We cover every project step, from healthcare software design to its implementation. A solid project plan, a value-driving feature list, a reliable and secure architecture, full regulatory compliance, and high software performance are a given when you work with ScienceSoft.

Healthcare IT Solutions and Services

ScienceSoft provides healthcare IT consulting, development, support, and evolution services. We deliver secure, value-driven medical IT solutions, backed by ISO 13485, ISO 27001, and ISO 9001 certifications.

Key Facts About ScienceSoft

One Partner to Meet All Your Healthcare IT Needs

Healthcare IT services by ScienceSoft cover every aspect of medical technology management, from IT strategy planning to software development, modernization, and support.

Healthcare IT consulting

Whether you want to polish your approach to ITSM or launch a new medical app, ScienceSoft's consultants with 5–20 years of industry experience will ensure the success of your initiative.

- IT strategy consulting

- Technology consulting

- Assessment of the existing IT environment

- Feasibility study

- Digital health startup consulting

- Medical solution consulting

IT modernization

Ready to upgrade your healthcare IT environment or legacy software? ScienceSoft’s medical IT services will help you improve the reliability, optimize performance, and ensure 100% security of the target IT components.

- Healthcare app integration (e.g., EHR integration)

- Modernization of legacy healthcare apps (recoding, reengineering, containerization, etc.)

- Healthcare data consolidation

- Upgrading information security and compliance safeguards

Cloud migration

Take a step toward a cloud-based IT environment to reduce infrastructure costs and enable on-demand scalability of your healthcare software.

- HIPAA-compliant cloud selection

- Devising a risk-free cloud migration strategy

- Cloud infrastructure management

- Application migration (gradually migrating app modules)

- Server, data warehouse, desktop migration

Healthcare data analytics

With 36 years of experience in data analytics, ScienceSoft is here to help you get insights from healthcare data and support clinical decision-making with AI-based recommendations.

- Healthcare business intelligence

- Healthcare data visualization

- Big data in healthcare

- Medical image analysis

Digital transformation

Looking for professional digital transformation services in healthcare?

Since 2005, ScienceSoft designs and implements successful digital transformation strategies even amidst diverse expectations of medical staff, shifting priorities, and resistance to change.

- Digital transformation consulting

- End-to-end digital transformation

- Targeted changes implementation

Healthcare IT support

With 17 years in IT support, ScienceSoft covers everything from help desk services for healthcare to holistic IT infrastructure maintenance and modernization.

- L1, L2, L3 healthcare IT support

- Proactive and reactive support

- Software troubleshooting

- Software evolution

- Software security management

- Software performance management

- Regulatory compliance management

Managed IT services

ScienceSoft's team is ready to proactively monitor and manage your healthcare IT infrastructure or its specific components. We can modify or optimize apps and infrastructures and adjust security policies and processes.

- IT infrastructure monitoring & administration

- Managed IT help desk

- Managed application services

- Managed security services

Cybersecurity and compliance

Our security and compliance experts ensure full adherence to HIPAA, GDPR, FDA, the 21st Century Cures Act, GCP, GMP, GLP, NCPDP, MDR, IVDR, SAMHSA, and MOHAP requirements. We also support CEHRT, MACRA, MIPS, and SAFER regulations to align with evolving healthcare IT standards. ScienceSoft is certified under ISO 13485, ISO 9001, and ISO 27001, ensuring a mature approach to quality and data security.

2-Minute Overview of Healthcare Software Development

Make a quick dive-in into ScienceSoft’s service offer and come back up in 2 minutes all the wiser about the service scope, collaboration perks, and details of our healthcare software development projects.

Medical AI Voice Assistant for Appointment Scheduling

See how conversational AI can be used to automate complex interactions like patient appointment scheduling. The AI voice agent, based on Amazon’s Nova Sonic Speech-to-Speech model, uses real-time speech recognition, identity verification, and system integration to handle patient appointment scheduling end-to-end without human intervention. The assistant can potentially reduce appointment booking time by 40%, cut call abandonment rates by 30%, and lower operational costs by at least 50%.

Chest X-Ray AI for Radiology Workflows

This demo tour presents a decision-support approach where AI delivers explainable X-ray review evidence that supports downstream reporting.

The solution is aimed to exceed 90% diagnostic accuracy and reduce review time by about 30%.

Clients We Serve

Why Choose Healthcare IT Services by ScienceSoft

- Hands-on experience with HIPAA, HITECH, FDA, the 21st Century Cures Act, MDR, IVDR, GDPR, NCPDP, ONC, and SAMHSA regulatory requirements.

- Interoperability standards proficiency (FHIR, HL7 v2/v3, USCDI, CCDA, XDS/XDS-I, NCPDP SCRIPT) — supported by HL7® FHIR® certified implementers on the team.

- Clinical coding/terminologies expertise (ICD-10, CPT, SNOMED CT, LOINC, RxNorm).

- Mature security and quality management systems, including the one for medical device software and SaMD, backed by ISO 27001, ISO 13485, and ISO 9001 certifications.

- Microsoft partner since 2008 and an AWS official partner since 2017.

- Since 1989 in software development and since 2008 in ITSM.

Our awards, recognitions, and certifications

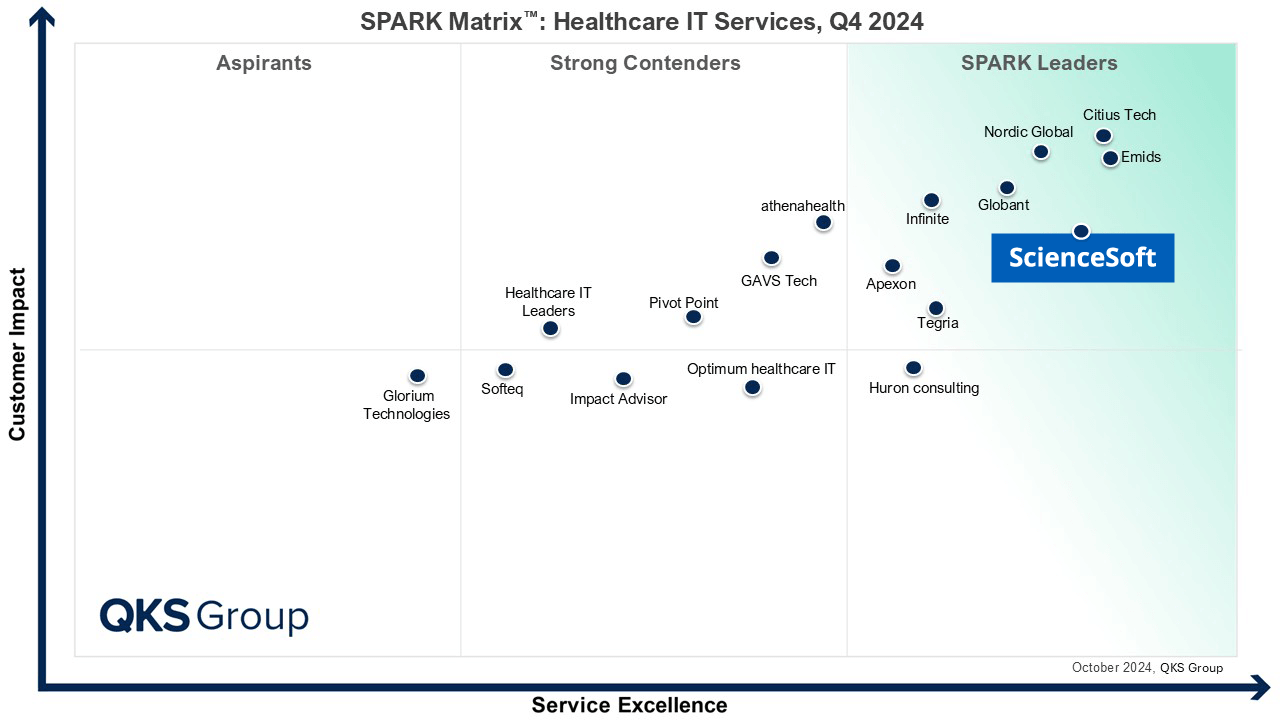

Featured among Healthcare IT Services Leaders in the 2022 and 2024 SPARK Matrix

Recognized for Healthcare Technology Leadership by Frost & Sullivan in 2023 and 2025

Named among America’s Fastest-Growing Companies by Financial Times, 4 years in a row

Top Healthcare IT Developer and Advisor by Black Book™ survey 2023

Recognized by Health Tech Newspaper awards for the third time (2022, 2023, 2025)

Named to The Healthcare Technology Report’s Top 25 Healthcare Software Companies of 2025

HIMSS Gold member advancing digital healthcare

ISO 13485-certified quality management system

ISO 27001-certified security management system

What We Do To Achieve Your Healthcare IT Project Goals

ScienceSoft's mission is to drive your project success despite time and budget constraints, adapting agilely to changing requirements. We use a set of project management practices developed and refined by our in-house PMO.

Team assembly and scaling

ScienceSoft selects the best-fitting skills for your project. We have project managers proficient in medical IT specifics, healthcare IT and regulatory consultants, and compliance officers on board. To optimize project expenses and address any changing needs, we can swiftly scale the team up and down.

Realistic time and cost estimates

We tailor time and cost estimates to the project scope defined by each client's unique needs. We always stay honest about the necessary investments and offer a clear rationale for the cost estimates.

Scope creep control

ScienceSoft rigorously manages change requests and involves stakeholders to prevent unnecessary deviations from project goals. We evaluate the feasibility, business impact, cost, and time of implementing each proposed change request and ensure its status visibility.

Teamwork and centralized knowledge management

To foster effective collaboration and fast progress, we choose a schedule convenient for all project stakeholders. By meticulously documenting all critical decisions and processes, we prevent any loss of vital project knowledge and make it accessible to the stakeholders.

Risk identification and mitigation

To ensure high project predictability and enduring cooperation success, we assess and monitor operational, technology, business, and external risks throughout the SDLC. We also devise proactive mitigation strategies to swiftly navigate disruptions, align mitigation plans with client priorities, and stay fully transparent about project health.

Project success assessment and routine reporting

To measure software development success throughout the SDLC, continuously improve service quality, and ensure that the deliverables meet our clients' expectations, we create and consistently monitor tailored sets of objectives and key results. We regularly revise success metrics, report on agreed KPIs, and use stakeholder feedback to spot areas of improvement.

IT Solutions for Healthcare We Deliver

For care providers, healthtech startups, and established software product companies

Hospital management

- Practice management software

- EHR and HIE

- Admission, discharge, and transfer (ADT) systems

- Hospital information system (HIS)

- Medical billing software

- Healthcare data analytics

- Appointment management apps

- Healthcare CRM

- AR/VR for medical staff training

- Medical HR and hospital staffing

- Hospital inventory management and asset tracking

- Incident management software

- Revenue cycle management (RCM)

Treatment management

- Diagnostic software (incl. AI solutions)

- Treatment planning software (incl. AI-driven personalization)

- Clinical decision support systems

- Care coordination platforms (incl. portals)

- Medication management software

- Nursing information systems (NIS)

- Pharmacy information systems (PIS)

- AR/VR for surgery planning

Patient engagement & experience

Mental health care

- Mental health EHR

- Telepsychiatry software

- Prescription digital therapeutics (PTD) for mental health

- Cognitive behavioral therapy (CBT) tools

- Mental health apps (for emotional regulation, guided therapy sessions, etc.)

- Mental health chatbots

- Mindfulness and meditation apps

Nursing homes and assisted livings

- Long-term care EHR/EMR

- Resident well-being monitoring

- Medication administration & tracking

- Remote health monitoring (for residents receiving at-home care)

- Telemedicine software for nursing homes

- Apps for resident-family communication

- Staff scheduling and management

- Digital workplaces for caregivers & nurses

- Incident management software

- Data analytics and management

- Billing and revenue cycle management

Home care

- Integrated home health solutions

- Telemedicine platforms, e.g., telenursing

- Remote patient monitoring (RPM) for chronic disease management

- Medication adherence tracking apps

- Self-management apps for patients

- Fall detection and emergency alert systems

- Analytics and reporting

For medical device manufacturers and SaMD companies

- Cloud software for data storage and analysis, device management and integration

- Medical image analysis

- AI-enabled diagnostics

- AI-powered personalized care planning

- Biosensor cloud applications

- ML-based sensor data analysis

- AR/VR solutions for diagnosis and treatment

User and staff software

- Patient applications for medical devices (wearables, smart devices)

- Medical staff applications (e.g., for medical device configuration)

- Portals for medical professionals

For pharmaceutical, biotech, life science companies & contract research organizations (CROs)

Clinical research & trial management

Research & analytics solutions

- Data analytics for contract research organizations

- Bioinformatics software (for analyzing biological data)

- AI/ML-based drug discovery platforms

For veterinary clinics and hospitals

- Veterinary EHR

- Scheduling and billing

- Veterinary practice management systems

- Veterinary intranet

- Inventory management

Veterinary-specific solutions

- Veterinary diagnostic software

- Veterinary telemedicine

- Remote monitoring for animal health (wearables for pets, livestock)

- Pet wellness and management apps

For healthcare GOs, NGOs, and insurance providers

Health insurance management

- Health information exchange (HIE) software

- Health plan management

- Population health management tools

- Policy administration software

- Insurance eligibility verification

- Billing software

- Claim management software

- Underwriting software

- Customer-facing health insurance apps

- Health insurance portals (for patients and providers)

- Behavior-based insurance software

- Risk management software

- Compliance monitoring systems

Software for healthcare GOs and NGOs

- Population health platforms

- Public health management systems

- Healthcare access platforms (e.g., telemedicine for rural areas)

- Epidemiology & disease surveillance software

- Disaster response & relief systems (tracking, logistics)

- Grant and fund management solutions

For fitness and wellness companies

Wellness and fitness applications

- Wellness apps

- Meditation apps

- Diet and nutrition apps

- Fitness apps

- Telefitness

- User apps for wearable devices

- Mental health apps (mood tracking, stress management)

- Sleep tracking apps

- Cycle monitoring apps

Gym and fitness center management

- Gym management software

- Class scheduling & trainer management

- Fitness CRM

- Membership and billing systems

Technologies We Work With

Low-code development

Monitoring tools

Containerization

Infrastructure automation

CI/CD tools

Clouds

Envisage Benefits of Cooperation with ScienceSoft

End-to-end compliance

We know all the ins and outs of compliance with HIPAA, GDPR, and the regulations of the GCC health authorities. Our in-house cybersecurity experts and regulatory consultants ensure full PHI protection and compliance at all project stages.

Smooth collaboration

You will be fully informed of the project status because cooperation with us is based on a pre-agreed process and a set of KPIs. We keep in touch with the client's stakeholders and self-manage our work.