Custom Professional Liability Insurance Software

ScienceSoft applies 13 years of experience in insurance software development to create robust professional liability insurance solutions that help E&O insurers streamline their unique workflows.

Professional Liability Insurance Software: The Essence

Professional liability insurance (PLI) software is a specialized business insurance solution aimed to help PLI providers improve the speed, accuracy, and efficiency of their service workflows.

Also known as errors and omissions (E&O) insurance software or professional indemnity (PI) insurance software, such solutions automate processes like customer risk assessments, professional licensing checks, policy issuance, claim processing, and legal defense management. They often come with a built-in portal that provides self-service options for insurance customers, partners, and loss witnesses.

Custom professional liability insurance software can employ artificial intelligence and big data technologies to maximize the degree of PLI process automation. Custom solutions simplify the process of achieving compliance with region-specific regulations and help establish advanced security of insurance data.

- Important integrations:

- Corporate systems: CRM, accounting software, an analytics and BI solution, etc.

- Customer interaction channels: email services, messaging services, etc.

- Third-party data sources: local business registries; employment verification services; internal systems of regional licensing boards, certification laboratories, professional associations, social security administration, police administration, etc.; ISO, NICB, and CLUE databases; GIS mapping and telematics platforms; policyholders’ tracking systems.

- Implementation time: 8–15+ months for a custom PLI solution.

- Development costs: $200K–$1M+, depending on insurtech solution complexity. Use our free calculator to estimate the cost for your case.

PLI Software Types ScienceSoft Specializes In

Whether you serve multiple industries or focus on some domain-specific type of professional negligence, your custom insurance software can cater to your specific service scope. ScienceSoft can build a multi-line PLI system or a specialized solution to automate one particular type of E&O insurance. Examples of niche solutions we create include:

Medical malpractice insurance software

Legal malpractice insurance software

Architects and engineers E&O insurance software

Financial advisors E&O insurance software

Technology and cyber liability E&O insurance software

Insurance agents E&O insurance software

Accountants E&O insurance software

Real estate E&O insurance software

Media and PR E&O insurance software

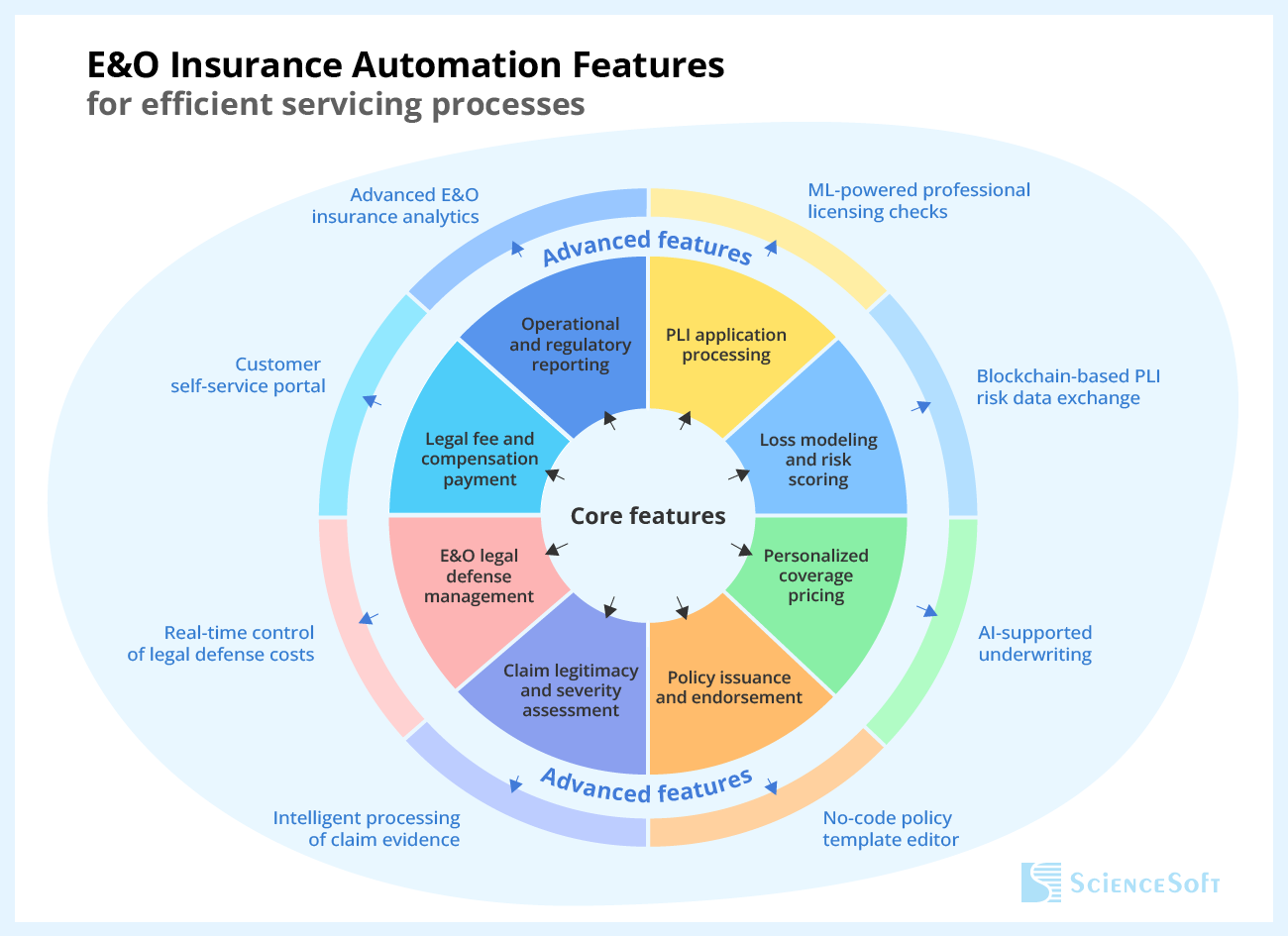

Key Features of Professional Liability Insurance Software

Below, ScienceSoft’s consultants share a comprehensive list of features that form the core of a robust PLI solution:

Customer document processing

AI, OCR, and image analysis technologies are used to automatically capture and process digital and paper insurance applications, customer business licenses, professional licenses and certifications, sample contracts, former claim narratives, and loss run records.

Professional licensing verification

Business documents, as well as professional licenses and certifications are automatically validated against the data from reliable third-party sources, such as business registries, licensing boards, certification laboratories, and professional associations.

Professional risk profiling

Risks are scored using custom actuarial rules or AI algorithms based on a customer’s industry, professional service scope, business maturity, contractual liabilities and obligations, number of employees and their qualifications, quality control and risk mitigation practices, employee training initiatives, and past claims history. AI can analyze web-wide sentiment, recognize professional reputation exposures, and suggest more accurate risk scores.

E&O insurance pricing

Individual insurance premiums are calculated based on custom formulas. Input parameters may include a customer’s risk score, requested policy type, coverage scope (damage done, arbitration costs, settlement costs, etc.), duration, limits, retroactive and tail dates, as well as insurer profitability requirements. AI can estimate customer-specific price elasticity, analyze competitor prices, and recommend personalized premium optimization.

Policy issuance

Insurance policies are automatically generated from templates that contain terms and conditions specific to different professional services (medical, legal, consulting, etc.) and can be tailored by language, currency, and coverage options.

Policy administration

Insurance policies get instantly updated when customer data changes, automatically terminated at the end of a tail coverage period, and can be renewed ad hoc or upon user-defined events, e.g., receiving the next-period premium payment.

Claim adjudication

PLI software relies on AI to automatically evaluate claim legitimacy and severity. AI analyzes insureds’ claim forms, claim proofs (demand letters from claimants, incident-related correspondence, witness statements, photo and video evidence), and claim-relevant big data, e.g., data from insurants’ service OMS and compliance tracking systems.

Legal defense management

Data on insurer partners specializing in E&O defense and a full record of claim-related communication with law firms is stored in a centralized database or a blockchain. Software enables real-time calculation and tracking of legal defense costs and notifies the responsible parties when the total costs of settlement near the coverage limits.

Claim settlement

Due compensation amounts are calculated using custom formulas and prioritized for payment based on urgency, loss amount, customer value, etc. Software can provide built-in payment automation features or route valid claims for settlement to accounting software.

Licensing and certification control

PI software continuously monitors the validity of professional licenses, certifications, and education credits and can notify customers (via email or an insurance portal) about the expiring documents that require renewal to remain eligible for insurance services.

Self-service options let insurants apply for PI coverage, pay premiums, access policies, file claims, and track claim resolution progress. A portal can also provide self-service for legal defense partners and witnesses to share claim-related documentation. Instant messaging enables real-time communication between insurer reps, customers, and partners. An AI-powered chatbot helps users solve simple issues 24/7.

Custom systems enable instant calculation and monitoring of E&O insurance sales, customer retention, underwriting, claim resolution, financial performance, and other KPIs. Using advanced predictive analytics, insurers can accurately forecast revenue and expenses. The required metrics can be automatically reported to senior management and regulators (e.g., NAIC, NICB, CFPB, state insurance regulators).

Security

PLI software and data it operates are protected via multi-level data encryption, permission-based access control, multi-factor user authentication, and intelligent UEBA.