Payroll System Redesign for a Home Healthcare SaaS in 4 Weeks

About Our Client

The Client is a US-based provider of home healthcare software. It offers a web-based SaaS solution that combines EMR and ERP functionality to cater to the business needs of home healthcare agencies.

Payroll System Lacked Automation, Accuracy, and Compliance

The Client was facing significant challenges with the payroll module of its home healthcare SaaS product. Payroll calculations and financial reports were inaccurate. Accounting processes lacked automation because of the absent integration between the payroll and accounting systems. Moreover, the payroll module did not have reliable analytics capabilities, and irregular software updates posed risks of regulatory non-compliance.

Recognizing the need to improve the product’s quality, the Client sought a reliable technology partner to identify the shortcomings of the current payroll system, improve its features, and plan the implementation of new functionality.

New Payroll System Design to Fix Its Flaws

Already knowing ScienceSoft as an experienced custom accounting software and web app development company from a previous project, the Client chose us again. For the payroll system discovery, we assembled a team of one solution architect and two business analysts, one of whom also held QA competencies.

The goal of the 4-week discovery process was to understand the problems with the SaaS’ original payroll system and propose an improved list of features along with a detailed action plan.

Payroll system issues revealed during the audit

ScienceSoft identified and analyzed the following flaws in the SaaS product’s payroll system:

- It was not integrated with the SaaS product’s accounting module. As a result, users had to manually transfer data from the payroll system to the accounting one and vice versa, which led to inconsistencies between payroll and general accounting records.

- The payroll system did not support complex payroll calculations, such as taxes and deductions, overtime, and accrued time-off balances. As a result, the SaaS users had to manually reconcile and correct payroll data, which increased the risk of errors.

- The system did not have proper data validation and verification protocols, which caused inaccuracies in employee records.

- The system did not provide year-end reports, payroll tax reports, and employee earnings statements. As a result, users did not have access to comprehensive analytics to identify cost-saving opportunities in the payroll process.

- Finally, the payroll system was not receiving regular updates, which posed the risk of non-compliance with frequently changing tax and labor regulations.

New payroll system feature list

To fix the revealed issues and improve the functionality, our team composed the following feature list for the payroll system:

- Integration with the SaaS product’s accounting module to automatically transfer payroll data and financial records.

- Automated salary calculation covering different pay structures such as hourly, monthly, or commission-based.

- Automated tax calculation based on applicable tax laws and regulations, deduction handling (e.g., Social Security and Medicare), and generation of tax reports.

- Leave management to handle employee leave requests, accruals, and balances. The system should also factor leave deductions into payroll calculations.

- Automated data checks to cross-reference data with external sources (e.g., tax authorities, employee benefit providers), identify duplicate records, and detect data manipulation.

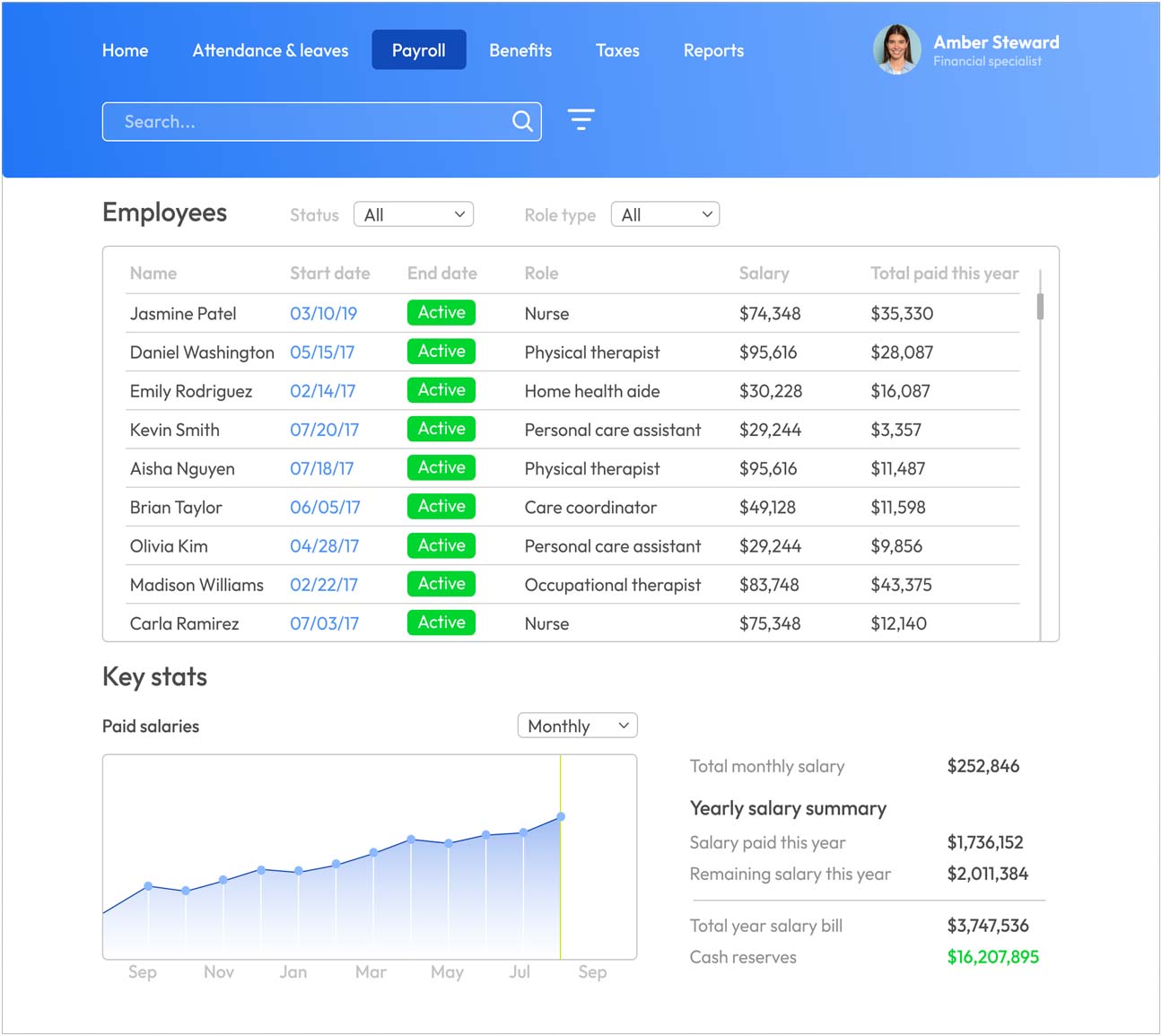

- Self-service reporting and analytics. The system should provide payroll summaries, earnings statements, tax reports, and year-end documentation. It should also offer interactive dashboards to track payroll costs, monitor trends, and gather insights for managerial decisions.

- Labor law compliance. The system should adhere to local labor laws, regulations, and legislation, ensuring compliance with minimum wage, overtime rules, and leave entitlements.

- Quarterly app release cycles with feature improvements and bug fixes based on user feedback and industry requirements. Updates should also accommodate changes in tax laws and government regulations.

ScienceSoft also recommended the inclusion of such features as a medical staff database, time and attendance tracking, automated generation and distribution of paychecks and direct deposit files, employee self-service portal, automated notifications to HR and payroll administrators, and more.

Feasibility analysis and a detailed project plan

Upon receiving the Client’s approval on the proposed feature list, ScienceSoft conducted a comprehensive feasibility study to determine the practicality and potential success of implementing an improved payroll system. We considered factors such as the feature complexity, resource availability, and effort needed for each task. Also, we evaluated the potential gains, including the impact of new features on end users’ satisfaction and the resulting churn reduction.

Our team created a detailed plan for implementing the new payroll functionality. It included a breakdown of tasks, roles, and responsibilities. Additionally, the plan outlined the milestones and deliverables, resource allocation, and risk mitigation strategies for each stage of payroll system development.

Full Revamp Plan for the Payroll System Delivered in One Month

In just four weeks, the Client received a comprehensive feature list for its SaaS product’s payroll system and an actionable implementation plan backed with a feasibility study. Satisfied with the proposed changes, the Client plans to involve ScienceSoft in the revamp of the payroll system.

Technologies and Tools

JavaScript, HTML, CSS3, Node.js, ASP.NET, Microsoft SQL Server, Microsoft Power BI, Microsoft Excel, Confluence.