Loan Processing Automation

Use Cases, Capabilities, Costs

In lending software development since 2005, ScienceSoft helps lending companies and banks implement secure, data-driven loan processing automation.

Loan Processing Automation in a Nutshell

Loan automation is applied to streamline all stages of the loan cycle, from risk assessment and decision-making to credit reporting and repayment control.

Automated loan processing software relies on artificial intelligence (AI), robotic process automation (RPA), optical character recognition (OCR), and other advanced techs to eliminate time-consuming and error-prone manual lending tasks.

|

|

|

|

|

Loan types that can be automated:

Essential integrations: A customer portal, accounting software, payment gateways, and more. Implementation time: 10–15+ months for a custom automated loan processing solution. Development costs: $200,000–$1,000,000+, depending on the automation solution’s complexity. Use our online cost calculator to estimate the cost for your case. Annual ROI: ~225%. Calculate ROI for your tailored solution. |

|

|

|

Main Loan Tasks to Automate

According to Experian, loan origination automation is currently leveraged by over 70% of lending businesses, and the percentage of its adopters is rapidly growing. The popularity of automated loan solutions is driven by the software ability to foster improvements across all major lending areas:

Loan application processing

2x–25x+ faster capture and processing of digital and paper loan applications with the help of RPA, ML, and intelligent image analysis techs.

Loan underwriting

Borrower risk assessment in minutes rather than days and 100% accurate loan approvals due to AI-powered risk analytics, fraud detection, and loan decisioning.

Loan agreement management

Automated loan agreement creation to drive up to 4x faster loan issuance. AI-based suggestions on the optimal loan prices to maximize profitability.

Loan repayment control

Full visibility of open and paid loans and automated debt collection to achieve up to 300% higher productivity of the loan servicing teams.

Borrower interaction

Automatically processing >50% of omnichannel borrower inquiries and communicating loan-related details to clients using intelligent chatbots.

Regulatory compliance

100% compliance with the required lending standards and 90%+ faster regulatory reporting due to automated compliance checks.

Key Features of an Automated Loan Processing System

For each loan processing automation project, ScienceSoft creates software with unique functionality tailored to the specific needs of a particular customer. Below, we share a list of features that form the core of any automated loan processing solution.

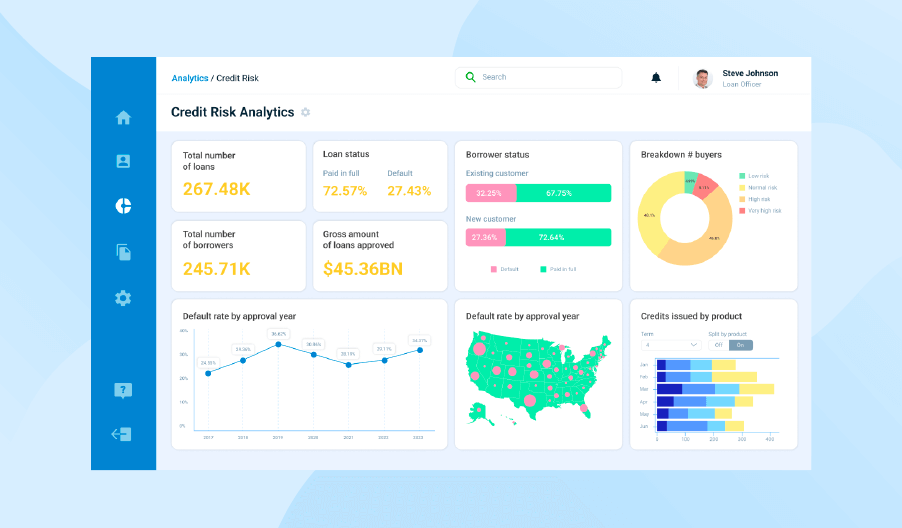

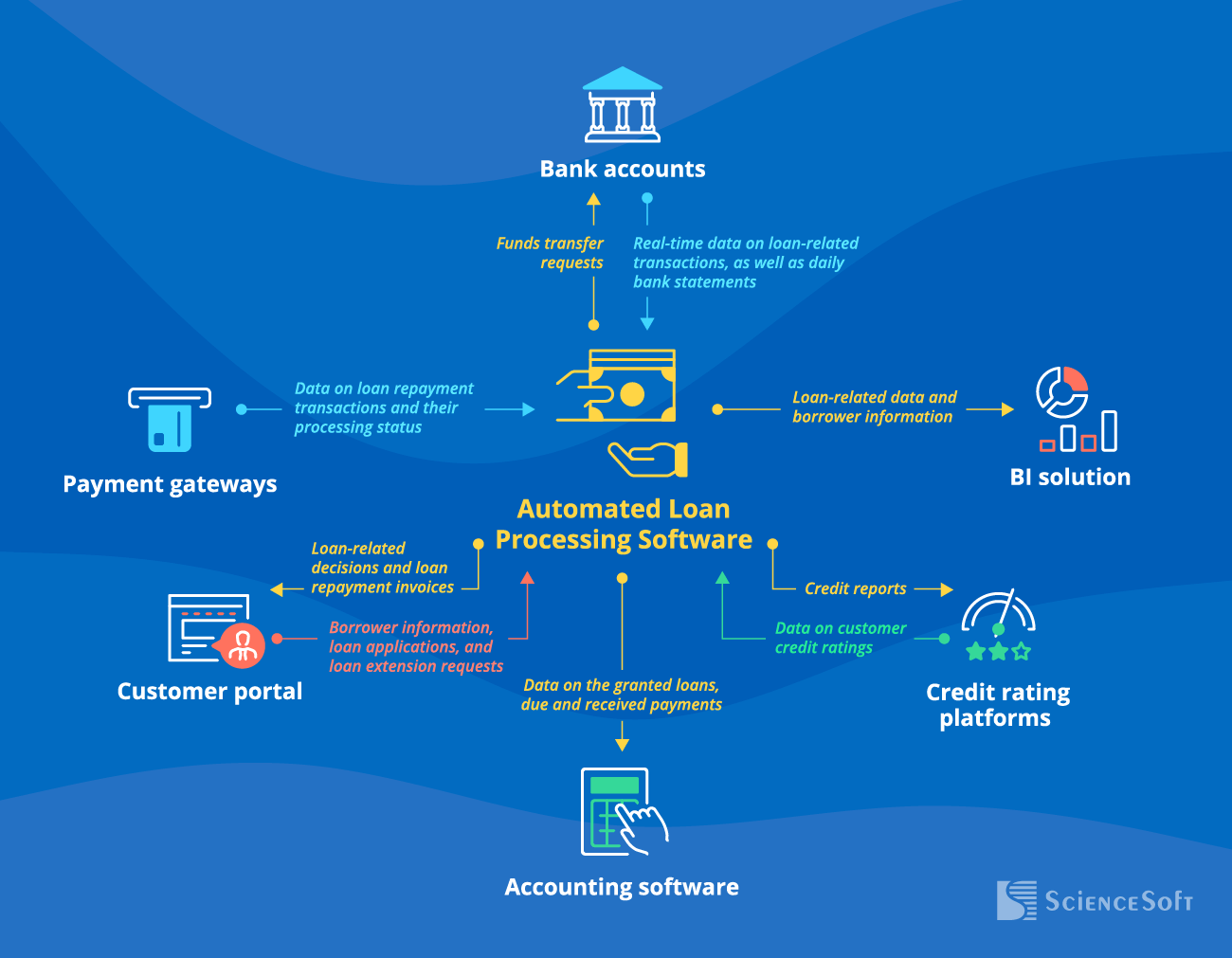

Essential Integrations for Automated Loan Processing Software

Connecting your loan processing solution with the relevant back-office and third-party systems helps speed up loan origination and minimize lending risks. ScienceSoft recommends establishing the following key integrations:

- A customer portal: to process loan applications faster; to instantly communicate loan decisions to borrowers, send invoices, and notify borrowers of due repayment dates.

- Credit rating platforms of the selected credit rating bureaus (e.g., Experian, Equifax): for facilitated credit rating checks and credit report submission.

- Payment gateways of banks or independent payment service providers (e.g., Stripe, PayPal): for smooth processing and real-time tracking of loan repayments.

- Bank accounts: for centralized tracking of loan-related transactions, timely transfer of the approved funding amounts to the borrowers, and streamlined reconciliation.

- Accounting software: for accurate recording of loan-related transactions in the general ledger.

- A business intelligence solution: for comprehensive loan analytics and reporting.

How to Achieve High ROI for Loan Automation

Relying on decades-long experience in financial software design and development, ScienceSoft’s consultants defined the main factors that help drive maximum payback from automated loan processing.

End-to-end automation

To eliminate time-consuming manual workflows and free up the lending teams for high-value tasks.

Advanced analytics

To ensure accurate decision-making and leverage data-driven forecasting of borrower payment behavior.

To protect loan software and data it operates against malicious user activities and external cyber threats.

To guarantee digital lending workflow adherence to sectoral servicing guidelines and data protection standards.

Your loan processing solution needs to stay compliant with the up-to-date financial security standards and legal requirements for credit reporting. To avoid unnecessary headaches in the future, make sure your software offers flexibility to smoothly and promptly adopt the newly-emerging regulations.

Ways to Set Up Automated Loan Processing

|

|

Business process management tool |

Market-available lending software |

Custom loan processing system ScienceSoft recommends |

|---|---|---|---|

|

Essence

|

Implementing OOTB general-purpose business automation software that enables digital service operations (including loan processing) and document management. |

Implementing an off-the-shelf loan automation solution, which typically features RPA-supported processing of loan applications, automated credit decisioning, and repayment tracking dashboards. |

Building custom automated loan processing software to get all necessary functional and non-functional capabilities and achieve 100% compliance with all relevant legal frameworks. |

|

Pros

|

Establishing a cohesive lending business automation environment. |

A fast and cost-effective way to leverage automated loan origination for SMBs. |

Fully tailored features. The ability to leverage advanced techs (AI/ML, blockchain). Non-restricted scalability. Advanced security. Smooth integration with all necessary systems, including legacy software. |

|

Cons

|

High licensing cost. Chances to obtain a large share of unnecessary functionality. Learning curve may be steep due to complicated UX and UI. Limited integration capabilities. |

Pre-defined features, integrations, and processing flows. Customization can be costly or impossible. May not provide compliance with your local lending standards. |

Software design requires additional time and investments. |

|

TCO components

|

Initial setup costs + customization and integration costs + licensing fees (typically high due to a wide range of covered business aspects). |

Initial setup costs + customization and integration costs + subscription fees that scale with the number of users. |

Upfront investments in software design and development. Lower TCO in the long run. |

Which Approach to Loan Automation Fits Your Needs Best?

Answer a few simple questions and find out whether you should opt for a custom solution or a ready-made automation tool.

Do you need to automate specific lending tasks, e.g., borrower credit risk assessment based on custom criteria, collateral valuation using custom formulas, or processing multi-entity credit documents for joint loans?

Do you want to leverage AI-supported loan automation, e.g., to predict borrower risks, get intelligent advice on credit application approval, or spot lending fraud?

Do you want to process crypto loans, automate lending operations using smart contracts, or get blockchain-based traceability of funding and repayment transactions?

Do you need loan processing software providing compliance with the latest lending regulations of the countries you operate in?

Do you need to integrate your automated loan software with multiple back-office systems or legacy tools?

Do you need a solution offering advanced cybersecurity mechanisms (e.g., intelligent fraud detection)?

Do you need a loan processing solution with various interfaces for different roles in the team (e.g., sales specialists, underwriters, payment collectors)?

Do you plan to evolve the automation solution with new functional and non-functional capabilities in order to adjust it to changing business and legal requirements?

Do you have large teams involved in loan origination and servicing processes and look to avoid the software fees associated with the per-user subscription model?

Please tell us a bit more about your needs

Answer at least 3 questions to get results.

You can go with off-the-shelf loan automation software

Looks like market-available solutions are a viable option to meet your automation needs. Turn to ScienceSoft if you need help with choosing the optimal ready-made tools, their implementation, customization, or integration with your existing systems.

You definitely should consider custom development

A tailor-made loan automation solution will help you reap the unique benefits that market-available software cannot offer. Turn to ScienceSoft to get the detailed assessment of a custom loan automation system’s feasibility for your business situation.

Custom loan automation software is your best choice

Looks like market-available automation tools don’t fit your specific business requirements and won’t be able to provide the expected operational and economic feasibility. Turn to ScienceSoft to get a consultation on custom loan automation software development and receive cost and ROI estimates.

Costs of Loan Processing Automation

The costs and timelines of implementing custom automated loan processing software vary greatly depending on:

- The number and complexity of functional modules, including AI-powered features.

- The number and complexity of integrations.

- Role-specific requirements for UX and UI.

- Non-functional requirements: security, performance, scalability, availability, etc.

- The sourcing model (full outsourcing, partial outsourcing, or all in-house).

From ScienceSoft’s experience, developing custom loan processing automation software of average complexity may cost around $200,000–$600,000.

A complex system for credit documentation automation and intelligent loan decisioning may cost $1,000,000+.

Want to know the cost of your lending solution?

Benefits of Automated Loan Processing

Loan processing automation can bring up to 225% ROI in the first year of implementation.

Higher productivity of loan specialists

Rule-based loan automation eliminates low-value and error-prone manual workflows, which enables a 35–50% improvement in the productivity of lending teams. Intelligent automation drives even more impressive results across particular tasks: for example, AI-supported debt recovery can bring a 3–4x increase in collector efficiency.

Lower operational expenses

By automating their service operations, loan providers can achieve an up to 50% reduction in operational costs, including labor, lending document processing, billing, borrower communication, and debt recovery costs.

Increase in loan origination volume

Automated loan decisioning helps speed up underwriting and credit issuance, assess borrower creditworthiness 70%+ more accurately, and minimize the risk of defaults, benefiting both lenders and borrowers. According to Experian, intelligent loan automation brings a 2x increase in loan approval rates while decreasing risk-associated losses by up to 20%.

Improved customer experience

Automation helps process credit applications and issue loans on average 2–4x faster. Plus, it ensures accurate and fair loan decision-making. These factors contribute to higher borrower satisfaction with lending services and drive an increase in client loyalty.

Simplified compliance

Custom loan processing software offers automated loan origination and servicing in accordance with all necessary data protection standards and industry regulations, eliminating the risk of regulatory compliance breaches.

Loan Processing Automation With ScienceSoft

Our awards, certifications, and partnerships

About ScienceSoft

ScienceSoft is a global IT consulting and software development company headquartered in McKinney, Texas. Since 2005, we have been designing and developing effective lending solutions, including automated loan processing systems. Being ISO 9001- and ISO 27001-certified, we apply a mature quality management system and guarantee that cooperation with us does not pose any risks to our clients’ data security.