Custom Software for End-to-End Loan Management Automation

About Our Client

The Client is a reputable financial services company with 50+ offices across the US. The company provides consumer loans, including personal loans for bad credit, and offers flexible repayment plans tailored to individual financial needs.

Challenge

The Client relied on the out-of-the-box on-premises loan management software to centralize customer and financial data, automate lending and borrowing processes, and control loan repayment. The software didn’t provide a full scope of necessary functionality and couldn’t be efficiently customized to the Client’s specific loan management needs. Also, the prebuilt tool failed to smoothly integrate with the Client’s corporate software and essential external systems. So, the Client decided to invest in creating their own loan management system that would be fully tailored to their unique business requirements.

Solution

Owing to ScienceSoft’s 17 years of experience in building software for financial services companies, the Client turned to us for end-to-end custom loan management software development. After examining the Client’s needs, ScienceSoft’s business analyst elicited detailed requirements for the loan management system. Based on the collected requirements, our solution architect elaborated an optimal architecture, feature set, and implementation tech stack for the software. This laid the basis for estimating the resources required to complete the project, as well as planning the project deliverables, budget, and schedule.

To meet the expected project timelines, ScienceSoft provided the Client with a full-scale development team that consisted of a project manager, a business analyst, three full-stack, two front-end, and two back-end developers, as well as manual and automated testing engineers. We composed a team of senior- and lead-level talents proficient in lending software development to balance the project budget and ensure the top-flight quality of the loan management solution.

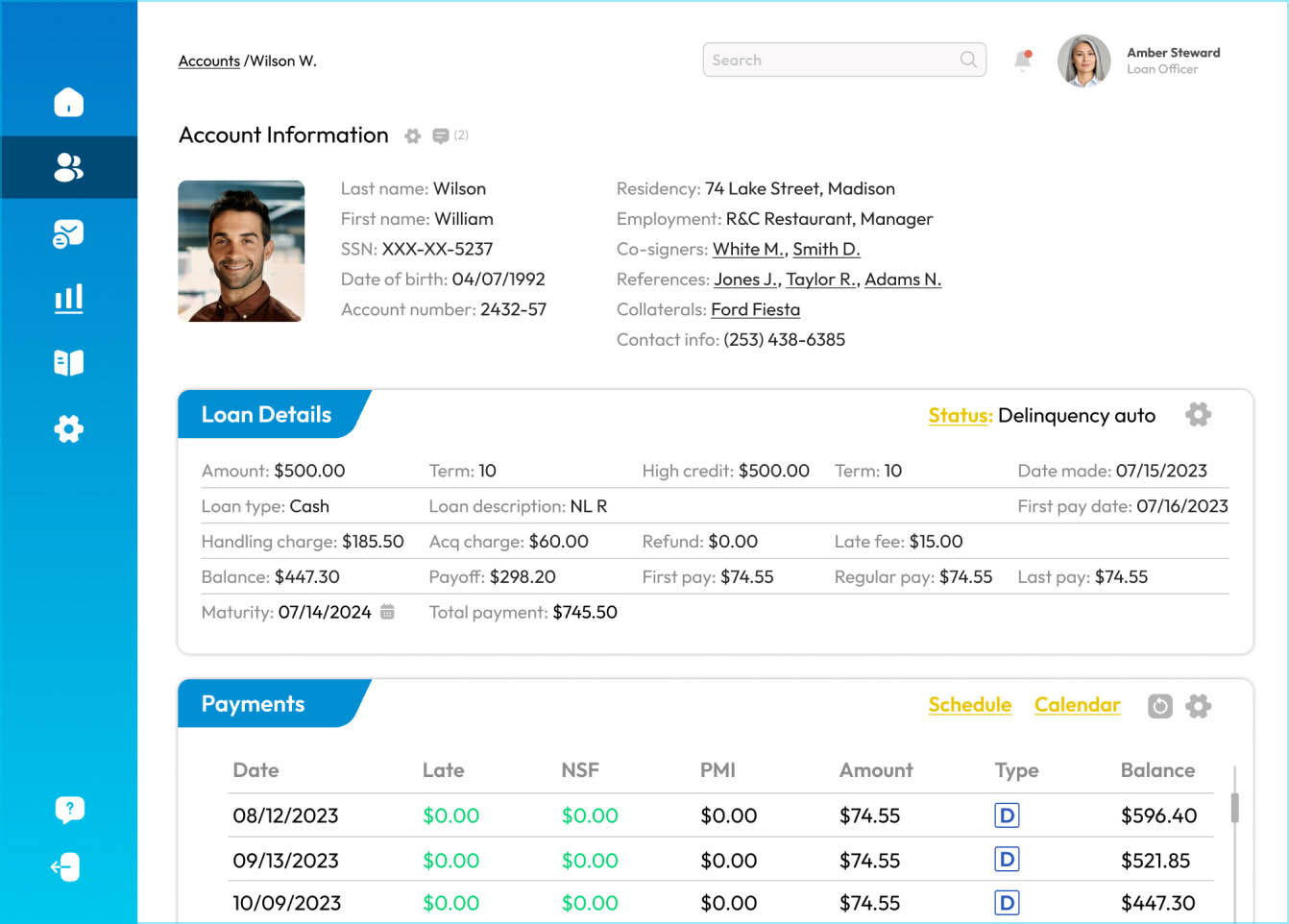

When creating the business logic, UX, and UI of the software, ScienceSoft’s experts strived to maintain a healthy similarity with those of the off-the-shelf loan management tool the Client previously used. This aimed to avoid drastic changes across the Client’s established business processes and ensure a smooth transition to the new software for the Client’s employees and customers.

Prior to coding, ScienceSoft’s team established container orchestration, CI/CD pipelines, cloud automation, etc., to speed up the solution development, integration, testing, and deployment.

The loan management software was to provide robust automation of the Client’s specific lending-related processes. To cover this requirement, ScienceSoft’s team delivered the following functionality:

- Automated creation and submission of loan applications and contracts.

- Automated verification of a customer credit rating (based on the history of collaboration with a borrower and the data provided by credit bureaus).

- Automated generation of loan documents in compliance with the relevant federal and state regulations.

- Configurable dashboards with real-time updates on the granted loans, received, and due loan repayments.

- Automated debt collection process.

- Scheduled and ad hoc reports on credit applications and repayments (50+ report types – by period, customer, office, etc.).

ScienceSoft’s team integrated the loan management solution with the Client’s existing software ecosystem, a US-wide SMS service platform, and customer credit rating systems of the US's three largest credit bureaus. This would help eliminate double data entry on the granted loans, free up the Client’s employees from tedious debt collection tasks, improve the speed and accuracy of lending-related decision-making, and loan repayment statistics reporting to the relevant institutions.

ScienceSoft’s quality assurance specialists were running manual and automated tests in parallel with development to promptly identify and fix any defects. Also, the solution was tested for user acceptance on the Client’s side to ensure it provides a convenient UX and UI.

ScienceSoft’s team now performs the migration of the Client’s business data to the new loan management system. After that, the solution will be launched to the production environment and will be completely ready for use by the Client’s employees and customers.

Results

As of August 2022, ScienceSoft has been collaborating with the Client for about two years. During this time, the Client got a comprehensive loan management solution built from scratch according to their specific business requirements. ScienceSoft’s expert advice on the optimal software architecture, functionality, and tech stack, as well as a reasonable approach to resource management, helped the Client optimize the project budget while ensuring the high quality of the solution.

Technologies and Tools

.NET Core, Angular, TypeScript, Bootstrap, Microsoft Azure Cloud, Azure DevOps Services, Docker, Selenium, Locust.