Award-Winning Loan Management System for Atlas Credit

Summary

ScienceSoft delivered a proprietary loan management system for Atlas Credit, a Texas-based consumer lender operating since 1968. The solution has been recognized as Best-in-Class Loan Management System at the Global FinTech Innovation Awards 2025.

About Atlas Credit

Atlas Credit is a consumer lending company that provides personal, credit starter, and signature loans to individuals, including those from underserved communities. Since its inception in 1968, Atlas Credit has served more than 2.5 million customers and grown into one of the most reputable consumer lenders in Texas, with over 50 offices across the state, as well as service centers in Oklahoma and Virginia.

In the past, Atlas Credit relied on an out-of-the-box on-premises loan management system (LMS) to centralize customer and financial data, automate lending and borrowing processes, and control loan repayment. As the workflows and operational model at Atlas Credit have evolved over time, the packaged tool could no longer meet the company’s automation needs, and it couldn’t be customized efficiently to address them.

Atlas Credit decided to invest in developing a proprietary, flexible loan management system tailored to its unique lending operations. Lacking the in-house skills to develop a comprehensive custom solution, Atlas Credit trusted the project to ScienceSoft, a domestic vendor with decades of experience in lending software engineering.

End-to-End Development of a Custom Loan Management System

LMS design and project planning

ScienceSoft’s financial IT consultants started by examining Atlas Credit’s needs and eliciting detailed requirements for the loan management system. The consultants conducted a series of interviews with Atlas Credit’s business stakeholders and reviewed available documentation on the company’s lending processes and tools. The team also documented compliance requirements for the LMS so that the solution’s logic would meet the lending regulations of Atlas Credit’s service regions from the outset. Based on the collected requirements, ScienceSoft composed the optimal feature set for the LMS, prioritizing features for implementation based on their expected value for Atlas Credit’s business.

Next, ScienceSoft’s solution architect designed an architecture and technology stack for the LMS. The architect suggested building the new system on Microsoft Azure to ensure the system’s high availability and cost-effective scalability for Atlas Credit’s future growth. Azure’s native security tools would make it easier for the development team to establish enterprise-grade security for the LMS and achieve compliance with US data privacy regulations. To support Atlas Credit’s plans for continued digital transformation, ScienceSoft opted for a flexible, cloud-native modular architecture that would enable future LMS evolution.

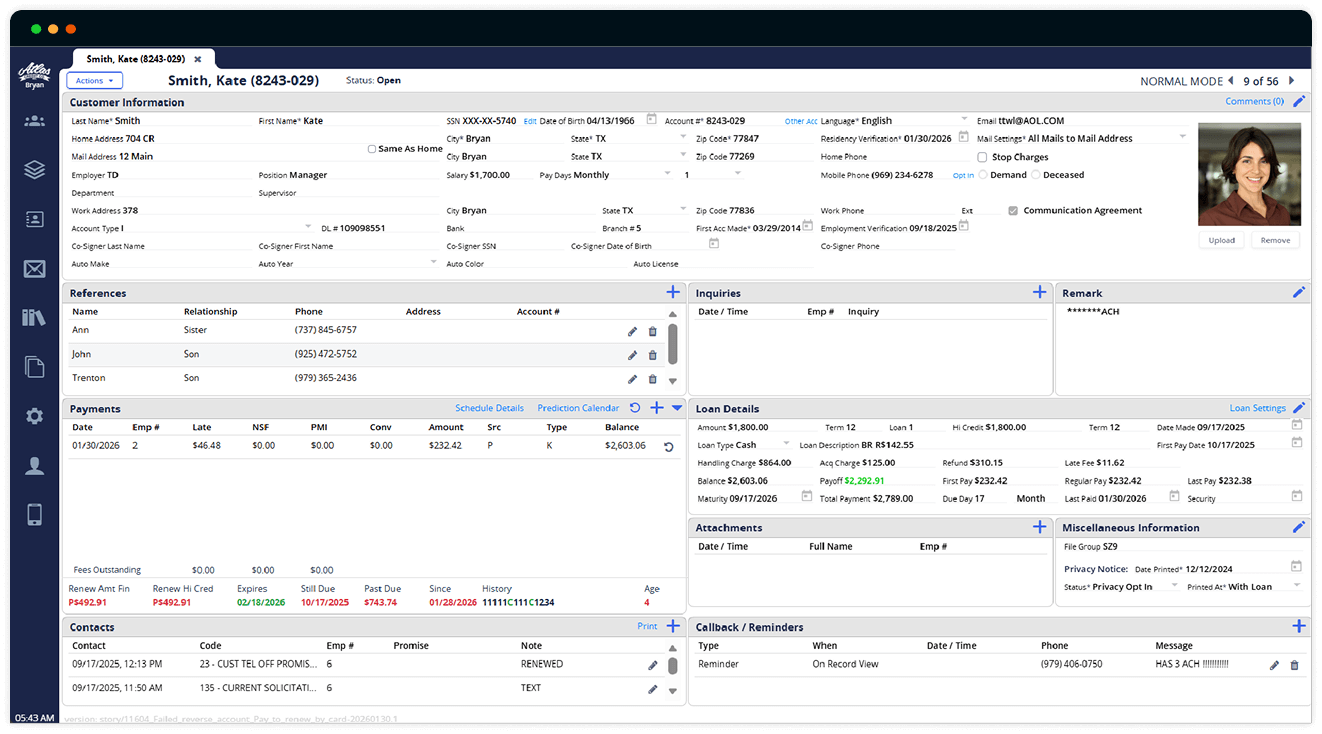

When designing the logic, UX, and UI of the LMS, ScienceSoft purposely kept some similarity with those of the off-the-shelf loan management software that Atlas Credit previously used. This approach was aimed at avoiding drastic changes to Atlas Credit’s established business processes and supporting a smooth transition to the new software for the lender’s employees.

ScienceSoft’s project manager used the resulting software design documentation to estimate the resources required to complete the project and plan the development timelines and budget. Atlas Credit received a detailed LMS implementation plan featuring a work breakdown structure (WBS), team composition, a time-framed budget utilization map, and risk mitigation steps.

Agile LMS development and testing

After Atlas Credit approved the project roadmap, ScienceSoft assembled a full-scale development team that included a project manager, a business analyst, three full-stack developers, two front-end developers, two back-end developers, and QA engineers. Later, the team was expanded to include a delivery manager, responsible for the multi-year LMS delivery strategy, processes, and client alignment. When selecting the resources, ScienceSoft prioritized talents that already had experience in financial software development to speed up delivery and optimize the project budget.

The team established a DevOps environment for the project, including container orchestration, CI/CD pipelines, and cloud automation tools. This move would facilitate and speed up LMS development, integration, testing, and deployment.

The loan management software had to automate every stage of Atlas Credit’s unique microlending operations, from loan initiation and underwriting to servicing and closure. ScienceSoft engineered the core functionality of the LMS, which included:

- Automated loan application processing and borrower onboarding.

- Credit rating and identity checks backed by the history of previous engagements, Experian Credit Report, MLA, social search, and more.

- Dynamic calculation of loans, payments, fees, and balances.

- Automated creation and distribution of loan documents.

- Loan and account servicing, including automated renewals, payoffs, and reversals.

- Delinquency tracking and collections management with mailing and label automation.

- Loan accounting with automated loan registry, reconciliations, and period closing.

- Lending analytics and real-time dashboards (sales, underwriting, loan servicing, debt collection, finance, compliance).

- Scheduled and ad hoc reports on credit applications and repayments (50+ report types — by period, customer, office, etc.).

- Cross-state, cross-branch digital workflow configuration, loan product setup, and compliance controls.

To speed up credit rating checks and loan reporting, simplify payment tracking and debt collection, and streamline finance reconciliation, ScienceSoft integrated the loan management solution with:

- Atlas Credit’s currently used accounting software (SAGE).

- Credit rating systems of the US's three largest credit bureaus (Experian, Equifax, TransUnion).

- Third-party payment gateways (for real-time tracking of electronic loan repayments).

- A US-wide SMS service platform (for automated distribution of dunning and collection messages).

In parallel with software engineering, ScienceSoft’s quality assurance specialists were running manual and automated tests (unit, integration, regression, and more) to promptly identify and fix the issues. The engineers applied test automation where possible to minimize the share of costly manual QA. ScienceSoft also established a dedicated user acceptance testing (UAT) environment, created test cases that reflected real business scenarios, and passed the ready LMS modules for UAT on Atlas Credit’s side as they came out. This step confirmed that the new solution provides convenient user journeys and helped prevent costly post-release changes.

For ScienceSoft, building a full-scale loan automation ecosystem meant sustaining Atlas Credit’s initial goals and project plans over several years while addressing the company’s emerging needs with minimal disruption to the roadmap. ScienceSoft’s project manager applied a hybrid methodology (Agile + classic PMI framework) with iterative LMS builds and continuous feedback cycles. This allowed the team to design, test, and refine software modules incrementally while ensuring adherence to Atlas Credit’s original business requirements.

LMS release and incremental expansion

After completing the required testing procedures, ScienceSoft migrated Atlas Credit’s business data to the new lending system and deployed the ready-to-use solution to the production environment. Atlas Credit and ScienceSoft agreed a one-time release of all LMS modules, giving Atlas Credit immediate access to the full set of core loan management capabilities without the delays of phased rollouts. Prior to launch, ScienceSoft conducted comprehensive training on LMS use for Atlas Credit’s branch staff, supervisors, and head-office teams to ensure smooth and fast software adoption.

As of December 2025, Atlas Credit’s custom LMS had gone live and had been delivering measurable improvements across the company’s operations and finance, reliably processing millions of loan records and supporting thousands of concurrent users. The predictable release and quick, tangible benefits earned the solution recognition as Best-in-Class Loan Management System at the Global FinTech Innovation Awards 2025.

Atlas Credit and ScienceSoft continue their cooperation on LMS evolution, with the following components planned for launch in 2026:

- A borrower portal enabling online self-service applications and renewals, real-time payments, balance tracking, and access to statements and loan documents.

- Voice AI agents to autonomously handle loan application verification, borrower identity confirmation, data validation, and other routine, phone-based interactions.

Vanessa Howland, General Manager at Atlas Credit:

Moving our loan operations to a new automated platform was a big step for Atlas Credit. With customer experience always front and center, we needed a partner we could trust to stay with us and see it through. Over more than five years, ScienceSoft supported us through every phase of this transformation and delivered a stable platform we can rely on.

I commend how steady and transparent the team was throughout the process. On a project of this scale, late changes and new questions were inevitable, but ScienceSoft stayed responsive, flexible, and in control of scope and timelines.

Their input on LMS design and strong architectural thinking gave us the confidence that we were building a stable platform that would support Atlas Credit for years into the future. There was some hesitation at the start, but the moment we went live, it felt like our capabilities expanded overnight. The new platform is now growing with every need, turning our operational vision into realities faster than we imagined.

I’d work with ScienceSoft again without hesitation.

Key Outcomes for Atlas Credit

- Launch of a proprietary loan management system (LMS) tailored to the company’s requirements and regulatory compliance rules.

- Reliable processing of millions of loan records and support for thousands of concurrent users.

- Higher productivity and satisfaction of lending teams due to less manual entry and fewer repetitive tasks.

- Minimized data and reconciliation errors due to the real-time, automated cross-checks enabled by the new LMS.

- Improved delinquency rates thanks to more structured risk tracking and strengthened digital collection practices.

- Quick adoption of the new LMS due to familiar interfaces and workflows.

- Optimized development costs thanks to ScienceSoft’s advice on the optimal feature set, architecture, and tech stack for the LMS.

- Timely, uninterrupted delivery thanks to ScienceSoft’s collaborative practices and mature risk management, which ensured alignment with Atlas Credit’s requirements and prevented scope creep despite changing project priorities.

- The ability to scale and evolve the LMS cost-effectively in tandem with the company’s business due to its cloud-first design and flexible modular architecture.

Technologies and Tools

.NET Core, C#, Angular, TypeScript, Bootstrap, Microsoft Azure Cloud, Azure DevOps Services, Docker, Selenium, Locust.