Home Healthcare SaaS Accounting Module Rebuilt 30% Faster Than Expected

About Our Client

The Client is a North American provider of home healthcare software. Its web-based SaaS solution combines EMR and ERP functionality, catering to the medical and administrative needs of home healthcare agencies. The solution’s accounting module enables agencies to streamline invoicing, expense and claim payment tracking, COA and bank account management, transaction recording, reconciliation, and financial reporting.

Inept IT Vendor Failed to Redevelop SaaS Accounting Module

The Client already knew ScienceSoft as a reliable accounting software development partner from a previous project, where we helped the company audit its SaaS accounting module. Our team found that the module had numerous defects and lacked fundamental accounting logic, which compromised the accuracy of financial records and reports. Wanting to fix these problems and improve its software’s usability, the Client decided to redevelop the accounting module from scratch, drawing from the audit’s insights.

Initially, the company chose another IT vendor to revamp the module, but the contractor failed to execute the project properly. To finish the module’s redevelopment and ensure its high quality, the Client turned back to ScienceSoft. Our team committed to saving what we could from the previous vendor’s work: we kept some of the UI elements but completely overhauled significant portions of the codebase.

Accounting Module Revamp in Less Than 5 Months

In just four and a half months, ScienceSoft refactored the front and back end of the accounting module. To speed up problem-solving, we collaborated closely with the Client and communicated directly with the previous vendor.

The redeveloped accounting module allows users to manage their financial transactions and records. It automates crucial accounting procedures and provides accurate insights into the financial health of home healthcare agencies. Users can:

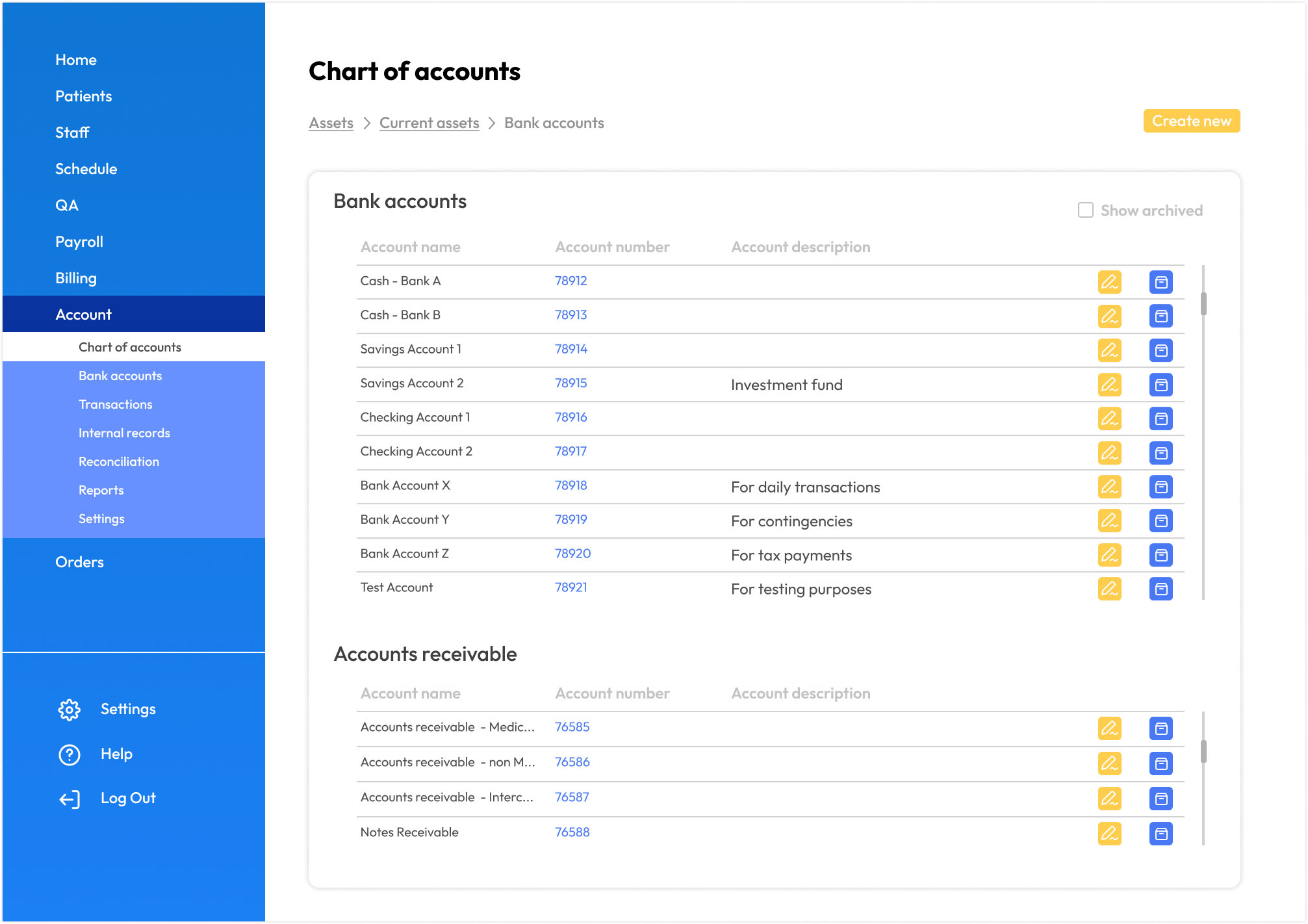

- Set up a chart of accounts (COA) for their agency. The default COA already has a tree structure of categories and accounts defined for home health agencies, but users can customize the COA to their unique business needs.

- Add bank accounts (to record bank transactions like deposits, withdrawals, and bank transfers) manually or automatically via bank feeds. Users can update account information, connect or disconnect accounts, and archive accounts that are no longer in use. Additionally, users can edit automatically generated default accounts like accounts payable, accounts receivable, and income/expense accounts.

- Record bank transactions, whether imported or manually added. Users can review all bank transactions and adjust the displayed ones using available filters (e.g., Date, Bank, Bank account, Type). They can also search for specific transactions by name. The SaaS uploads new transactions daily, but users can also initiate the update manually to ensure the latest transactions are displayed accurately.

- Process incoming bank transactions to enhance reconciliation. Users have options such as Find match (for linking bank transactions with outstanding invoices, bills, or other internal transactions in the SaaS), Categorize (for manual entry of transactions with no existing match), and Record as transfer (for inter-account transfers).

- Split bank transactions, like large business income or expense, across multiple accounts for better tracking.

- Exclude bank transactions to prevent duplication in accounting and undo the actions performed with the transaction (in case any inconsistencies are spotted later) to unlink bank and internal transactions. In addition, they can edit and archive manually entered bank transactions.

- Create internal transactions that serve to track income and expenses in bank accounts. These transactions can also be edited (until matched with bank transactions) and archived (if duplicated or entered erroneously).

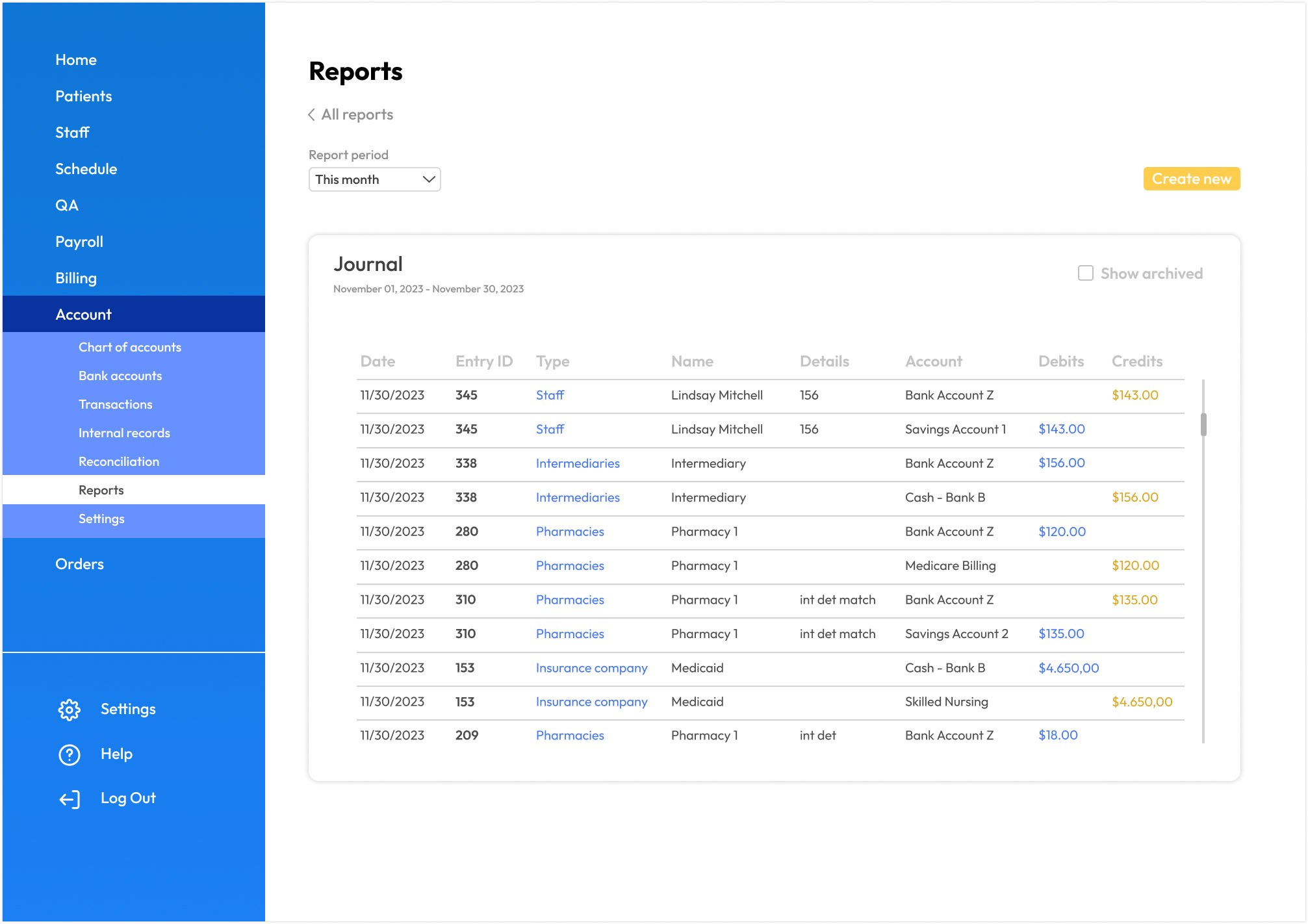

- Create journal entries to transfer funds between accounts, correct potential accounting errors, and record transactions that do not reflect the movement of money in bank accounts. All entries must follow the principles of double-entry bookkeeping, which means that they must have equal debit and credit values.

- Reconcile bank statements to ensure accurate recording of transactions and alignment of the bank account balance in the software with the agencies’ actual bank records. Reconciliation helps detect discrepancies between the bank balance and the book balance for necessary adjustments. Once reconciled, records cannot be edited or archived.

- Generate financial reports, such as balance sheets, trial balance reports, profit and loss statements, and journal reports. Users can view reports by date, switch between accrual and cash methods, and save reports in PDF or XLSX for external use.

Achieving a 30% Reduction in Redevelopment Time

Within just four and a half months, the Client got an accounting module that automates invoicing, expense and claim payment tracking, COA and bank account management, transaction recording, reconciliation, and financial reporting.

ScienceSoft achieved a 30% reduction in the expected redevelopment time. Initially, we estimated that the module’s overhaul would take us six to seven months, but the combination of proactive project management and mature Agile and DevOps practices helped the team complete the work sooner. This swift turnaround was crucial for the Client, as it needed the module revamped as quickly as possible.

ScienceSoft went the extra mile by designing a detailed user guide for seamless user onboarding. This guide covers every step of user interaction with the software and includes a schema illustrating all scenarios of accounting record creation covered by the module.

The Client successfully launched the rebuilt module, empowering its end clients to streamline accounting processes and prioritize the provision of exceptional patient care. Pleased with the results of our collaboration, the Client plans to rely on ScienceSoft for the ongoing support and maintenance of the SaaS.

Technologies and Tools

JavaScript, HTML, CSS3, Node.js, ASP.NET, Microsoft SQL Server, Microsoft Power BI, Microsoft Excel, Confluence.