Loan Management Software

Features, Development Steps, Costs

In lending software development since 2005, ScienceSoft helps lending service providers design and build all-in-one solutions for secure, compliant management of their loan activities.

Loan Management Software: The Essence

Loan management software automates the entire loan portfolio cycle, streamlines control of lending activities, and simplifies compliance with internal credit policies and legal regulations.

Such solutions offer instant processing of loan applications and repayments, support automated debt collection and credit reporting, provide centralized storage for borrower data and documents. They usually also cover customer portal functionality to provide borrowers with seamless lending experience and facilitate lender-borrower interactions.

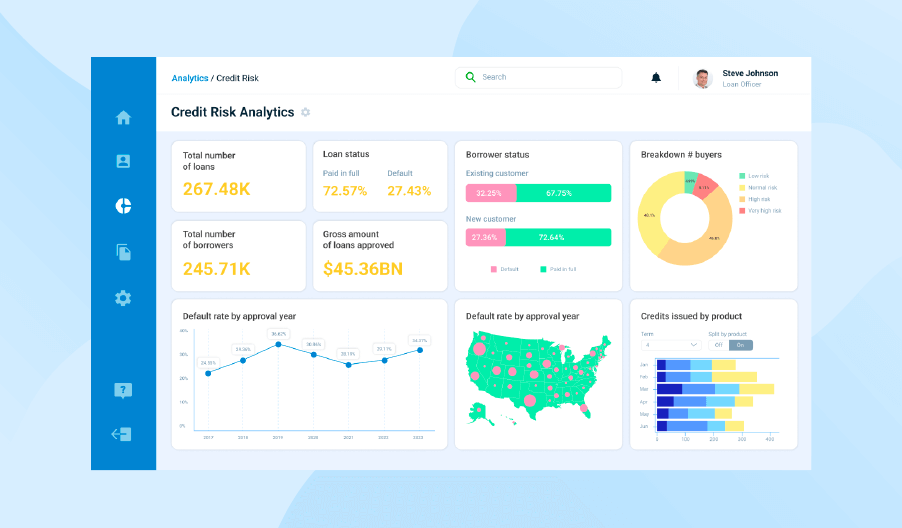

Custom loan management software can include advanced analytics to enable data-driven assessment of borrower credit risks and ensure accurate loan decisioning.

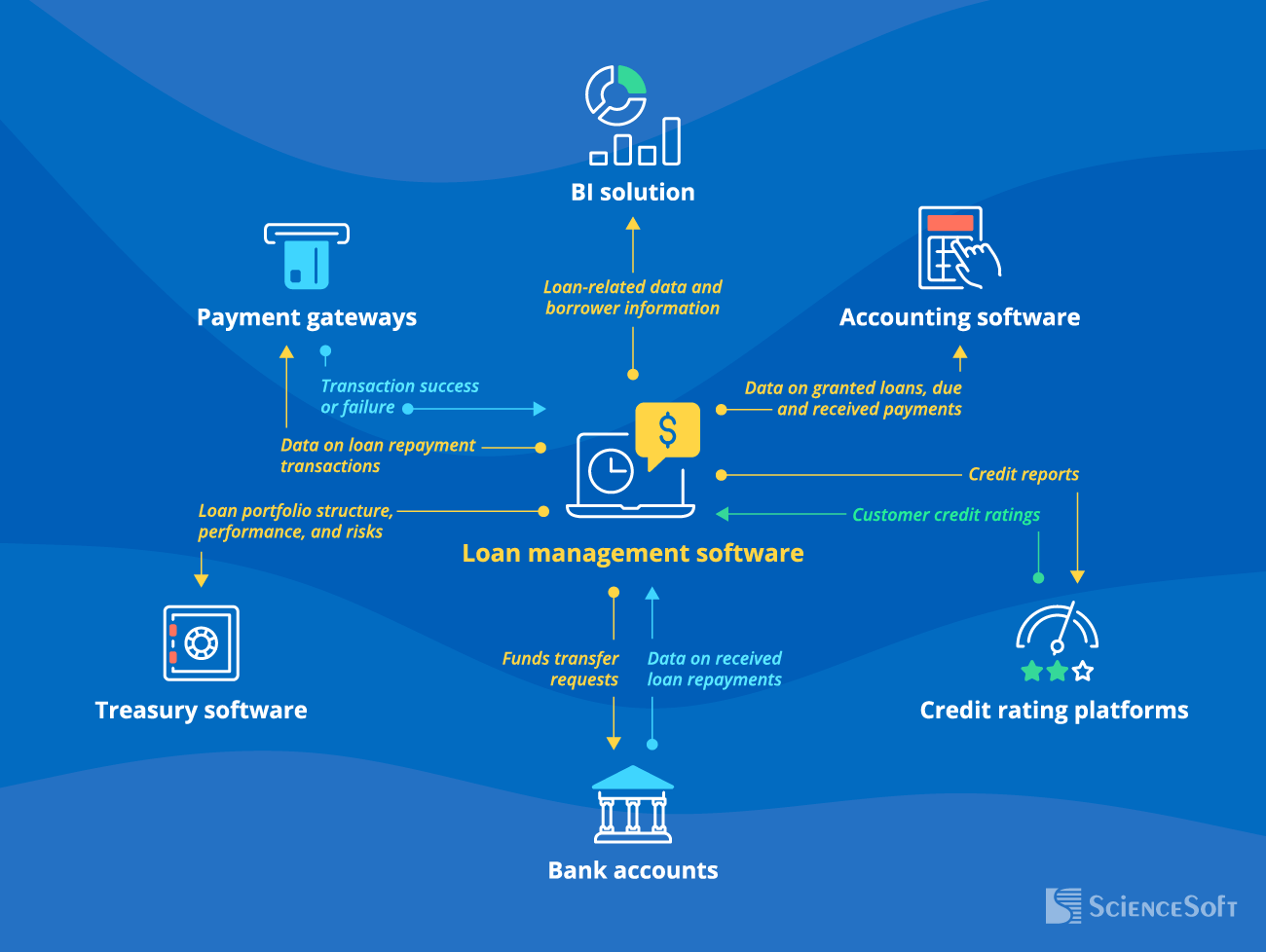

- Main integrations: Accounting software, a treasury management system, payment gateways, a BI solution, and more.

- Implementation time: 10–18+ months for a custom loan management solution.

- Development costs: $400,000–$2,000,000+, depending on the solution’s complexity. Use our cost calculator to estimate the cost for your case.

- Annual ROI: 100–540%.

Benefits of Loan Management Software

Key Features of a Loan Management System

ScienceSoft knows that each lending business has unique loan management processes and credit automation needs. In our lending software projects, we create loan management systems with functionality tailored to each of our clients’ business specifics. Here, our consultants compiled a comprehensive list of features commonly requested by our clients.

Essential Integrations for Loan Management Software

Connecting your loan management solution with the relevant corporate and external systems helps speed up the aggregation and processing of borrower data and documents. Plus, it streamlines lending data sharing between the internal teams and legal authorities. ScienceSoft recommends setting up the following integrations:

For instant processing and real-time tracking of loan repayments.

For accurate recording and reporting of lending transactions.

Credit rating platforms

of the selected credit rating bureaus (e.g., Experian, Equifax)

For streamlined customer credit rating checks and prompt submission of credit reports.

Bank accounts

- For timely transfer of the approved fund amounts to the borrowers.

- For facilitated reconciliation of repayments.

When used by banks, loan management software can be integrated directly with a core banking system.

For data-driven planning of the loan portfolio hedging strategies.

For comprehensive lending analytics and advanced visualization of credit reports.

Factors that Drive ROI for a Loan Management System

The ROI for lending software can vary significantly (from 100% to 540%+) depending on the solution complexity as well as company size and specifics. Below, ScienceSoft’s consultants share the main factors that, when covered, help achieve maximum payback:

To eliminate manual routine across lending workflows and free the lending teams for high-value tasks while preventing operational errors and disruptions.

Advanced analytics

To accurately assess borrower credit risks and loan portfolio risks. To get intelligent recommendations on the optimal personalized loan terms and debt collection strategies.

To ensure loan underwriting, servicing, and reporting in accordance with global, country- and industry-specific lending regulations.

Mobile access

To enable loan management teams to approve loan applications and track repayment progress on the go.

Cloud deployment

To provide scalable centralized storage for borrower data and documents and enable 24/7 remote employee access for faster loan processing.

Advanced security

To protect your IT system from all types of cyber attacks and prevent the risk of sensitive data leakage.

How to Develop Loan Management Software

Loan management software development is a complex process that involves business and regulatory requirement analysis, solution planning and design, coding, testing, integration, establishing security and achieving legal compliance.

Below, ScienceSoft outlines key steps to build a custom loan management system. Check our project management and development practices to learn how we lead lending software projects to success.

1

Business needs and regulatory framework analysis and eliciting requirements for your lending system.

2

Introducing the optimal feature set, architecture design, UX/UI design, and tech stack.

3

Project planning: deliverables, scope of work, duration, budget, etc.

4

Loan management software development (from scratch or platform-based).

5

Quality assurance in parallel with coding.

6

Lending data migration (from spreadsheets or a previously used tool).

7

Integration with other business-critical solutions and relevant third-party systems.

8

Establishing security of your loan solution and lending IT system.

9

User training.

10

Continuous support and evolution of the lending solution (optional).

How Much Does Loan Management Software Cost

The costs and timelines of implementing a custom loan management system vary greatly depending on:

- The scope and complexity of a solution’s functional capabilities, including AI-powered features.

- The number and complexity of integrations.

- Non-functional requirements: performance, scalability, availability, security, etc.

- Requirements for the UX and UI for various user roles.

- The chosen sourcing model (all in-house, team augmentation, or full outsourcing), team composition, tech stack, etc.

Based on ScienceSoft’s experience, custom loan management software of average complexity costs around $400,000–$1,500,000. Large financial institutions looking to build a comprehensive loan management system powered with advanced analytics should expect to invest $2,000,000+.

Want to know the cost of your lending solution?

Off-the-Shelf Lending Software ScienceSoft Helps Implement

Fusion Loan IQ by Finastra

Best for

Managing complex commercial (including syndicated) loans.

Features

- Automated origination of various types of loans, including mortgages and syndicated loans.

- Recording and tracking financial and non-financial collaterals.

- AI-supported decision-making on credit approval.

- Customizable templates for various types of lending documents.

- Documents e-signing.

- Pre-built integrations with over 70 market-available core banking platforms and popular credit-rating platforms.

- Compliance with IFRS9, CECL, AnaCredit standards, FACT Act, Regulation B.

Cautions

Consumer loan management requires integration with Fusion LaserPro, a separately licensed Finastra’s product, which increases the solution’s TCO.

CL LoanTM by Q2

Best for

End-to-end automation of lending processes.

Features

- Instantly processing loan applications from multiple channels: a website, email, phone, and more.

- User-defined lending terms: repayment frequency, interest structure, delinquency grace days, etc.

- Automated borrower pre-qualification against the internal borrower requirements.

- Real-time tracking of lending activities.

- Analytics-based planning of debt collection strategies for various borrower segments.

- A borrower self-service portal.

- Pre-built APIs to integrate with business-critical software and digital banking systems.

Cautions

CL LoanTM may not provide compliance with lending regulations of the countries you operate in.

FIS Loan Management System

Best for

Setting up user-defined automated loan processing workflows.

Features

- Managing multiple types of consumer and business loans, including lines of credit, mortgages, installment loans, payday loans, and more.

- User-defined loan application approval rules.

- Customizable templates for repayment invoices and credit reports.

- Processing repayments via connected payment gateways.

- Scheduled borrower notifications and payment reminders.

- Configurable dashboards providing full view of loan transactions, borrower data, the lending team performance.

Cautions

Although FIS solution provides vast customization opportunities, it is costly and complicated to extend with additional features you may need.

When to Opt for Custom Loan Management Software

Market-available general-purpose loan servicing solutions do provide credit automation functionality, but often fail to bring the expected ROI. This is especially the case for the companies with specific loan management needs and large teams involved in lending processes.

Below, ScienceSoft describes the most prominent cases that may require custom development. If you find your needs listed below, a tailored loan management system will be the most economically feasible option for you.

|

|

You need to automate unique loan management operations and want to receive intelligent guidance on specific credit-related decisions. |

|

|

You want smooth and cost-effective integration of loan management software with your internal systems, including legacy tools. |

|

|

You need software that is compliant with all required lending regulations, including region-specific standards. |

|

|

You are involved in high-value and high-volume commercial credit deals and need a highly secure solution providing advanced data protection capabilities. |

|

|

You need flexible loan tracking software that is easy to evolve with new features and advanced techs as your business grows or transforms. |

|

|

You have large lending teams and want to avoid considerable subscription costs for off-the-shelf lending tools, which scale as the number of users grows. |

|

|

You’re starting a lending business and want to build your corporate software ecosystem around a comprehensive loan management system. |

|

|

You’re building a DeFi lending platform and need to introduce blockchain-based loan transactions recordkeeping and smart-contract-enabled credit automation. |

Build Your Own Lending System with ScienceSoft

Having 20 years of experience in engineering custom lending solutions, ScienceSoft knows how to design and launch an effective loan management system tailored to your unique needs. We provide:

Loan management software consulting

- Business and borrower needs analysis; assessment of the existing lending processes, tools, and their integration points.

- Suggesting optimal features, architecture, and a tech stack for a loan management system.

- Preparing a plan of integrations with the required internal and third-party systems.

- Security and compliance consulting.

- Implementation cost & time estimates, expected ROI calculation.

Loan management software implementation

- Software conceptualization and architecture design.

- End-to-end software development or modernization of your existing lending system.

- Integrating the solution with the required internal and third-party systems.

- Quality assurance.

- User training.

- Continuous support and evolution (if required).

Our awards, certifications, and partnerships

About ScienceSoft

ScienceSoft is a global IT consulting and software development company headquartered in McKinney, Texas. Since 2005, we help financial services providers design and develop reliable loan management solutions. Being ISO 9001- and ISO 27001-certified, we apply a mature quality management system and guarantee that cooperation with us does not pose any risks to our clients’ data security.