Selected Success Stories From Our 4,200-Project Portfolio

in

16 results:

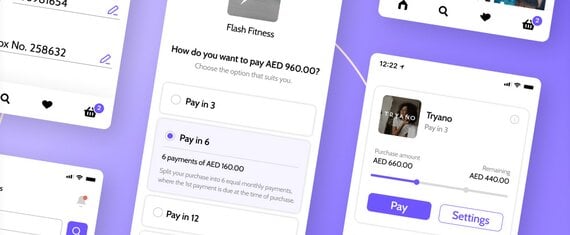

Rapid Development and Consulting to Reduce Time to Market for a Buy Now Pay Later Platform

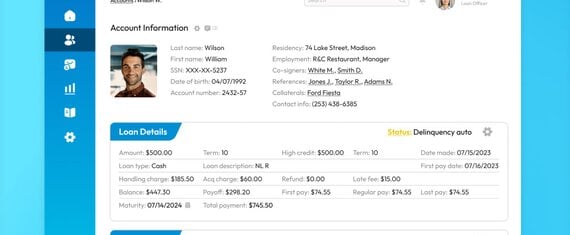

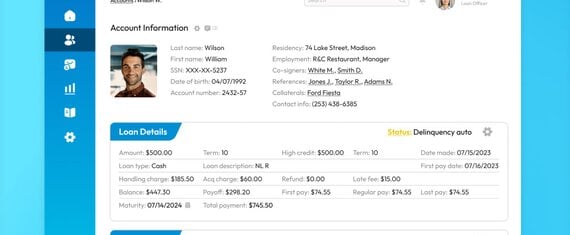

Mobile-Friendly Lending Portal Driving Higher Borrower Satisfaction and Employee Efficiency

Azure-Based Lending Platform Powered by AI

Credit Analysis Software for Automated Borrower Solvency Verification

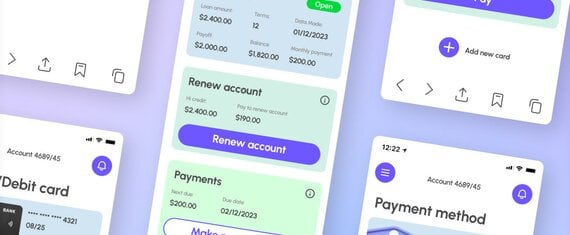

Mobile Credit Platform Revamp and AWS Cost Optimization in 3 Months

Cross-Platform App for Convenient Access to Online Credit Marketplace

Multi-Party Software for Loan Processing Automation

Complex Dynamic UIs for a North American Debt Management Platform