Capital IM Gets Tailored Commercial Property Insurance Software in 2 Months

Summary

ScienceSoft modified and implemented custom commercial property insurance software for Capital Insurance Markets. The quick solution rollout let the firm launch its new insurance products promptly while reducing project investments.

About Capital Insurance Markets

Capital Insurance Markets, or Capital IM, is an Irish wholesale insurance brokerage that provides tailored insurance packages for the broker market underwritten by A-rated insurers. Recognized as a leading wholesale insurance provider in Ireland, Capital IM focuses on delivering innovative products and sustainable capacity, combining strong insurer relationships with accessible services for brokers.

In 2024, Capital IM acquired a portion of a property insurance managing general agent’s (MGA) business to expand its commercial property product portfolio. As part of the deal, Capital IM inherited several modules of the MGA’s custom software used for property insurance policy management. Capital IM decided to adapt the solution to the company’s operational needs and use it to manage its new commercial property insurance products. Knowing that ScienceSoft had prior experience revamping that specific solution, Capital IM turned to us for assistance. The goal was to promptly transition the software to Capital IM’s IT infrastructure and tailor it to the firm’s commercial property insurance workflows.

Implementation of Commercial Property Insurance Software

To meet Capital IM’s tight deadlines for software launch, ScienceSoft involved the insurance IT consultant and insurance software engineers who had personally worked on revamping the original property insurance solution. The team already knew the software’s functional and technical potential, which allowed them to skip the lengthy system audit. They were later joined by a project manager, PHP developers, and a DevOps engineer who carried out the software migration and enhancements.

Implementation strategy design and project planning

ScienceSoft’s consultant interviewed Capital IM’s stakeholders and business users (brokers, underwriters, policy managers, accountants, and IT specialists) to elicit their business and transition requirements for the solution. The expert matched the gathered requirements against the functionality of the original system, determined the features that could be completely or partially reused, and scoped the missing automation capabilities. As a result, our consultant composed a detailed software transition plan describing the features to preserve, modify, and add to the new system.

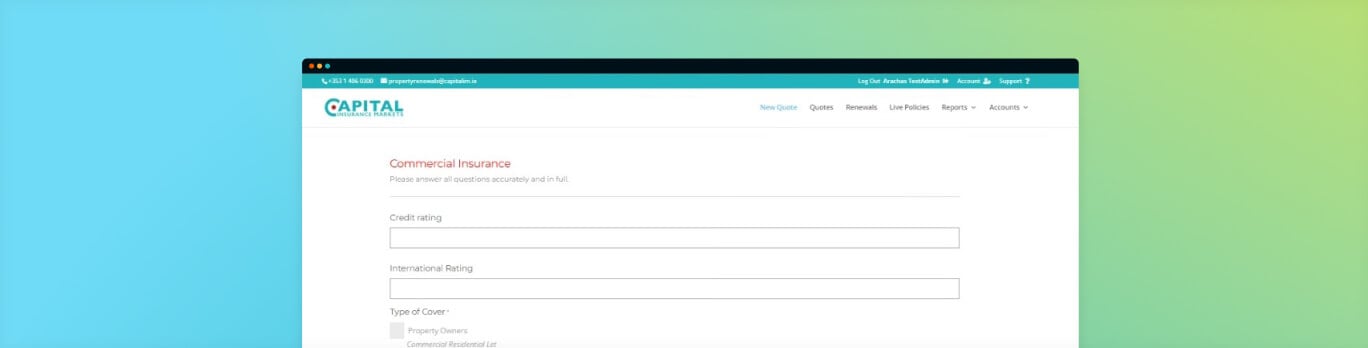

Capital IM liked the software’s original UX/UI design but wanted to incorporate its own branding elements to ensure consistent employee experiences. ScienceSoft’s consultant advised the company on cost-effective ways to customize user interfaces for enhanced brand visibility and sleek aesthetics.

ScienceSoft suggested software forking as the optimal way for Capital IM to obtain a tailored commercial property insurance system. Forking would allow the team to create an independent version of the existing software that would retain the original functionality and interfaces while enabling any necessary enhancements. For Capital IM, this meant full ownership over the software and the ability to evolve it independently of the co-owner. Most importantly, code replication via forking enabled the fastest and most affordable software deployment, ensuring the firm could quickly kick off its commercial property insurance lines.

ScienceSoft’s engineers explored Capital IM’s AWS infrastructure and mapped the steps to smoothly transition the forked commercial property insurance modules to the new cloud environment. Next, the team audited the company’s data management systems and crafted a strategy for secure insurance data migration from the MGA to Capital IM. The engineers also created a plan for insurance software integration with the required systems.

Once Capital IM approved the proposed approach, ScienceSoft’s project manager created a time-framed work breakdown structure (WBS), sharpened the cost estimates, and introduced a tailored set of KPIs to control project health. The PM also prepared a plan to mitigate operational and technical project risks.

Software implementation and customization

Working in close collaboration with Capital IM’s stakeholders, the team did the following:

- ScienceSoft’s DevOps engineer set up a dedicated insurance software infrastructure in Capital IM’s AWS environment. The engineer optimized cloud resources to enable cost-effective system scaling for periodic operational loads (e.g., during end-of-period insurance reporting).

- PHP developers replicated the source code from the inherited commercial property modules, removed code-level dependencies from the MGA’s infrastructure, and migrated the code to Capital IM’s environment. During the transition, they optimized the code to improve its maintainability and enhance software performance.

- The team customized some of the quoting, policy management, and reporting features to match Capital IM’s workflows. Next, ScienceSoft’s engineers developed new features for insurance quote processing, property risk data capture, insured communication, and scheduled generation of specialized reports. In particular, they built asynchronous report generation pipelines that allow lightweight and complex statements to be produced in parallel, without sequencing delays and session time-outs. The team also implemented a centralized report registry so report owners can quickly identify and reuse previously generated reports.

- To automate risk-relevant data aggregation, the team integrated the commercial property insurance solution with the third-party OFAC, credit score, and flood risk databases of Capital IM’s choice. The engineers also connected the software to email services to automate insurance application intake and document sharing.

- ScienceSoft updated logos, color schemes, and design elements across the insurance software interfaces to align with Capital IM's brand identity. Additionally, the team adjusted the design of the templates used for the automated generation of insurance documents (quotes, invoices, policies, and reports).

- For data migration, the engineers isolated the MGA’s insurance data relevant to Capital IM’s operations and manually removed sensitive data fragments disclosing the MGA’s financial performance. After that, the team moved the data to the database hosted in Capital IM’s AWS space, applying secure transfer protocols and encryption mechanisms to prevent breaches. After the migration, the team split, cleaned, and mapped the data to match the new system’s structure.

- To ensure a smooth software rollout, ScienceSoft performed functional (including integration and regression), performance, and security testing. Capital IM also received a detailed plan and test cases for in-house user acceptance testing (UAT).

- Throughout implementation, ScienceSoft’s consultant cooperated with engineers to scope newly requested functional changes and refine priorities.

- ScienceSoft’s project manager tracked and reported the progress to Capital IM, adjusted the team’s tasks to address feasible change requests, and continuously optimized the development flow to align with Capital IM’s goals and deadlines.

It took ScienceSoft less than 6 weeks to finalize the implementation stage. As a result, Capital IM received proprietary cloud-based software that is tailored to the firm’s commercial property insurance operations and can be upgraded with new features in the future.

After launching the solution, ScienceSoft provided Capital IM with detailed technical and user documentation to streamline software support and evolution. The team also conducted remote employee training to help Capital IM’s teams master the new tools quickly.

As of March 2025, Capital IM continues working with ScienceSoft on the maintenance and functional upgrading of its commercial property insurance system.

Damien Sewell, Head of IT Projects at Capital Insurance Markets:

At Capital IM, we put people at the heart of everything we do and constantly improve our insurance systems to make employee and customer experience the very best it can be. We were delighted to find that the software inherited from our partner was kept in good shape, and we could work directly with the ScienceSoft engineers who recently revamped the system.

Engaging ScienceSoft this way saved us a lot of precious time and resources, as otherwise, the software exploration and team sourcing stages alone could have taken months. Their quick buy-in and readiness to take the initiative made the project faster and less stressful for everyone involved, from Capital IM’s insurance specialists to leadership.

At the end of a short yet highly productive two months, we got a secure and wholly owned property insurance solution that is fully adapted to Capital IM’s corporate practices and brand book. We couldn’t have asked for a better IT partner.

Key Outcomes for Capital IM

- Capital IM obtained a cost-effective proprietary insurance solution that can be freely evolved without dependency risks due to the forking approach suggested by ScienceSoft.

- The new software was scoped and implemented in just two months, which let Capital IM promptly launch its new commercial property insurance products.

- ScienceSoft’s professional data migration guaranteed the security of the MGA’s sensitive data and the integrity of the insurance data Capital IM inherited.

- The reporting module upgrades sped up report generation via asynchronous processing and lowered operational costs through streamlined collaboration and report reuse.

Technologies and Tools

PHP, AWS, WordPress, WooCommerce, MySQL, Cloudflare, Confluence.