Buy Now Pay Later Application Development

A Comprehensive Guide

ScienceSoft brings 20 years of experience in engineering custom payment solutions to help companies design and develop robust Buy Now Pay Later applications.

Buy Now Pay Later Application: The Essence

A Buy Now Pay Later (BNPL) application allows shoppers to make instant online and in-person purchases and pay them off in installments, often interest-free. The solution provides consumers with a convenient and cost-effective way to afford the products and services they need.

As Buy Now Pay Later becomes an increasingly popular payment option globally, such apps have the potential to generate significant revenue for BNPL service providers and drive higher order value and frequency for merchants.

Buy Now Pay Later app development in 6 steps

- Gather business and end user requirements for the BNPL app.

- Plan the development tasks, project team, timelines, and budget.

- Design the BNPL app’s features, architecture, UX and UI.

- Select a cost-effective tech stack to implement the solution.

- Develop your BNPL app and establish the necessary integrations.

- Finalize QA procedures and set the ready-to-use app live.

Ways to provide customers with access to BNPL services: introducing a standalone BNPL app with built-in shopping capabilities, BNPL integration as one of the payment methods in merchants’ selling platforms.

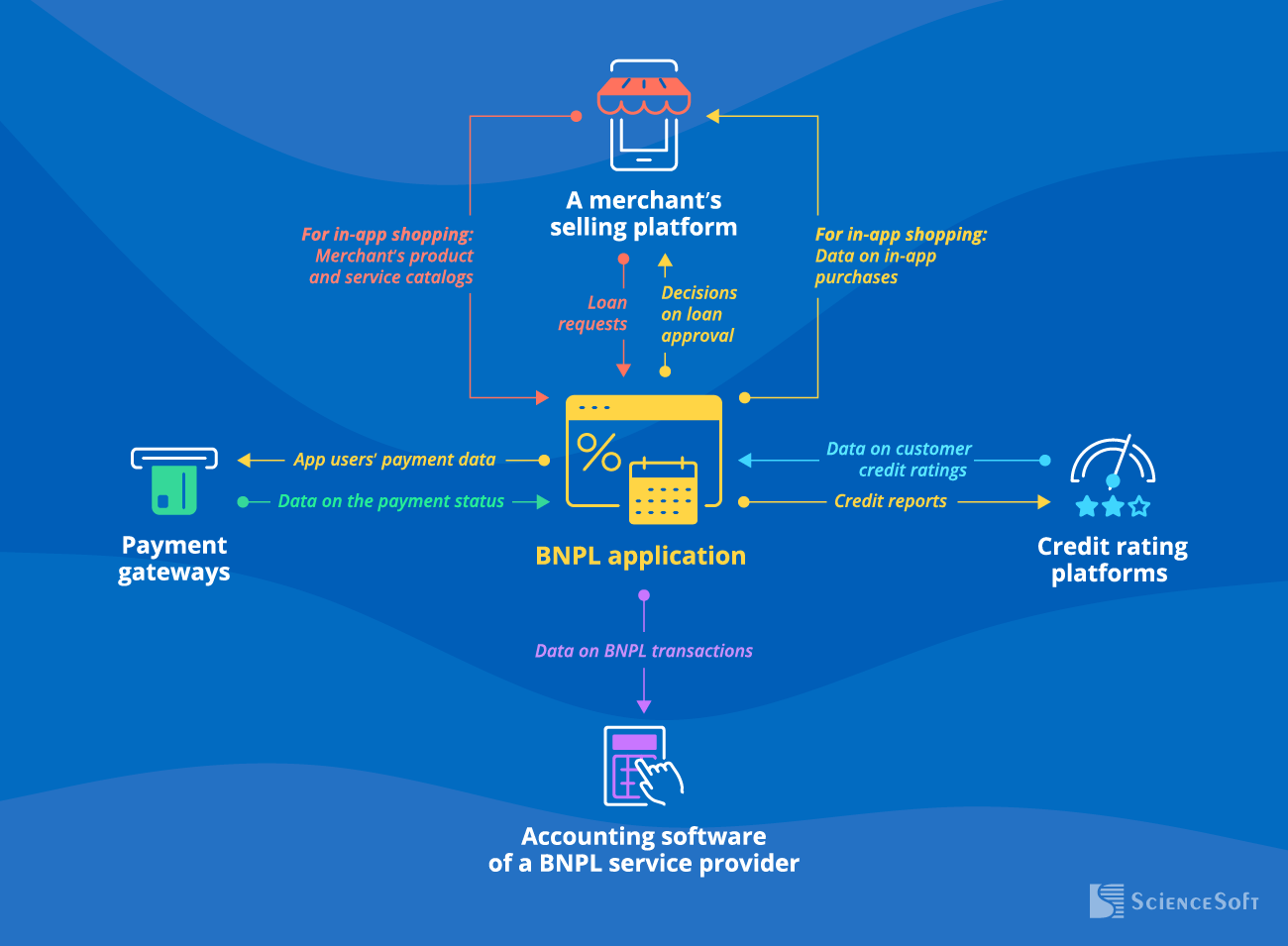

Necessary integrations: a merchant’s selling platform, payment gateways, a credit rating platform, accounting software of a BNPL service provider.

Timelines: 6–11 months on average.

Cost: $120,000–$400,000+, depending on the software complexity. Use our cost calculator to estimate the cost for your case.

Key Features of a Buy Now Pay Later Application

A Buy Now Pay Later app combines robust functionality for streamlined loan management with a comprehensive set of features for convenient and secure online and in-store shopping. Here, ScienceSoft shares a sample feature set for the application:

Essential Integrations for a Buy Now Pay Later App

ScienceSoft recommends that a BNPL application should integrate with the following systems to streamline payments on the loan and ensure a seamless flow of purchasing and payment data:

- A merchant’s selling platform (a merchant’s website, an ecommerce marketplace, POS software, etc.) – to instantly process loan requests and communicate the decision on loan approval to customers; (for in-app shopping) to ensure the accuracy of introduced information on merchants’ products and services and promptly inform merchants about the purchases made via a BNPL app.

- Payment gateways provided by banks or independent payment services providers (e.g., PayPal, Stripe) – to enable real-time processing of payments sent by customers, merchants, and a BNPL service provider; to keep app users up to date on the status of their payments.

- Credit rating platforms of the selected credit rating bureaus (e.g., Experian, Equifax) – for facilitated customer credit rating checks and credit report submission.

- Accounting software of a BNPL service provider – to automatically record data on upfront payments to merchants, due and received loan repayments from customers, and payments from merchants for BNPL services in the general ledger.

Factors that Drive ROI for a Buy Now Pay Later App

In Buy Now Pay Later application development projects, ScienceSoft always looks to cover the following important factors to maximize the app’s potential to generate revenue:

Convenient UX and user-friendly UI

To drive high app adoption among customers and merchants.

Mobile access

To enable consumers to make in-app purchases on the go.

Single-use virtual cards

To let customers use a BNPL service when paying for purchases in a physical store.

Support for multiple installment plans and repayment methods

To allow customers to choose preferred financing and repayment options.

Robust security

To guarantee the protection of payment plan software and sensitive data it stores from fraudulent and malicious activities.

Easy-to-use APIs

To ensure fast and smooth app integration with required systems and eliminate double data entry.

When powered with advanced analytics, the solution helps merchants precisely identify BNPL-related customer purchasing patterns and enables data-driven planning of segmented ads and discounts.

A Buy Now Pay Later Solution Launch Plan

Buy Now Pay Later app development typically starts with a comprehensive research of competitive environment and target audience needs and involves the steps like project planning, application design and development, integration, testing, release, support and evolution.

However, roadmaps to BNPL implementation may differ depending on your business-specific needs. Choose the service type you’re interested in to explore a sample BNPL project plan by ScienceSoft.

Custom BNPL development for BNPL service providers

The BNPL market is expected to show more than 20x growth for the next decade. Don’t miss the best time to launch your own BNPL application to maximize your market share and enjoy high and prompt ROI.

BNPL integration in the online store for merchants

Drive 45% higher purchase frequency, achieve a 40%+ increase in AOV and up to 30% growth in conversion. Just let your clients get the products and services they need right now while reducing their financial burden.

Buy Now Pay Later Application Development for BNPL Service Providers

Buy Now Pay Later app development with ScienceSoft usually looks as follows:

1

BNPL application conceptualization

Duration: 1–3 weeks.

- Communicating with key project stakeholders to discuss the BNPL app vision.

- Analyzing the needs of the client’s target audience to perform requirements engineering and outline the scope of the BNPL application.

- Introducing a detailed list of requirements for the application, which describes:

- The required platform to base the app on (web, mobile, or both).

- Functional capabilities the app is expected to provide, e.g., support for particular installment plans, loan repayment methods, in-app purchases, virtual cards, and more.

- The data the app should be able to process (customers’ personal information, payment card data, SKU data, etc.).

- Role-specific requirements for the UX and UI.

- Non-functional requirements, including security and compliance requirements.

2

Project planning

Duration: 1–2 weeks.

- Defining objectives, KPIs, and milestones for the project.

- Determining project deliverables, duration, and budget.

- Forming the project team and designing collaboration workflows.

- Outlining possible project risks, introducing a risk mitigation strategy and plan.

- Estimating the expected TCO and ROI of the BNPL application.

3

BNPL application design

Duration: 3–6 weeks.

- Designing the architecture of a BNPL app and its integration points.

- Introducing an optimal feature set.

- Designing UX and UI for customers, merchants, a BNPL service provider. It comprises:

- UX research to understand the behavior of the app’s target audience.

- Creating functional wireframes and content layouts for the app.

- UX prototyping.

- Designing the app’s visual appearance and introducing UI mockups.

- Delivering a plan of BNPL app integrations with the required systems, suggesting optimal ready-to-use integration solutions (particular payment gateway APIs, credit rating platform APIs, etc.), if needed.

4

Tech stack selection to implement a BNPL app

Duration: 2–3 weeks.

ScienceSoft’s best practice: We use platforms, frameworks, and ready-made components (e.g., UI components, authentication services) where possible to streamline Buy Now Pay Later app development and optimize project cost.

5

BNPL application implementation

Duration: 5–8+ months, depending on the app’s complexity.

- Establishing development and delivery automation environments (CI/CD, container orchestration, etc.).

- Creating the back-end code of a BNPL app, including API code.

- Delivering role-specific user interfaces.

- Performing unit tests in parallel with coding.

- Integrating the app with the required systems.

- Conducting functional, including integration, and non-functional app testing.

- Configuring the BNPL app’s infrastructure, backup and recovery procedures.

- Implementing infrastructure security tools (authorization controls for APIs, firewalls, DDoS protection algorithms, etc.).

- Deploying the BNPL application in the production environment.

- Uploading the app to the required web or mobile app stores.

6

Support and evolution of a BNPL app (optional)

Duration: continuous.

- Maintaining app compliance with the required data security standards and regulations.

- Fixing app performance, scalability, and security issues, if any.

- Adjusting the app’s functionality to the changing customer needs (e.g., adding new loan repayment methods).

Buy Now Pay Later Integration in the Online Store for Merchants

ScienceSoft typically performs the following steps to help merchants smoothly integrate Buy Now Pay Later as a payment option in their selling platforms:

1

Business needs analysis and requirements engineering

Duration: 1–3 weeks.

- Analyzing the merchant’s needs to be met with BNPL integration.

- Auditing the software to be integrated to understand its capabilities and constraints.

- Assessing the maturity of the merchant’s existing IT infrastructure.

- Introducing a detailed list of functional and non-functional requirements for the integration.

2

Project planning

Duration: 1–2 weeks.

- Defining objectives, KPIs, and milestones for the project.

- Determining project deliverables, duration, and budget.

- Forming the project team and designing collaboration workflows.

- Outlining possible project risks, introducing a risk mitigation strategy and plan.

- Estimating the expected TCO and ROI of the integration.

3

Design of the BNPL integration

Duration: 2–5 weeks.

- Deciding on the best-fitting approach to the buy now pay later integration:

- Hosted integration – the customer is redirected away from the checkout page at the merchant’s platform to the BNPL service provider's website to complete a payment. After the payment is complete, the customer is redirected back to the platform.

- Self-hosted integration – merchant’s clients don’t need to leave a platform’s checkout page to complete a purchase. A white-label BNPL solution integrates directly into the platform via ready-to-use or custom APIs, and the entire checkout process takes place within the platform.

- Selecting an optimal market-available BNPL solution according to the merchant’s specific criteria and business priorities.

ScienceSoft’s best practice: BNPL service providers typically charge a merchant account setup fee and a fee for transaction processing services (a monthly fee or a fee for each transaction processed). The solutions they offer differ in cost, functionality, integration methods, and the level of security. We at ScienceSoft perform a detailed comparative analysis of possible solutions to help our clients access the required features and minimize the costs of relying on BNPL services.

- Defining the proper BNPL integration solution depending on the selected approach to integration:

- A BNPL button, redirect scripts, and webhooks to embed into the checkout interface.

- Ready-to-use integration APIs provided with a market-available BNPL solution.

- Custom APIs to smoothly connect a BNPL solution to the merchant’s selling platform(s).

- Designing the architecture of both the integrated system and an integration solution.

- Designing a custom UI of a checkout page (optional).

4

Choosing a BNPL integration tech stack

Duration: 2–3 weeks.

ScienceSoft defines the techs and tools required to integrate BNPL functionality in a merchant’s selling platform(s), compares various integration techs and tools in the context of the documented business requirements, and selects the optimal ones.

5

Implementing the BNPL integration

Duration: 2–8 weeks, depending on the chosen integration pattern.

NB: Prior to the integration implementation, the merchant needs to establish a merchant account with a BNPL service provider.

- Developing the appropriate Buy Now Pay Later integration solution.

- Quality assurance of the BNPL integration.

- Implementing authorization controls for APIs, transaction validity confirmation mechanisms, DDoS protection algorithms, and other cybersecurity tools to protect sensitive data transferred between the BNPL app and the online store.

- BNPL integration solution deployment in the production environment.

6

Support and evolution of the integration (optional).

Duration: continuous.

- Monitoring the integrated system performance.

- Fixing scalability issues, if any.

- Extending an integration solution’s functionality based on a merchant’s evolving needs.

Market-Available BNPL Solutions ScienceSoft Helps Integrate

Affirm

Best for

Large ecommerce businesses.

Features

- Prebuilt APIs for hosted and non-hosted integration with merchants’ online stores.

- Easy-to-use plugins to integrate with Salesforce Commerce Cloud, BigCommerce, Shopify, and other popular ecommerce platforms.

- Support for Pay in 4, customizable biweekly and monthly installment plans.

- Automated generation of single-use virtual cards for onsite purchases.

- Multiple loan repayment methods, including a bank transfer, a debit card, a check.

- No late fees for missed payments.

- Loan transactions reporting to Experian.

Merchant fees

A flat fee of $0.30 plus a variable fee of ~ 5%–6% per purchase transaction.

Buy Now Pay Later Implementation Costs

Developing a Buy Now Pay Later application may cost around $120,000–$400,000+, depending on app functionality, the scope of supported platforms, the complexity of integrations, and more.

Below, we provide the approximate cost estimations based on ScienceSoft's expertise in BNPL software development projects:

$20,000–$100,000

Integrating a market-available BNPL solution into the merchant’s selling platform.

$120,000–$180,000

Developing a mobile BNPL app of average complexity.

$400,000+

Building a comprehensive web-based Buy Now Pay Later platform.

The cost, duration, and approach to BNPL implementation depends on the following factors:

For BNPL app development

- The number and complexity of a BNPL app’s features.

- The platform to base the app on (web, mobile, or both).

- (for mobile installment apps) Supported mobile platforms (iOS, Android).

- Performance, scalability, availability, and security requirements for the app.

- Role-specific requirements for the UX and UI.

- The number and complexity of integrations.

For BNPL integration in the online store

- The chosen approach to the BNPL integration.

- The number and specifics of solutions to be integrated and the number of integration points.

- Performance, availability, scalability, security requirements for the integrated system.

- The required modifications of the integrated solutions.

Choose Your Service Option

ScienceSoft’s BNPL implementation services are customized to your business needs and can be related to:

FAQs About Buy Now Pay Later App Development

How do Buy Now Pay Later companies make money?

There is a variety of options to monetize a BNPL app, and the choice should be made based on your preferred business model. Some popular ways to generate revenue are:

- Charging a merchant fee (a flat fee or a percentage of the transaction amount) for offering the BNPL service.

- Charging customer fees for late payments.

- Charging merchant fees for promotional services, e.g., offering exclusive deals or personal discounts for merchants’ clients.

- Cross-selling or upselling other financial products, e.g., payment cards, personal loans, or insurance.

- Selling in-app advertising.

- Data monetization (requires app user consent).

How to tap into the BNPL market with minimal risks?

At ScienceSoft, we define the best-fitting market niche and a unique selling proposition for each BNPL app, as well as measure economic feasibility of app development to help our clients confidently start their initiatives. We also deliver a detailed project roadmap for risk-free application launch and provide precise estimates for accurate investment planning.

Who is involved in the BNPL app development process?

Typical roles on ScienceSoft’s BNPL app development teams are a business analyst, a solution architect, a project manager, a UX/UI designer, a front-end developer, a back-end developer, a DevOps engineer, and a QA engineer. If you want your app to provide AI-based analytics, we also involve data scientists to design and train BNPL machine learning models.

About ScienceSoft

ScienceSoft is a global IT consulting and software development company headquartered in McKinney, Texas. We provide full-cycle application development services to help companies design and build reliable and secure Buy Now Pay Later apps. In our projects, we employ robust quality and data security management systems backed by ISO 9001 and ISO 27001 certifications.