. Integration testing is critical to verify that data is correctly transferred and that security (data encryption, access controls) is intact across systems.

- Consider migrating real estate investment data in small increments (e.g., one real estate class or one year of transactional data at a time) and during off-peak hours. This way, if anything goes wrong, it’s easy to roll back that slice of data without workflow disruptions. At ScienceSoft, data engineers establish automated pipelines for data migration and reconciliation (verifying record counts, key financial metrics, asset-portfolio relationships, etc.) to speed up the process and prevent manual migration errors.

6.

Pilot deployment (MVP)

At this stage, the real estate investment software’s core modules are released for a pilot run. Development teams configure the software infrastructure (servers, cloud services, security measures), execute final quality checks, and deploy the solution to the live environment.

- Regulatory frameworks can evolve during the course of a large-scale development project, especially in technology areas like AI and blockchain. Running a pre-launch compliance audit will let you double-check software adherence to the latest real estate investing regulations.

- Deploying the pilot for a limited group of users first offers safe solution testing in live settings. For example, you might initially enable the system for the commercial real estate portfolio team, while others continue with existing tools. The dual run of the legacy and new software lets engineers quickly spot data and functional gaps. From ScienceSoft’s experience, this approach also effectively combats user adoption issues. Check our real estate investment analysis software project to discover how deploying a new system to tech-savvy employees first helped gradually foster adoption among resisting teams.

- You need to establish robust network security solutions to protect your production environment. ScienceSoft’s security specialists recommend firewalls to control network traffic, IDS/IPS to monitor and block malicious activities, SIEM systems to aggregate and flag suspicious events, and intelligent UEBA to catch behavioral anomalies as a minimal robust tool set.

- Launch is not the end of the journey — after deployment, your real estate investment management software will require continuous support, maintenance, and evolution. Check out ScienceSoft’s dedicated page for ways to organize efficient L1–L4 support operations both for outsourced and in-house scenarios.

7.

Full-scale rollout

After the pilot is proven successful, development teams proceed with gradually deploying the real estate investment system across the entire organization. Testing procedures from the pilot phase are repeated here, but at a larger scale and across multiple environments. ScienceSoft also conducts role-specific employee trainings in the client’s preferred format (face-to-face, remote, hybrid) to foster wide adoption. The entire stage may take 3–10+ months, depending on solution complexity and the company’s scale.

Tech Stack for a Real Estate Investment Management System

Here are some of the techs and tools engineers at ScienceSoft apply to create reliable investment management software:

Low-code development

AI

Machine learning platforms and services

Machine learning frameworks and libraries

DevOps

Containerization

Automation

CI/CD tools

Monitoring

Blockchain

Smart contract programming languages

Frameworks and networks

Cloud services

Costs of Real Estate Investment Solutions

Developing custom software for real estate investment management may cost from $150,000 to $3,000,000+, depending on the solution’s functional scope, the number and complexity of integrations, as well as performance, scalability, security, and compliance requirements.

Here are ScienceSoft’s sample cost ranges:

$150,000–$400,000

Basic real estate software for investors built on a low-code platform like Microsoft Power Apps. It offers RPA-supported automation and statistical analytics across key operations like capital raising, portfolio management, accounting, and reporting.

$400,000–$800,000

A custom solution that automates the whole spectrum of real estate investment and management operations. It features intelligent data processing capabilities, rule-based automation for multi-step workflows, and ML-powered predictive analytics.

$800,000–$3,000,000+

A large-scale custom system that handles complex real estate investment workflows across deal, portfolio, trading, and operating areas. It offers AI-supported automation, optimization, and analytics features, including capabilities powered by IoT, big data, and generative AI.

Why Build Real Estate Investment Software With ScienceSoft

-

Since 2007 in engineering custom solutions for the investment industry.

- Investment IT and compliance (SEC, FINRA, GLBA, GDPR, SOC 2, etc.) consultants with 5–20 years of experience.

- 45+ certified project managers (PMP, PSM I, PSPO I, ICP-APM) with experience in large-scale projects for Fortune 500 companies.

- Principal architects with hands-on experience in designing complex investment solutions and driving secure implementation of advanced techs.

- 350+ software engineers, 50% of whom are seniors or leads.

- Quality-first approach based on an ISO 9001-certified quality management system.

- Robust security management supported by ISO 27001 certification.