Why Does Mobile Banking Lag Behind?

In contrast to thousands of various services which have already reached out to the mobile world with applications that conveniently complement businesses, mobile banking is only cautiously moving forward. Not that it is being suppressed by the lack of interest among potential users, let alone of mobile development competence. Rather, it's banks that, due to some reason, take their time to adopt the idea of dealing with finance from mobile devices.

But all the more so creating a quality mobile banking application is a great way for any bank to stand out and gratify their clients by introducing such a highly-anticipated service modification.

Clients' expectations

Social studies show that Americans are indeed eagerly waiting for mobile banking to evolve and spread. 60% of US bank clients say that this very option is a major factor according to which they choose or switch banks. In comparison: location, service quality and even fee rates all received from 21% to 28% of votes. Besides, as proved by a 2014 survey, 62% of Americans expected mobile banking applications to be actively used from smartphones by 2016.

From all these figures it is obvious that lots of people recognize the convenience of mobile banking and treasure it as an essential service. But sadly, as we are already on the verge of 2016, we cannot but admit that users' wish to benefit from mobile banking is seriously hampered by the banks' rigid attitude.

The real picture

Among today's most popular US financial institutions only a few, including Bank of America and Citibank, have their exclusive and official mobile banking applications. Other existing mobile banking software is developed and distributed by third parties and provides access to multiple bank accounts at once. In this respect, it has some limitations, which we will tackle later.

Credit union mobile applications generally support bill payments, money transfer and mobile remote deposit capture (RDC), but, surprisingly, do not provide the main option represented by every credit union - contracting a loan. In a similar manner, bank clients are unlikely to succeed in finding a mobile offering for insurance. The reason for these flaws is unclear, considering that implementation of the mentioned functions as well as of many others is more than feasible.

The missing features

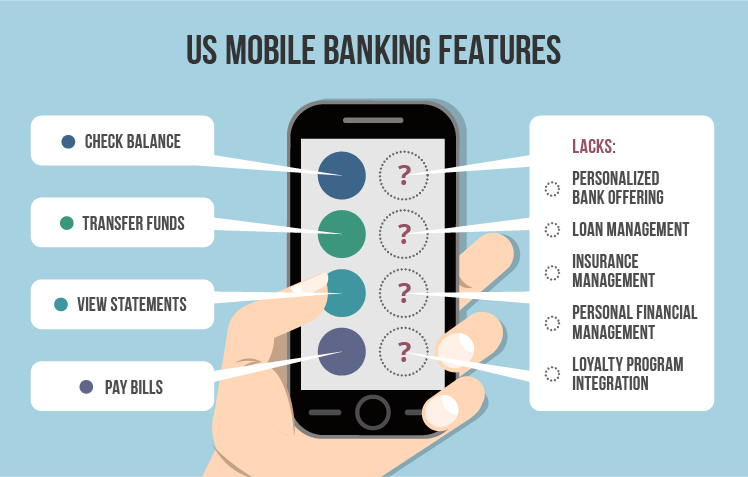

Surveys state that the activities mobile banking is most often used for are checking balance and deposits, paying bills, viewing statements and transferring funds. In addition to being most widespread, these 4 operation types are the core of what a mobile banking application should offer. But today, with the mobile software's capability to safely and briskly execute even intricate operations, all ScienceSoft's specialists in banking software development know that there could be created a lot more.

Apart from providing such basics as account management, payments, transfer and alerts, mobile banking can continually enrich the list of available functions. Loyalty program integration, personalized bank offering as well as applications for loans and insurance via mobile are the options that are beneficial for both users and banks. Even complementing the personal financial management function with such features as creating a budget, setting saving goals and organizing spending will significantly advance clients' experience. Try out this demo to see how smoothly these features can be integrated in a mobile banking app.

Security

Although security is the most delicate issue of mobile banking, 88% of American population believe in the power of mobile software and are not afraid to entrust their financial operations to mobile devices. However, here reveals itself the drawback of applications delivered by third parties.

A proprietary application designed at the request of a particular bank uses the bank's unique security algorithms. A third party, while developing an application on their own, has no way of knowing these algorithms and therefore creates its own ones. In practice, the latter can be as effective as the exclusive algorithms, but it all comes down to trust. After all, someone who has nothing to do with the bank the application works with can appear less responsible and dependable to the public. Therefore, official applications are in a much bigger demand.

Conclusion

Being an expert in mobile development and knowing its trends and tendencies, ScienceSoft can confidently say that mobile banking is a truly solid investment. Most of the US population is long ago accustomed to using mobile devices and always gladly accepts the wide range of possibilities that mobile applications offer. So it's sure a waste not to use this chance to please your clients by demonstrating them a great care for the way they experience banking services and at the same time - attract new ones.