Payment Gateway Integration for Mobile and Web Apps

ScienceSoft applies 36 years of experience in software integration and 20 years of experience in paytech to help companies integrate payments in their web and mobile applications — securely and with minimal disruption to business processes.

Payments Integration for a Web or Mobile App: Summary

Integration of payment functionality in a web or mobile application aims to help companies smoothly, quickly, and securely accept digital payments from customers.

Key project steps: Business needs analysis and requirements elicitation, integration conceptualization, project planning, tech stack selection, integration implementation and quality assurance, support and evolution of the integrated system.

Timelines: 2–5+ months, depending on the chosen approach to payment integration.

Cost: $20,000–$100,000 to integrate a market-available payment gateway, $100,000–$300,000 to build and integrate a custom payment gateway. Use our free calculator to estimate the cost for your case.

Team: a project manager, a business analyst, a solution architect, developers, a DevOps engineer, a QA engineer.

Online Payment Gateway Overview

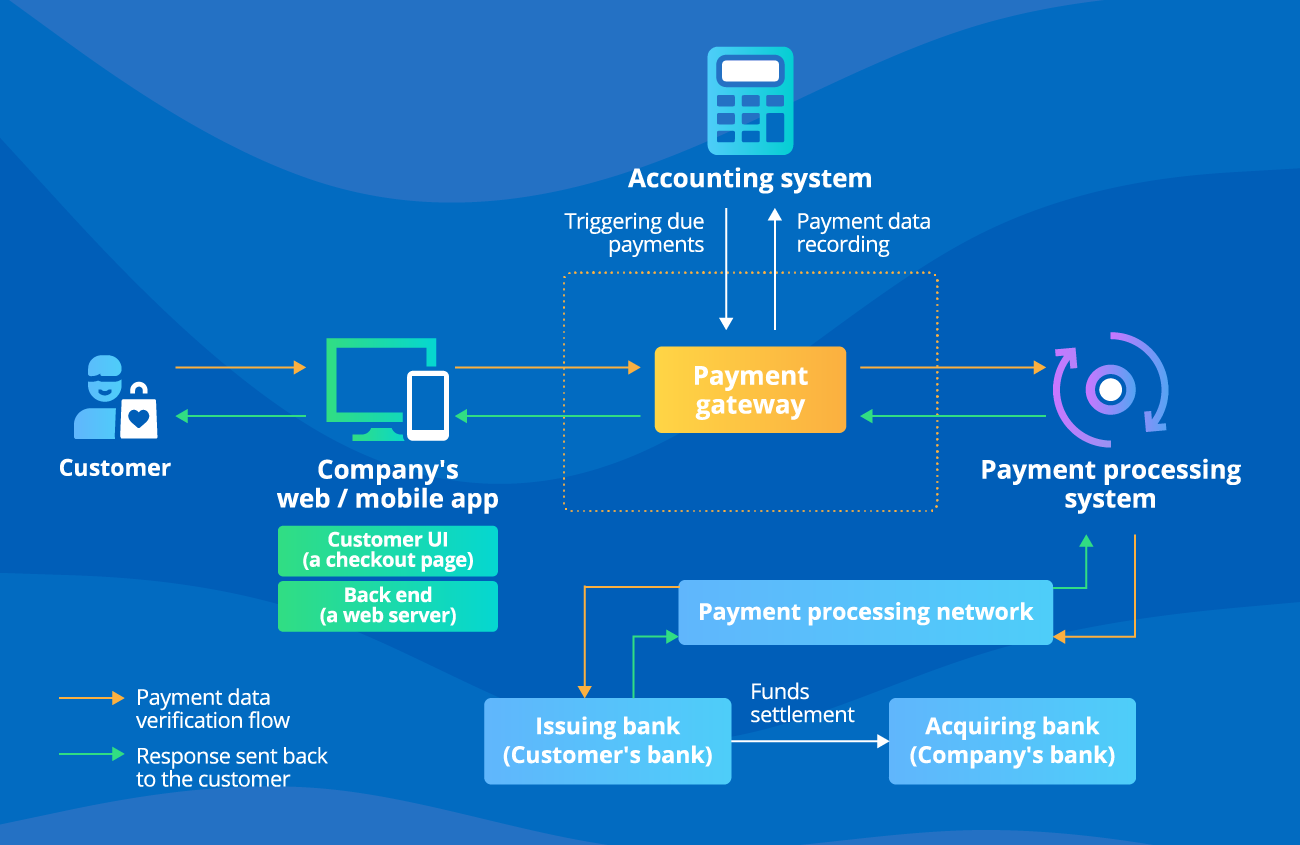

To enable payment functionality, your application should be integrated with an online payment gateway. Such software:

- Connects to a web and/or mobile application that hosts a checkout page to collect purchasing details, personal information, and payment data (e.g., credit card data) provided by customers.

- Encrypts sensitive data and transfers it securely to a payment processing system of an acquiring bank, an independent payment processing provider (e.g., PayPal, Stripe, Authorize.Net), or the company (in case of relying on in-house payment processing). The payment processing system verifies the customers’ personal and financial data and transmits transaction details to a payment processing network (e.g., a card network) that connects to the customer’s bank to finalize settlement.

- Integrates with an accounting system to instantly communicate data on successful payments and receive triggers to charge the recurring payments.

|

|

|

|

|

According to Capgemini, cash usage declined by 4x globally over the past decade. The shift in consumer and business preferences towards flexible cashless settlements, amplified by the rapid adoption of mobile techs and the growth of the ecommerce industry, drives the increasing popularity of convenient electronic payments. Mirroring the sectoral sentiment, MarketsandMarkets anticipates the global market of digital payments to grow at a CAGR of 11.8% and exceed $193.7 billion by 2028. For companies in all industries, introducing convenient web and mobile payment options for their clients becomes a must rather than a need to ensure excellent customer experience and keep a competitive edge. For payment software companies specifically, the payment gateway market, with its projected 22.2% CAGR over 8 years, becomes a lucrative niche to step into and quickly generate revenue. |

|

|

|

Sample Architecture of Online Payment Gateway Integration by ScienceSoft

There are two main approaches to integrating a payment gateway with your application, each with its benefits and limitations. Architects at ScienceSoft are ready to help you choose the optimal approach to meet your payment handling needs.

1. Integrating a market-available payment gateway

With this approach, you rely on a prebuilt payment gateway offered by a third-party payment processing provider (e.g., an acquiring bank, PayPal, Stripe, Authorize.Net) to handle customer payments. Such solutions offer ready-to-use APIs to facilitate and speed up integration with arbitrary apps and provide plug-and-play integrations with popular ecommerce platforms, accounting software products, analytical tools, etc.

Depending on the chosen payment gateway’s type – self-hosted or hosted – checkout can take place in your app or on a payment provider’s website. The former option provides a more consistent payment experience for customers and offers flexibility in terms of solution customization and branding. The latter option is more cost-effective as it doesn’t require maintaining a payment data storage infrastructure and achieving compliance with data security standards, such as PCI DSS. For more information, check our detailed comparison of hosted vs. non-hosted payment gateways.

Main benefit: A fast and easy way to integrate payments in the app with no investments in custom design of integration solutions and components (APIs, payment buttons, redirect scripts, webhooks, etc.).

Limitations:

- The need to pay fees for the payment gateway provider’s services, including a one-time gateway setup fee, a monthly gateway fee, a merchant account setup fee, and a fee for each transaction processed.

- Costly and lengthy integration with your legacy apps.

- Customizing a prebuilt payment gateway to the company’s business-specific needs may be effort-consuming or impossible.

2. Building and integrating a custom payment gateway

With this approach, we develop an online payment gateway from scratch and build custom APIs to integrate the solution with your required business applications. Integration with an external payment processing system is enabled by the ready-made APIs that a payment processing provider (typically an acquiring bank) provides.

Main benefits:

- Minimized operational and security risks due to complete control over the checkout flow, transfer and storage of sensitive data.

- Tailored functionality (support for all required payment methods, including cryptocurrency payments, recurring payments, refund processing) and required scalability, speed, and security of payment data processing to fully meet your unique needs.

- Flexibility to evolve the payment gateway and add new features when needed.

- Seamless integration with legacy web and mobile applications and corporate systems.

- No fees for the payment gateway providers’ services.

Limitations:

- The need to invest in custom solution design.

- Responsibility for setting up and maintaining payment data storage infrastructure, as well as obtaining PCI DSS compliance, is fully on your side.

As an alternative to custom payment gateway implementation, you may consider integrating your application with multiple prebuilt payment gateways. It could help overcome functional, non-functional, and geographical constraints of each particular ready-to-use solution. However, this option may appear economically unfeasible even for larger enterprises as it requires substantial investments in integration efforts and goes with large payment gateway license fees.

Specialized Apps That Benefit From Payments Integration

In web development since 1999 and in mobile development since 2005, ScienceSoft helps companies in 30+ industries design and build reliable web and mobile apps tailored to their business needs. Based on our experience, the following types of apps would benefit from the integrated payment functionality the most:

How to Integrate Payments for a Mobile or Web Application

During a typical payments integration process, ScienceSoft experts take the following steps:

Step #1. Conduct business analysis and requirements elicitation

Duration: 1–3 weeks.

ScienceSoft starts any payments integration project with a thorough analysis of a client’s needs and expectations. We closely collaborate with project stakeholders to collect the answers to the following key questions:

- What payment methods should the payment gateway support? (a credit/debit card, an e-wallet, crypto, etc.)

- In which regions should payments be available? (globally or in specific countries)

- What volume of transactions should the solution be able to process? (daily, monthly, during peak periods, etc.)

- Are there any specific requirements for the customers’ checkout experience? (in-app payments only or redirect is possible)

After that, ScienceSoft’s consultants analyze the company’s existing IT infrastructure and the applications to be integrated with an online payment gateway to understand their capabilities and constraints. Also, we define the data to be shared (customers’ personal information, credit card data, etc.), figure out how it should flow and whether it needs to be transformed into a different format.

One more important point to analyze is potential regulatory risks and compliance requirements. This helps ensure the online payment gateway will meet PCI DSS requirements for secure credit card payment processing, AML and KYC requirements to prevent payment fraud, other industry- and region-specific regulations.

Once the analysis is done, ScienceSoft’s consultants prepare a detailed list of requirements for the integration solution, which describes:

- All the payment capabilities the solution should provide.

- The required data inputs, outputs, and attributes of the online payment gateway.

- Non-functional requirements for the integrated system (availability, integrity, scalability, maintainability, performance, security, etc.).

Step #2. Conceptualize payment integration in the app

Duration: 2–5 weeks.

Upon forming a high-level vision, ScienceSoft proceeds with the design of a payments integration solution. This step involves making several important technical decisions:

- Deciding on the preferred type of an online payment gateway to integrate:

- a market-available payment gateway:

- a hosted payment gateway.

- a self-hosted white-label payment gateway.

- a custom payment gateway.

- a market-available payment gateway:

- (In case of opting for third-party software) Choosing an optimal prebuilt payment gateway according to the client’s specific criteria and business priorities. We at ScienceSoft perform a detailed comparative analysis of possible solutions to recommend the one that offers the required features and ensures economic feasibility.

- Defining the appropriate payment integration pattern depending on the selected type of payment gateway:

- Embedding payment buttons and redirect scripts into the checkout interface.

- Relying on ready-to-use integration APIs provided with market-available online payment gateways.

- Designing custom APIs to integrate custom online payment gateways or smoothly connect OOTB solutions with existing customer-facing applications.

A payment gateway type and an integration pattern, as well as functional and non-functional requirements for the payment solution, provide a basis for designing the integration architecture. At this stage, ScienceSoft also designs a custom payment gateway and creates a custom UI of a checkout page, if required.

Some companies may want to introduce offline mobile payments so that their customers can send payments without network connectivity. In this case, payment gateway integration in a mobile application will also involve planning dedicated features, e.g., to store transactions locally on the device and auto-sync them with the processing system once the device is back online.

Step #3. Plan the project

Duration: 1–2 weeks.

During this stage, ScienceSoft introduces a detailed integration project plan, which defines:

- Project deliverables.

- Project duration and budget.

- Critical milestones, objectives, and KPIs for the project.

- Project-associated risks and the ways to mitigate them.

- Expected TCO and ROI of the integration solution.

Step #4. Choose an integration tech stack

Duration: 2–3 weeks.

ScienceSoft defines the techs and tools required for web and/or mobile payment gateway integration, relevant back-office systems (e.g., accounting software), and an external payment processing system. We compare various integration techs and tools in the context of the documented business requirements and select the optimal ones.

To integrate payment gateways in Android and iOS apps quickly and cost-effectively, our teams rely on trusted SDKs (e.g., PayPal SDK, Stripe SDK, Braintree SDK) and prebuilt components (ready-made mobile UI components, building blocks for the app logic, OOTB deployment scripts, etc.) where possible.

Step #5. Implement payment integration and conduct quality assurance

Duration: 2–8 weeks, depending on the chosen integration pattern (custom payment gateway development and integration may be significantly longer than integrating a market-available solution).

The implementation of payments integration with ScienceSoft usually covers:

- Developing and deploying a custom web and/or mobile payment gateway (if required).

- Depending on the chosen type of payment gateway and an integration pattern:

- Developing and installing custom integration APIs.

- Setting up ready-to-use APIs.

- Building payment buttons, redirect scripts, webhooks, and other required components and incorporating them into the checkout interface.

- Establishing further integrations with the required solutions (a web and/or a mobile app, a payment processing system, accounting software).

- Implementing security tools (authorization controls for APIs, transaction validity confirmation mechanisms, DDoS protection algorithms, firewalls, IDSs / IPSs, DLP systems, etc.) to ensure the protection of the integrated system and the sensitive data it processes and stores.

ScienceSoft’s team performs quality assurance of each component of the solution in parallel with coding to eliminate possible vulnerabilities and logic errors and guarantee the proper functioning of all uni- or bidirectional queries between the connected applications.

Note: Before launching the payment features in your app, you need to establish a merchant account with a bank to receive customer payments. In the case of relying on a prebuilt payment gateway, you also need to establish a merchant account with a payment processor (e.g., PayPal, Stripe, Authorize.Net) to manage the received funds.

Prior to payment gateway implementation in the real environment, you need to achieve PCI DSS compliance. This is critical in the case of building a custom payment gateway or setting up a self-hosted OOTB solution.

Step #6. Provide after-launch support and evolution of the integrated system (optional)

Duration: continuous.

- Fixing payment gateway performance and scalability issues, if any.

- Adjusting the payments integration solution’s functionality to the changing business needs (e.g., adding new payment methods).

- Monitoring and maintaining payment gateway compliance with PCI DSS and other relevant data security standards and regulations.

Consider Professional Services to Integrate Payments for Your Application

Consulting on payment integration

Our consultants:

- Help you conceptualize a payments integration solution.

- Define the optimal integration patterns for a payment gateway.

- Determine the integration architecture and tech stack.

- Advise on an integrated system’s security.

- Help comply with PCI DSS and other relevant standards.

- Deliver a detailed payments integration roadmap for your app.

Payments integration

Our team takes over:

- Payments integration solution conceptualization and feature mapping.

- Integration architecture design.

- Custom payment gateway development (if required).

- Payment gateway integration with required systems and apps.

- Quality assurance of the integration solution.

- Payments integration launch and support.

- Further evolution of the integration solution (optionally).

Why Integrate Payments in the Application With ScienceSoft

- Since 1989 in application integration services.

- Since 2005 in engineering custom payment solutions.

- Since 2003 in cybersecurity to ensure world-class protection of payment app integrations.

- Practical knowledge of 30+ industries, including ecommerce, BFSI, healthcare, telecoms, professional services.

- Well-established Lean, Agile, and DevOps practices.

- A quick project start (1–2 weeks) and frequent releases (every 2–3 weeks).

- A mature quality management system and client data security backed up by ISO 9001 and ISO 27001 certifications.

Our awards, certifications, and partnerships

Typical Roles on ScienceSoft’s Payments Integration Teams

Project Manager

- Plans the project scope (goals, timeline, budget).

- Manages the project team.

- Controls the integration progress.

- Communicates with the stakeholders and reports the progress to them.

Business Analyst

- Elicits, prioritizes, and documents the requirements for the payments integration solution.

- Chooses an approach to payments integration (in collaboration with the solution architect).

Solution Architect

- Defines a payments integration approach (in collaboration with the business analyst).

- Architects the integration solution.

- Designs frameworks and processes to support the implementation of an integration solution.

Developers

- Write custom integration code (APIs, redirect scripts, etc.).

- (for prebuilt gateways) Set up triggers and choose resulting actions for payment data sharing.

- Develop the UI and the back end of a custom payment gateway.

- Fix code issues on a QA engineer’s notices.

DevOps Engineer

- Configures the infrastructure for the payments integration solution.

- Automates integration processes by introducing a CI/CD pipeline.

QA Engineer

- Designs and implements a test strategy, a test plan, and test cases for the payments integration solution.

- Verifies the integration solution’s adherence to the quality standards defined in the project plan.

NB! ScienceSoft is ready to provide additional talents, for example, UX and UI designers to design a checkout page for your application.

Sourcing Models for Payment Integration in the App

Tech Stack for Payments Integration in the Application

ScienceSoft’s team usually relies on the following tools and technologies to streamline payment integration into web and mobile apps and ensure the high quality of an integration solution.

Databases / data storages

SQL

NoSQL

Clouds

Real-time data processing

DevOps

Containerization

Automation

CI/CD tools

Monitoring

How Much Does It Cost to Integrate Payments in an App?

From ScienceSoft’s experience, each payment integration case is unique, so the cost factors vary for different customers. Below, we outline general factors that affect the cost and duration of payments integration projects.

Integration cost factors

- The chosen type of online payment gateway (hosted or self-hosted), which defines the integration pattern.

- The number and specifics of solutions to be integrated and the number of integration points.

- (for a custom payment gateway) Solution complexity and requirements for the UX/UI of a checkout page.

- The required modifications of the integrated apps, both on the technical level and on the app logic level.

- The chosen sourcing model (in-house, outsourced).

Operational cost factors

- Performance, availability, scalability, security requirements for the integrated system, which defines data processing and storage capacity and IT infrastructure security mechanisms.

- (for a market-available payment gateway) Setup fees for a gateway and a merchant account.

- (for a self-hosted payment gateway) The cost of maintaining PCI DSS compliance.

Integration of a market-available payment gateway costs around $20,000–$100,000, while the implementation of a custom payment gateway requires $100,000–$300,000 in investments.

Want to understand the cost of your solution?

Learn the Cost of Your Payment Integration Solution

Please answer a few simple questions about your business needs to help our experts estimate the cost of your custom payment solution faster.

Thank you for your request!

We will analyze your case and get back to you within a business day to share a ballpark estimate.

In the meantime, would you like to learn more about ScienceSoft?

- Project success no matter what: learn how we make good on our mission.

- Since 2005 in financial IT services: check what we do.

- 4,200+ successful projects: explore our portfolio.

- 1,400+ incredible clients: read what they say.

About ScienceSoft

ScienceSoft is a global IT consulting and software development company headquartered in McKinney, Texas. We provide end-to-end application integration services to help companies integrate payment functionality in their web and mobile apps and seamlessly accept digital payments from customers. In our projects, we employ robust quality management and data security management systems backed up by ISO 9001 and ISO 27001 certifications.