Money Transfer Application Development

Steps, Costs, Best Practices

ScienceSoft relies on 20 years of experience in engineering custom payment solutions to help companies create robust, secure money transfer apps.

Money Transfer Application Development: Summary

Money transfer application development helps introduce a solution that enables an easy, fast, and secure way to make domestic and cross-border funds transfers. Custom money transfer apps support all required currencies and transfer methods, provide full traceability of funds movement, offer advanced security of transfer data, and smoothly integrate with transaction processing systems.

How to create a money transfer app in 8 steps

- Analyze business needs and elicit requirements.

- Create a detailed project plan.

- Design a money transfer application.

- Select an optimal tech stack.

- Develop and test the application.

- Establish app integrations.

- Deploy the application to production.

- Handle after-launch app support and evolution.

Read more details about each step in our full guide.

|

|

|

|

|

Timelines: 6–11 months on average. Cost: $120,000–$400,000+, depending on the solution’s complexity. Use our online calculator to estimate the cost for your case. Team: a project manager, a business analyst, a solution architect, a UX/UI designer, a DevOps engineer, a back-end developer, a front-end developer, a QA engineer. User groups: individuals, businesses from any industry, money transfer service providers (agents from a financial sector). |

|

|

|

Key Features of a Money Transfer Application

Being a comprehensive digital wallet at its core, a money transferring app provides robust functionality for convenient and secure funds transfer, full visibility, and streamlined control of transfer transactions.

Essential Integrations for Money Transfer Software

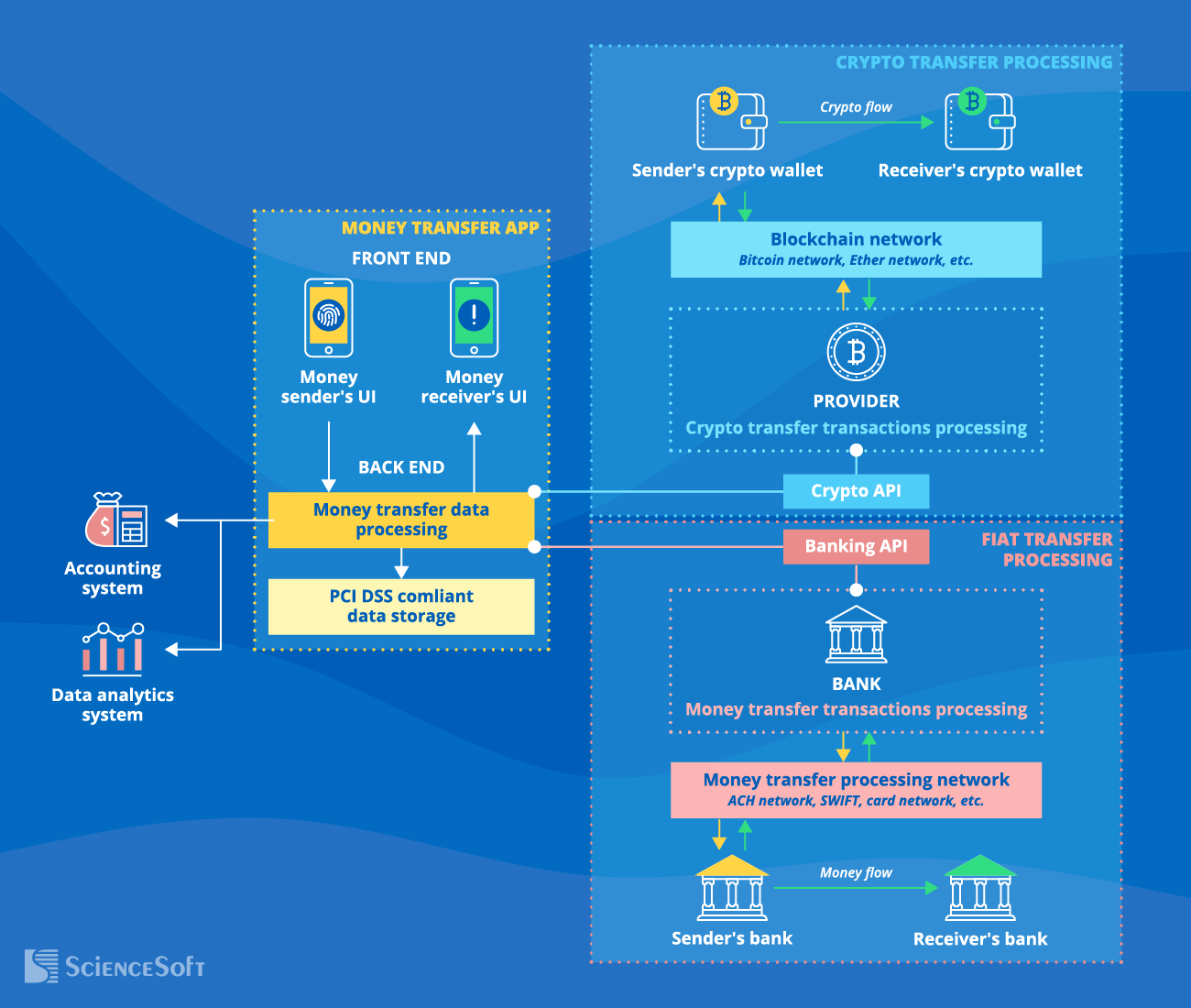

To enable fast and accurate funds movement between the involved parties, a money sending app needs to seamlessly transmit data on the requested money transfer transactions to the processing system of a chosen bank. The latter validates the sender’s personal and financial information (e.g., via 3D Secure mechanisms) and passes transactions to the relevant regional or global processing networks (the ACH network, SWIFT, VISA / MasterCard / American Express card network, etc.) to finalize funds settlement between the money sender’s and money receiver’s banks.

In money transfer app development projects, ScienceSoft relies on market-available open banking APIs to connect the app to the bank’s processing system, facilitate access to the user information necessary for KYC verification, and allow real-time acquisition of up-to-date exchange rates for multi-currency transfers.

NB! Cryptocurrency transfer processing requires integration with dedicated blockchain networks of the crypto coins that a money transfer app supports. ScienceSoft employs market-available cryptocurrency APIs (e.g., Coinbase API, CoinGate API) to streamline the connection of a money transfer app to the required blockchain networks.

Depending on the business model, a funds transfer app may also need to be integrated with an accounting system of the app provider, for example, to instantly record data on the received transaction fees. Additionally, the solution may be connected to a data analytics system to share relevant data required to analyze the app users’ behavior, which is essential, e.g., for app monetization via in-app advertising. ScienceSoft can also build ready-to-use APIs to enable quick and easy app integration with business systems of its corporate users.

How to Create a Money Transfer App

A typical process of developing a money transfer application with ScienceSoft looks as follows:

Step 1.

Analyze business needs and elicit requirements

From the very beginning and through the whole project, ScienceSoft maintains close and consistent collaboration with a client’s team to get an in-depth understanding of their money transfer needs or the app vision and avoid the risk of costly redevelopment. At this stage, our consultants:

- Analyze a client’s current business situation and business needs / product vision.

- Elicit and document requirements for the application, including:

- The required app type (web or mobile app for money transfer).

- Requirements for the app’s functional capabilities, for example, support for particular transfer types (P2P transfers, P2B transfers), transfer methods (bank transfers, card-to-card transfers, etc.), currencies, transfer models (e.g., recurring transfers), and more.

- The types and formats of data the app should be able to process.

- User experience requirements.

- Non-functional requirements for the app (performance, scalability, availability, latency, etc.), including security and compliance requirements (with AML and KYC, PCI DSS, etc.).

Step 2.

Create a detailed project plan

By accurately planning money transfer app development, ScienceSoft’s project managers lay the basis for transparent, KPI-driven cooperation with minimized risks. This stage includes:

- Defining objectives and KPIs.

- Determining project deliverables, duration, schedule and budget.

- Deciding on the roles in the project team and designing collaboration workflows.

- Identifying possible project risks, creating risk mitigation strategy and plan.

- Estimating TCO and ROI of the money transfer application.

Step 3.

Design a money transfer application

- Architecture design. We describe how the solution’s functional modules should perform at the code level and decide on the best-fitting approach to the integration between the app’s components.

- A detailed list of features. Apart from the core features, the list covers recommended security features for the app’s infrastructure and compliance procedures to meet the required standards and regulations.

- Accurate logic for money transfer automation, including specialized logic components like custom balance calculation formulas, payment smart contracts, and ML algorithms for guided account management.

- UX/UI design for the required user roles (individuals, corporates, admins, etc.). We perform UX research, deliver prototypes, conduct usability testing, create the visually appealing style of the app, and provide UI mockups.

- A plan of integrations. We advise on optimal integration solutions (banking APIs, crypto APIs, etc.) and design custom integrations with existing back-office systems, if needed.

Step 4.

Select an optimal tech stack

- Defining techs and tools required for the money transfer app development.

- Comparing different techs and tools in the context of documented business requirements.

- Selecting the optimal techs and tools.

To optimize project duration and costs, we employ cross-platform techs and ready-made components (building blocks for the app logic, prebuilt UI components, OOTB deployment scripts, open-source online payment APIs, etc.), if applicable.

Step 5.

Develop and test the application

At ScienceSoft, this stage starts with configuring CI/CD pipelines and setting up container orchestration tools to facilitate further app development, integration, deployment, and release. Upon establishing the automation environment, our team proceeds with creating the app’s back end, implementing a PCI DSS-compliant storage for app users’ sensitive data, and developing role-based user interfaces.

We perform quality assurance of each app component and check how the components work together in parallel with coding to fix possible vulnerabilities and logic errors before deployment.

Step 6.

Establish app integrations

At this stage, ScienceSoft’s team integrates the app with required software. We conduct integration testing to guarantee proper functioning the integrated solution.

Step 7.

Deploy the application to production

We configure the app’s infrastructure, backup and recovery procedures, implement relevant security tools (authorization controls for APIs, DDoS protection algorithms, firewalls, IDSs / IPSs, etc.), and set the ready-to-use app live.

ScienceSoft can also assist in creating a website for app promotion or uploading the money transfer app to the required web or mobile app stores to streamline app release.

Our team can draw comprehensive role-specific user guides to help individuals and businesses quickly learn how to operate a new money transfer application.

Step 8.

Handle after-launch app support and evolution

ScienceSoft offers a range of services to ensure the smooth operation of the money transfer app in the long run. Particularly, our team can:

- Monitor the app performance and handle operational issues.

- Scale the app to serve a growing number of users.

- Perform security and compliance audits.

- Develop and release new functionality according to a company’s or end users’ evolving needs.

Create Your Money Transfer Application With Confidence

In payment software development since 2005, ScienceSoft provides companies with full-cycle money transfer app services, including:

Implementation consulting

- Business needs analysis / product conceptualization.

- Feature set, architecture design, and tech stack for the app.

- A plan of integrations with the required systems.

- Security and compliance consulting.

- Providing a money transfer app implementation plan, including a risk mitigation plan.

End-to-end development

- Money transfer app conceptualization.

- App development.

- Developing APIs to expand the app’s integration capabilities.

- Application integration with the required systems.

- Quality assurance.

- Support and evolution (if required).

Costs of Building a Money Transfer Application

From ScienceSoft's experience, the cost to develop a money transfer application may vary from $120,000 to $1,500,000+.

Major factors that affect the cost of a money transfer app development project are:

- The chosen sourcing model (in-house, outsourced).

- The type of a money transfer app – web or mobile.

- (for mobile apps) Supported mobile platforms (iOS, Android, cross-platform).

- The number and complexity of the app’s functional modules.

- The number and complexity of integrations.

- The number of user roles; UX and UI requirements for each role.

- Performance, scalability, availability, security requirements.

- Fees for the required cloud services, prebuilt app components, integration APIs, security tools, etc.

Sample estimates

$120,000–$180,000

Building a mobile money transfer app of average complexity.

$400,000–$600,000

Developing a web-based money transfer solution.

$1,500,000+

Creating a comprehensive money transfer app with an independent transaction processing system behind it.

Why Develop a Money Transfer App With ScienceSoft

- Since 1999 in web development and since 2005 in mobile development.

- Practical knowledge of 30+ industries, including banking and fintech.

- Since 2003 in cybersecurity to build a money transfer app for complete security and regulatory compliance.

- Quick project start (1–2 weeks) and frequent releases (every 2–3 weeks).

- Well-established Lean, Agile, and DevOps cultures.

- Quality-first approach based on an ISO 9001-certified quality management system.

- Robust security management supported by ISO 27001 certification.

Our awards, certifications, and partnerships

Typical Roles on ScienceSoft’s Money Transfer App Development Teams

Project Manager

Plans the project (deliverables, schedule, budget), coordinates the team, monitors the project progress and reports it to the client.

Business Analyst

Analyzes a client’s business needs/app vision, elicits functional and non-functional requirements for the money transfer app.

Solution Architect

Architects the money transfer app and integration points for its components and required systems.

UX/UI Designer

Designs the user experience and role-based user interfaces of a money transfer app.

DevOps Engineer

Configures the automation environment (CI/CD, containerization, etc.) for facilitated app development, integration, testing, release.

Front-end Developer

Delivers UI of a money transfer app and fixes the defects found by the QA team.

Back-end Developer

Delivers the server-side code of a money transfer app, integrates the solution with the required systems, fixes the defects found by the QA team.

QA Engineer

Creates and implements a test strategy, a test plan, and test cases to validate the quality and security of the money transfer app, reports testing results.

Sourcing Models for Money Transfer Application Development

Reliable Tech Stack for Money Transfer App Development

In ScienceSoft's money transfer app development projects, we usually rely on the following technologies and tools:

Low-code development

Databases / data storages

SQL

NoSQL

Real-time data processing

DevOps

Containerization

Automation

CI/CD tools

Monitoring

FAQ About Money Transfer Apps, Answered

Why create a money transfer app?

The global P2P payment market is expected to reach $13.3 trillion by 2035, witnessing a CAGR of 14.25% between 2025 and 2035. Key factors that drive the popularity of money transfer apps among individuals and businesses are convenient and fast fund transfers and full visibility over transfer transactions. This creates momentum for payment service companies and paytech startups to step into the fast-evolving market with a brand-new solution and promptly generate revenue.

How to start a money transfer app with minimal risks?

At ScienceSoft, we analyze the economic feasibility of money transfer app development for each company-specific case to help our clients confidently start their development initiative. We also deliver a step-by-step project roadmap for risk-free application launch and provide detailed estimates for accurate budget planning.

How to create a money transfer app without breaking the bank?

We always identify cost optimization opportunities and help our clients reduce development budgets. Some ways to optimize the money transfer app cost are:

- Partially or fully outsource the project (this step alone ensures 30–50% lower costs).

- Thoroughly plan the app’s tech design to avoid costly redevelopment.

- Rely on cross-platform mobile techs and employ prebuilt components where possible.

- Opt for iterative development to speed up payoff.

How do money transfer apps make money?

There is a variety of options to generate revenue with your app, and the choice should be made based on your preferences towards a particular business model. Some examples of monetization strategies for money sending apps are:

- Charging a fee for each transaction that takes place in the app (a flat fee or a percentage of the transferred amount).

- Applying a markup on the exchange rate for transactions that involve currency conversion.

- Investing the funds that are pending processing and earning the interest on the float.

- Charging a fee for premium services, e.g., for higher transfer limits or faster processing.

- Selling in-app advertising.

How to make a money transfer app success?

Seamless user experience, sleek visual style, comprehensive functionality, stable performance, and advanced security are the five pillars of a winning money transfer application. Prioritize these critical aspects at the app planning and development stages to ensure high value of your app for end users and drive high ROI. And if you need help with designing and building your funds transfer solution for excellence, do not hesitate to turn to ScienceSoft for help.

About ScienceSoft

ScienceSoft is a global IT consulting and software development company headquartered in McKinney, Texas. We provide end-to-end application development services to help companies design and build reliable money transfer apps. In our projects, we employ robust quality management and data security management systems backed by ISO 9001 and ISO 27001 certifications.