Automated Debt Collection System

Features, Integrations, Benefits, Costs

In financial software development since 2005, ScienceSoft designs and implements robust debt collection solutions that offer secure, accurate automation of collection planning and debt recovery activities.

Automated Debt Collection Software: The Essence

Automated debt collection software is a solution aimed to streamline debt recovery workflows and achieve 360° view of collection activities and creditor-debtor interactions. Such software simplifies regulatory compliance and can provide analytics-driven optimization of debt collection processes.

With robust automation of debt collection, companies can decrease operational costs, ensure timely cash inflow, and reduce bad debt.

|

Main user groups |

Lending services providers, debt collection agencies, banks, merchants selling on credit. |

|

Key integrations |

Accounts receivable software, a CRM or a loan servicing system, a customer portal, etc. |

|

Implementation time |

9–12+ months for a custom automated debt collection system. |

|

Development costs |

$150,000–$500,000+, depending on a solution's complexity. To get a more precise estimate, you can use our online cost calculator. |

|

ROI |

Up to 760%. |

Ways to Set Up Automated Debt Collection

General-purpose finance automation software

Implementing a market-available finance automation suite like Microsoft Dynamics 365 Finance or SAP Finance that comprises a digital payment tracking system and an automated debt collection tool.

Pros: Establishing a cohesive financial process automation environment.

Cons: High subscription cost, chances to get unnecessary functionality and miss industry-specific features (e.g., for lending or ecommerce).

Off-the-shelf debt collection software

Implementing OOTB debt collection software, which typically covers payment analytics, automated debt collection planning and execution, dashboards to control debt recovery progress and collector performance.

Pros: A fast and cost-effective way to get debt collection automated.

Cons: Pre-defined features and integrations, inability to upgrade the solution when needed.

Custom debt collection system

Building a custom automated debt collection system that provides all necessary functional and non-functional capabilities to digitalize your unique debt collection flows and meet industry-specific compliance requirements.

Pros: Getting a solution fully tailored to your business needs with no limitation for the number of users.

Cons: Software design requires additional time and investments.

Key Features of a Debt Collection Automation System

Here at ScienceSoft, we create debt collection software with custom-made automation functionality tailored to each client's business specifics. Below, we share a comprehensive list of features that form the core of a powerful automated debt collection solution.

Essential Integrations for an Automated Debt Collection System

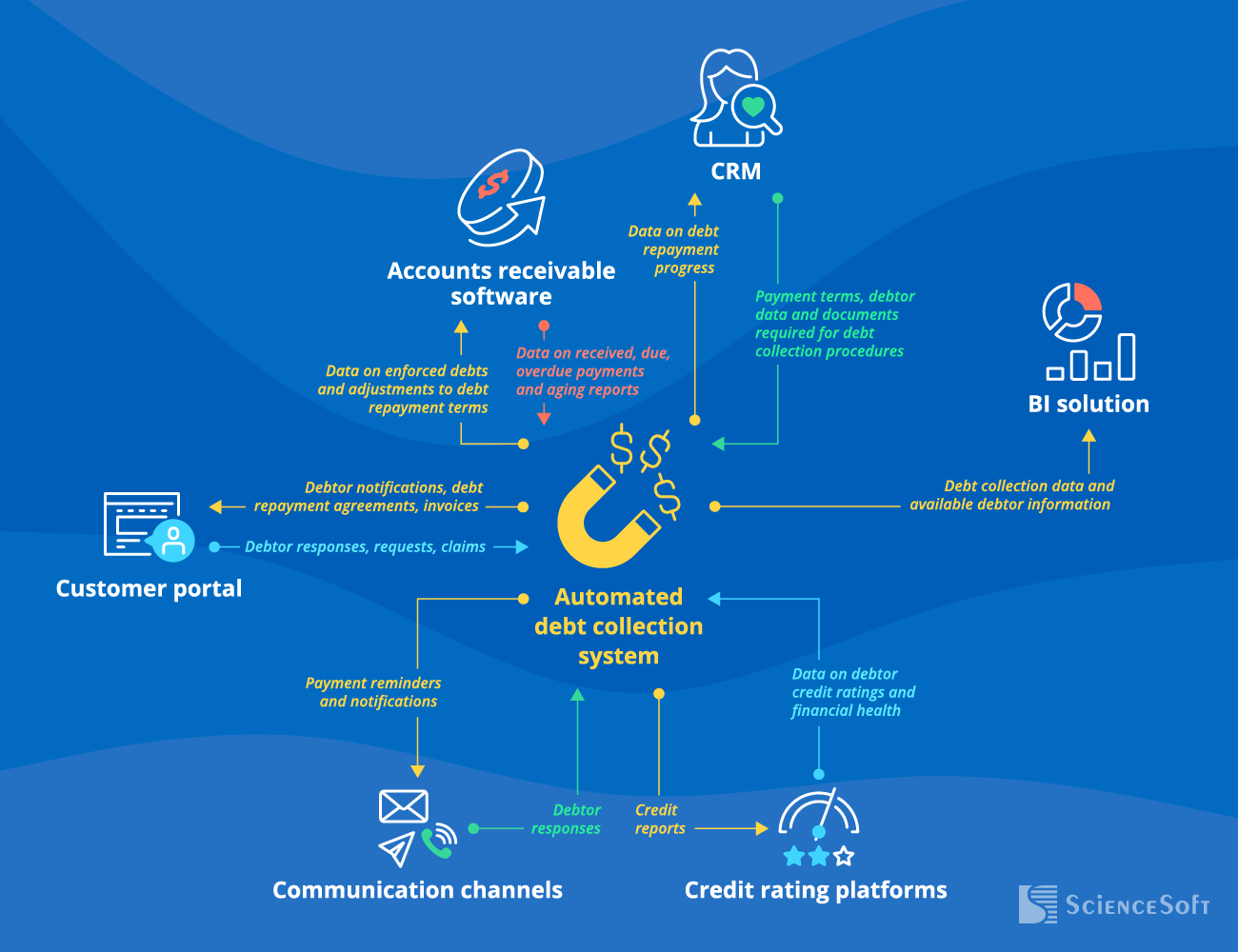

ScienceSoft recommends establishing the following key integrations to minimize human involvement across debt collection activities and improve process accuracy and efficiency:

- To trigger automated debt collection procedures and keep the collectors up to date on debt repayment progress.

- To accurately record due payment amounts under debt extension, restructuring, selling, or purchasing agreements and timely write off bad debts.

- For data-driven debt collection planning and automated input of up-to-date debtor information in the collection notifications, repayment agreements, etc.

- To keep sales agents up to date on debtor performance and timely initiate service termination or limit the access to particular products in case of non-payment.

Alternatively, instead of a CRM, debt collection software can be integrated with a loan servicing system of a lending services provider or a debt collection agency.

- To streamline debtor communication and speed up the delivery of debt-related documents.

- For automated processing of the information submitted by debtors.

Communication channels

Email, messaging services, an auto dialing system, etc.

To quickly and easily reach debtors and get their responses via various communication channels.

Credit rating platforms

of the selected credit rating bureaus (e.g., Experian, Equifax)

To easily access up-to-date information about a debtor's financial health (e.g., credit rating dynamics, bankruptcy status checks) and quickly submit credit reports.

Success Factors for Automated Debt Collection Software

In our debt collection automation projects, we always look to cover the following important factors that help drive high payback from the implementation:

|

Advanced analytics To ensure accurate, data-driven debt collection planning and get intelligent recommendations on collection strategy improvements. |

Omnichannel collections To reach debtors via a communication channel of their choice and drive high debtor response rate. |

|

Easy-to-use APIs To ensure seamless integration between debt collection software and other business-critical systems and eliminate double data entry. |

Intuitive UX/UI and proper user training To help debt collectors quickly learn how to apply automation to streamline their daily tasks. |

|

|

|

Consider implementing an AI-powered debt collection chatbot on top of your customer-facing app. Intelligent digital assistants help eliminate the low-level debtor interaction tasks and provide instant upload of the communication details to debt collection software. This step alone helps achieve up to 70% reduction in debtor coverage costs.

What Is the Cost of a Debt Collection Automation Solution

Based on ScienceSoft's experience, custom debt collection software of average complexity may cost around $150,000–$300,000.

The cost to develop a complex debt collection system powered with advanced analytics starts from $500,000.

Want to know the cost of your debt collection solution?

Benefits of Debt Collection Automation

Debt collection software drives significant operational cost savings and helps prevent revenue leakage. In a long-term perspective, a custom system can bring up to 760% ROI for large companies. An average payback period for such a solution is about 6 months.

Off-The-Shelf Debt Collection Automation Software ScienceSoft Recommends

Below, we list the leading offerings in the market of automated debt collection software. ScienceSoft can help you implement the tool that best fits your business specifics, as well as customize the product to your needs and integrate it with your internal systems.

TietoEvry Collection Suite Nova

Best for

Debt collection services providers.

Features

- Comprehensive debt collection automation engine.

- Real-time monitoring of debt repayments.

- Full traceability of communications with debtors across multiple channels, including printed correspondence, phone, SMS, email, voice messages, eNova portal.

- Automated reporting on user-defined KPIs.

- Prebuilt APIs to integrate with necessary corporate systems.

Cautions

It may be hard to customize the software to your specific debt recovery needs.

Pega Collections

Best for

Banks and lending services providers.

Features

- AI-supported recommendations on optimal collection strategies for each particular debtor.

- Scenario modeling and visualization for various collection strategies.

- Omnichannel debtor interactions, including those via social networks.

- Real-time tracking of debt collectors' performance.

- Rule-based prioritization of collection tasks.

Cautions

It may be costly and time-consuming to integrate the solution with your existing corporate systems.

Experian's Debt Collection System

Best for

SMEs selling on credit.

Features

- Rule-based debtor segmentation by region, debt amount, behavior, and more.

- Intelligent prioritization of debt collection activities.

- Real-time tracking of debt repayment transactions.

- Native integration with Experian's credit database to get real-time updates on a debtor's financial status changes.

- Compliance with FDCPA, CFPB, and other consumer protection regulations.

Cautions

Experian's system doesn't provide end-to-end automation of debt collection workflows.

Should You Opt for a Custom Debt Collection Automation System?

Answer a few simple questions and find out whether you should opt for a custom-made solution.

Do you need a solution to automate specific debt collection tasks, e.g., processing debtor responses in user-defined languages or debts triaging for collection based on custom criteria?

Do you need a debt collection system powered with AI, e.g., to predict missed payments or get intelligent guidance on optimal debt collection strategies?

Do you need a debt collection solution providing compliance with the latest debt collection regulations of the countries you operate in?

Do you need to integrate your automated debt collection software with multiple back-office systems or legacy tools?

Do you operate in a regulated industry (e.g., lending, healthcare, public sector) and need a solution providing advanced data security?

Do you need a debt recovery solution with various interfaces for different roles in the collector team?

Do you plan to evolve the solution with new functional and non-functional capabilities in order to adjust it to changing business and legal requirements?

Do you have large teams involved in debt collection processes and look to avoid the software fees associated with the per-user subscription model?

Please tell us a bit more about your needs

Answer at least 3 questions to get results.

You can go with off-the-shelf debt collection software

Looks like market-available solutions are a viable option to meet your debt collection needs. Turn to ScienceSoft if you need help with choosing the optimal ready-made debt collection tools, their implementation, customization, or integration with your existing corporate systems.

You definitely should consider custom development

A tailor-made debt collection solution will help you reap the unique benefits that market-available software cannot offer. Turn to ScienceSoft to get the detailed assessment of a custom debt collection system’s feasibility for your business situation.

Custom debt collection software is your best choice

Looks like market-available debt collection tools don’t fit your specific business requirements and won’t be able to provide the expected operational and economic feasibility. Turn to ScienceSoft to get a consultation on custom debt collection software development and receive cost and ROI estimates

Build Effective Debt Collection Software with ScienceSoft

Entrust the implementation of your debt collection system to professionals. In financial software development since 2005, ScienceSoft provides a full scope of services to help our clients launch reliable automated debt collection solutions with no hassle, ensuring that the resource constraints are met and changes are addressed agilely.

About ScienceSoft

ScienceSoft is a global IT consulting and software development company headquartered in McKinney, Texas. Since 2005, we provide full-scale digital transformation services to help our clients establish effective automation of their debt collection processes. In our projects, we employ robust quality management and data security management systems backed up by ISO 9001 and ISO 27001 certifications.