Energy Insurance Software

Since 2012, ScienceSoft has been delivering robust digital solutions that help insurers in the energy sector improve operational efficiency and leverage new business models.

Energy Insurance Software in a Nutshell

Energy insurance software helps insurers and brokers in the energy sector streamline processes like underwriting, policy administration, loss adjustment, claim processing, and regulatory reporting.

Custom energy insurance software includes specialized automation features tailored to each insurer’s operations. Custom solutions can be powered with advanced technologies like AI/ML, big data, blockchain, and IoT to automate risk data processing, accurately predict potential exposures, leverage remote loss inspection, and enhance the security of service information.

High scalability and easy evolution make custom software the most feasible option for energy insurers who actively expand their service lines or plan to enter new markets with different regulations.

- Implementation time: 9–15+ months for a custom energy insurance solution.

- Development costs: $200K–$1M+, depending on insurtech solution complexity. Use our free calculator to estimate the cost for your case.

- Payback period: <12 months.

Energy Insurance Sectors That Benefit From Custom Software

At ScienceSoft, we create cloud-centric, flexible energy insurance solutions tailored to our clients’ unique requirements. Whether you hedge oil and gas companies against infrastructure damage or insure businesses relying on green energy from power blackouts, we’ve got your needs covered.

Examples of specialized energy insurance types custom software by ScienceSoft automates include:

By energy source

- Fossil fuel insurance:

- Oil and Gas

- Coal

- Renewable energy insurance:

- Solar

- Wind

- Hydroelectric

- Geothermal

- Biomass

- Nuclear energy insurance.

By coverage object

- Stored and transmitted energy insurance.

- Insurance for fossil and fissile fuel extraction facilities and equipment.

- Insurance for fossil and fissile fuel transportation and distribution assets and facilities (pipelines, tankers, etc.).

- Insurance for energy generation facilities and equipment.

- Insurance for energy transmission and distribution facilities (power grids).

- Insurance for energy storage facilities.

- General liability and professional indemnity insurance for companies involved in energy operations.

- Environmental liability insurance.

By coverage subject

- Insurance for energy producers.

- Insurance for energy processors (e.g., petrochemical enterprises).

- Insurance for energy distributors (transportation providers, gas and electric utility companies).

- Insurance for energy site construction companies.

- Insurance for corporate energy consumers (energy-associated business interruption insurance).

By energy source location

- Onshore energy insurance.

- Offshore energy insurance.

By coverage geography

- Domestic energy insurance.

- Multinational energy insurance.

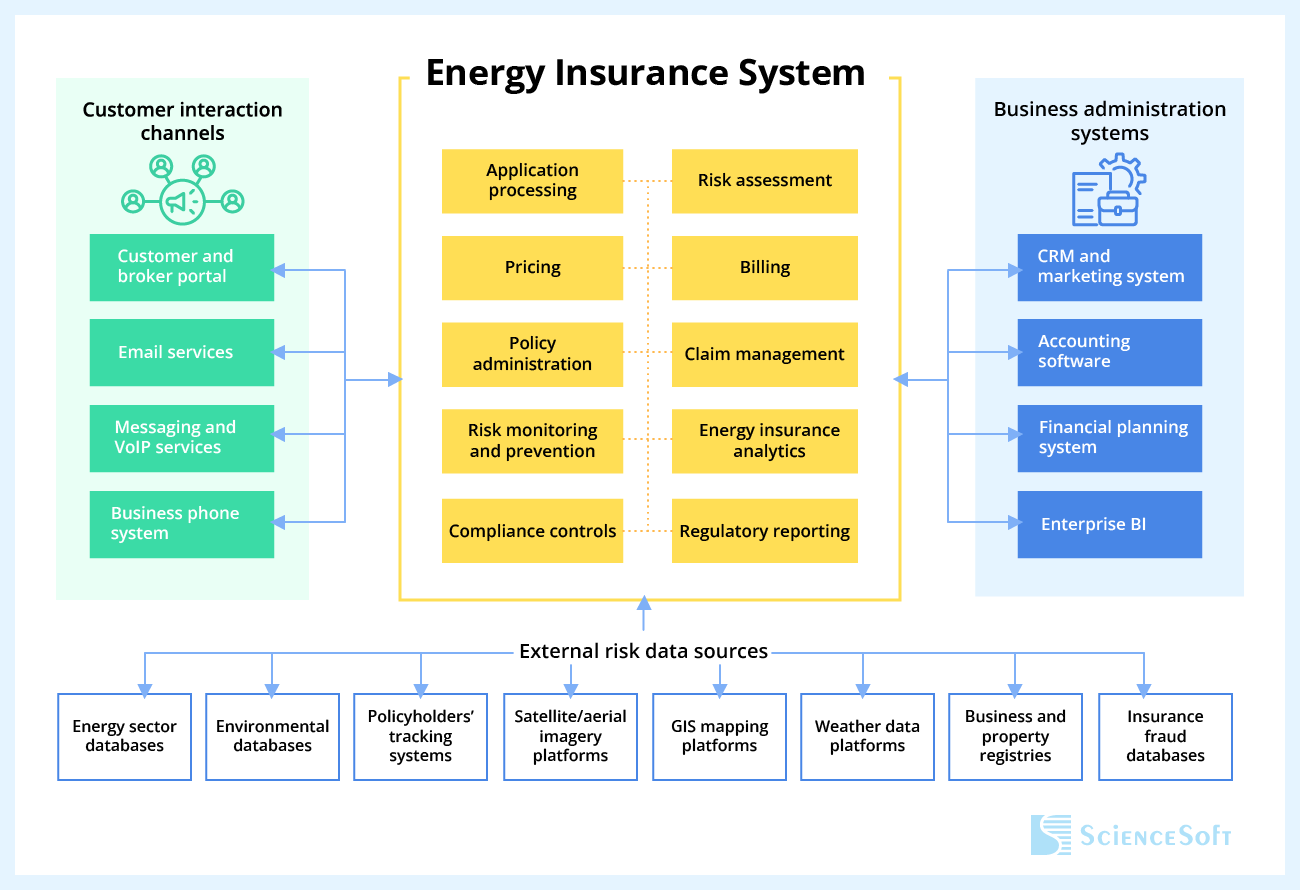

Important Integrations for Energy Insurance Software

- Corporate systems: CRM, accounting software, a business intelligence solution, etc.

- Customer interaction channels: an insurance portal, email services, messaging services, etc.

- Third-party data sources: local business and property registries; FERC, EPA, EIA, NERC, NICB databases; satellite/aerial imagery and GIS mapping platforms; policyholders’ energy production and distribution tracking systems.

Key Features of Energy Insurance Software

Below, ScienceSoft’s consultants share a comprehensive list of features that can form the core of robust energy insurance software. Depending on your needs, we can build an all-in-one system or develop one or several specialized modules to power particular energy insurance areas.

Data processing automation

To automatically capture and process multi-format energy insurance data and metadata (insurance applications, customer business documents, energy production site maps, energy market data, etc.), we power the solution with AI, RPA, and image analysis technologies and integrate relevant business and third-party data sources.

Risk assessment

Customer-specific risks are auto-calculated based on tailored criteria with pre-assigned weights. The criteria may include a customer’s industry, capacities, operational scope, and claim history, as well as the insured asset’s location, value, and as-is state. AI can be involved to suggest the criteria and weights for sharper risk scoring.

Risk modeling

Energy insurers can create custom risk scenario models and run what-if analyses to measure the potential impact of various perils (e.g., natural disasters, equipment and stored fuel deterioration, non-renewable resource depletion, regulatory changes). The software automatically quantifies damage under the simulated events, red-flags the most severe scenarios, and calculates claim reserves.

Risk insight sharing

Risk modeling insights get automatically converted to reports and can be instantly shared with energy insurance customers via an insurance portal. Policyholders get an opportunity to inform their risk management strategies and better prepare for severe events. The insurer benefits from increased client loyalty due to a higher service value.

Pricing

Individual premiums for each customer can be calculated automatically based on custom formulas, considering the requested coverage terms, a customer’s risk score, and an insurer’s profitability requirements. Risk analysts can review and adjust initial calculations for large-scale or complex cases to ensure optimal premiums.

Automated quoting and billing

Energy insurance quotes are generated from customizable templates and get instantly submitted to prospects. Similarly, invoices for the accepted quotes are created and sent to customers in a fully automated manner. Insurers can track due and paid invoices via a centralized dashboard.

Policies are issued, updated, and renewed automatically based on user-defined rules. Policy administrators can create custom policy templates tailored by coverage (energy supply, equipment damage, pollution liability, business interruption, etc.), language, location, and more using a no-code template editor.

Predictive risk analytics

The solution enables real-time capture and analysis of risk-relevant data from asset tracking systems of energy insurance clients, third-party geospatial and environmental data platforms, and public sources. Machine learning models analyze real-time risk factors and identify growing exposures that may result in claims.

Proactive loss prevention and payouts

High-risk event predictions and AI-based suggestions on the proper risk mitigation steps are instantly communicated to energy insurance customers. In alternative service models like parametric energy insurance, risk forecasts are used to quantify the expected energy-associated losses and trigger proactive payouts once the risk reaches a certain level.

Automated claim processing and fraud detection

AI-based software captures and validates energy insurance claims and proofs of loss (e.g., loss incident reports, images and videos of the damaged energy assets and facilities, reports on business losses due to power outages). It instantly spots fraudulent claims and routes suspicious data pieces for manual check.

Remote damage inspection

AIoT and computer vision technologies enable automated damage inspection in dangerous and hard-to-access areas like nuclear energy plants, offshore oil rigs and wind farms, oil tankers, remote power lines, and isolated manufacturing facilities.

Loss estimation

The solution consolidates the data relevant for loss estimation (damage data from inspection reports, coverage terms from policies, etc.) and presents it to loss adjusters. Calculating due compensation amounts and claim triaging for settlement can be automated based on user-defined rules.

Reporting

KPIs related to sales, underwriting, claim settlement, etc. are reported automatically in compliance with internal policies and regulatory standards like FIO, NAIC, and IFRS 17 standards. Reports can be routed to senior management and regulators following a user-defined schedule or generated ad hoc.

Security

Software can be secured via role-based access control, multi-factor authentication, data encryption, intelligent user behavior analytics, and more. A blockchain-based system enables immutability and full traceability of energy insurance data. Custom solutions can also enable compliance with SOX, GDPR, NYDFS, CCPA, and other global and regional standards.