Environmental Insurance Software

In insurance software development since 2012, ScienceSoft delivers reliable custom solutions that automate environmental risk assessment, disaster impact modeling, and compliance controls, improving the efficiency, speed, and security of environmental insurance workflows.

Environmental Insurance Software in a Nutshell

Environmental insurance software is a specialized business insurance solution aimed to streamline risk profiling, pricing, policy issuance, claims operations, and regulatory reporting for environmental insurers. Such software often offers self-service capabilities for insurance customers.

Custom environmental insurance software can automate insurer-specific operations and simplify compliance with regional regulations. Tailored solutions can be powered by artificial intelligence and real-time big data analytics to precisely evaluate customer risks, ensure optimal insurance pricing, and instantly spot fraudulent claims.

Recent advancements in insurtech AIoT enable the creation of custom functionality for proactive loss mitigation, helping policyholders maintain environmentally responsible behavior and insurers — minimize the financial impact of potential exposures.

Custom development also opens a way to leverage blockchain smart contracts for quick and transparent environmental loss compensation payouts.

- Implementation time: 9–18+ months for a custom environmental insurance system.

- Development costs: $200K–$1.5M+, depending on solution complexity. Use our free calculator to estimate the cost for your case.

Software to Automate Various Types of Environmental Insurance

As the scope and complexity of environmental insurance services increase, carriers and agencies are switching to custom solutions that enable cohesive workflow automation across various insurance lines.

Depending on a client’s needs, ScienceSoft can create a scalable digital solution that smoothly handles all or several of the following environmental insurance types:

Environmental liability insurance

for manufacturing, construction, energy, and environmental consulting services.

Climate change liability insurance

for carbon-emitting industries like oil & gas, chemicals, manufacturing, transportation, and agriculture.

Green building insurance

for homeowners and business owners committed to environmental sustainability.

Environmental cleanup cost cap insurance

for covering cost overruns in environmental remediation projects.

Pollution liability insurance

for storage tank owners and transporters of toxic substances and wastes.

Pollution and remediation legal liability insurance

for property owners, real estate managers, and tenants.

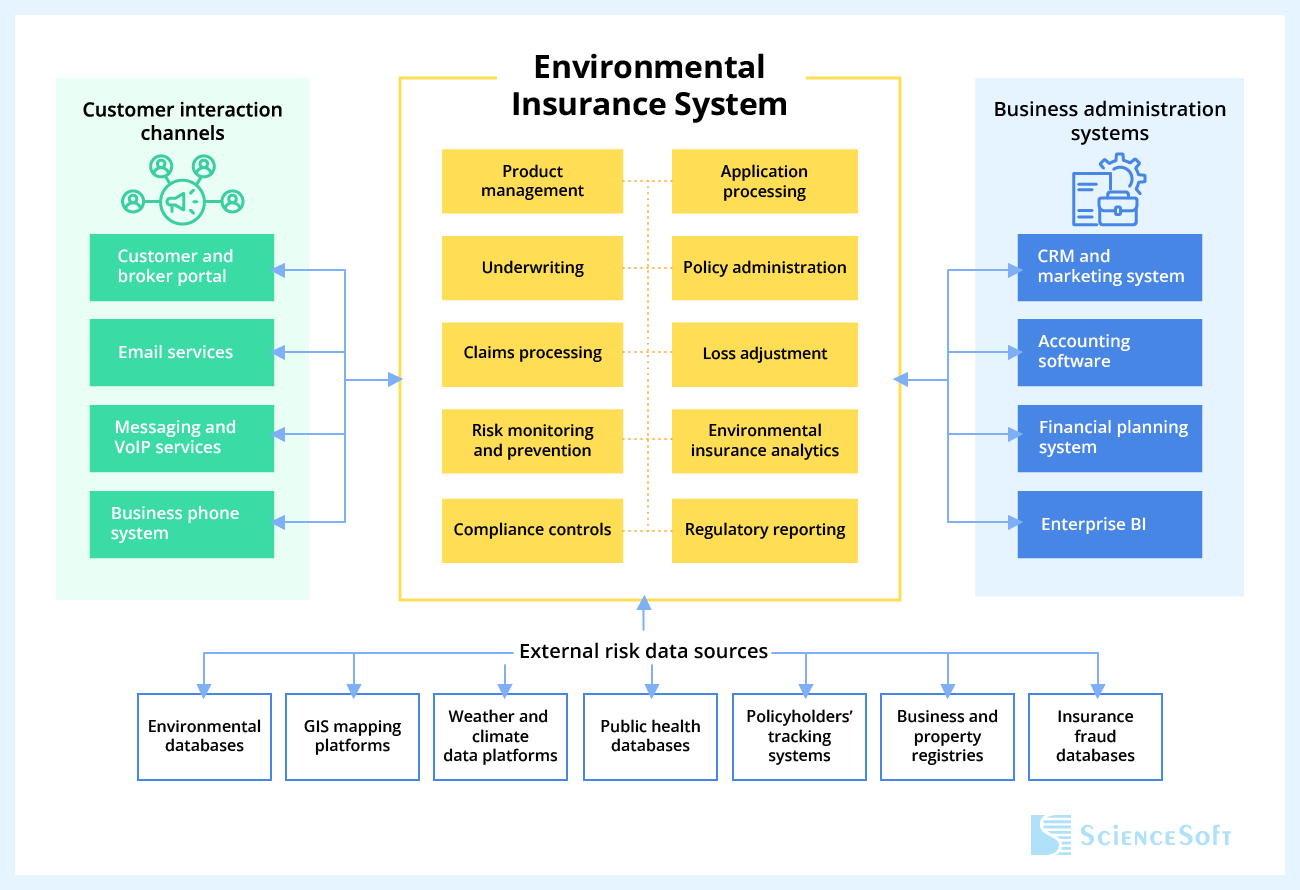

Important Integrations for Environmental Insurance Software

- Corporate systems: CRM, accounting software, a BI solution, etc.

- Customer interaction channels: a customer portal, email services, messaging services, etc.

- Third-party data sources: environmental, toxicology, and chemical databases; local business, infrastructure asset, and utility registries; GIS platforms; weather and climate data platforms; public health databases; policyholders’ asset tracking and operations control systems; ISO, NICB, and CLUE databases.

Key Features of Custom Environmental Insurance Software

Below, ScienceSoft’s consultants compiled a comprehensive list of features that would form the core of an effective environmental insurance solution.

Insurance product management

Carriers can create environmental insurance products with user-defined terms (coverage scope, limits and duration, availability by region, etc.) from customizable templates. AI-powered solutions can terms based on the analysis of demand and emerging market trends.

Application processing

Digital and paper insurance applications get automatically processed using AI, RPA, and image analysis technologies. Custom software can use AI to cross-check the provided customer information against the data from public sources. Valid applications are then auto-assigned and routed to the fitting underwriters.

Risk data intake

Multi-format data on customer risks is aggregated in real-time or in batches. The data may come from multiple sources, including customer documents, asset tracking and operations control systems, insurer systems, region-specific pollution reports, weather forecasts, satellite images, and telematics platforms.

Risk evaluation

Custom actuarial models (statistical or ML-based) help model potential losses and quantify their impact based on the insured object’s location, at-risk customer operations, pollution source, and other parameters. The software then scores customer risk based on custom formulas or AI suggestions.

Pricing

Personalized environmental insurance premiums are calculated taking into account a customer’s risk level, requested insurance type and terms, and insurer profitability goals. AI can analyze client demand elasticity and competitor prices and suggest the optimal premium amounts.

Environmental insurance policies are automatically generated, updated, and renewed following a user-defined schedule or ad hoc. Insurers can also automate customer billing for one-time and recurring premium payments.

Claim adjudication

If powered with AI, custom software can automatically process insurance claims and claim-supporting documents: environmental incident reports, reports on environmental conditions at particular sites, photos and videos of polluted areas, etc. Besides, AI can instantly spot fraudulent claims and report fraud to employees and regulators.

Damage inspection

Claim specialists can automatically create environmental damage inspection requests and send them to in-house or third-party loss adjusters: environmental consultants, engineers, laboratories, etc. IoT and computer vision techs enable remote damage inspection in rural regions, geographically isolated industrial and utility sites, and maritime and offshore locations.

Claim settlement

After the loss amount is quantified, custom software can calculate the due claim payment amounts and enforce the payments. Claims under the reinsured contracts are routed for settlement by reinsurers. Environmental parametric insurance payouts are triggered based on user-defined rules before the loss event takes place.

Loss prediction and prevention

AI-powered solutions analyze streaming data from customer systems, social media, weather platforms, and pollution databases and predict high-risk events. AI assists in mapping the optimal course of action to mitigate loss risks.

Analytics and reporting

KPI monitoring and AI-powered forecasting across sales, underwriting, claim resolution, finance, and other environmental insurance areas. Automated reporting helps quickly communicate environmental insurance metrics to senior management and regulators.

Self-service tools allow customers to submit applications, calculate prices, overview policies, make payments, and submit claims. An AI chatbot helps portal users promptly solve common issues. Instant messaging enables direct communication between the insurer and clients to handle complex requests.

Security

Data security is established via role-based access control, multi-factor user authentication, intelligent user behavior analytics, data encryption in transit and rest, and other mechanisms.