High-Performing Broker and Agent Apps for a Renowned Insurance NMO

About Our Client

The Client is a US national marketing organization (NMO) with more than 50 years in business. The company focuses on wholesale insurance brokerage across federal life and health lines. It provides agencies and individual agents with full-cycle back-office services, including lead sourcing, marketing, licensing, certification, and technology.

Legacy Broker and Agent Apps Caused Operational Errors and Delays

The Client used to rely on its homegrown web apps to provide in-house brokers and partner agents with role-specific workflow automation tools. The apps were integrated tightly with the organization’s Salesforce-based operations management system. As the NMO’s service complexity and number of partners grew, the apps began experiencing functional, integration, and performance issues, leading to operational errors and delays. At a certain point, the frequency of software-induced workflow disruptions spiked, prompting the NMO to prioritize urgent app troubleshooting.

The Client’s in-house IT team lacked specialized engineering skills to revamp the apps quickly. Owing to ScienceSoft’s proven experience in custom insurance software engineering and Salesforce integration, the NMO turned to us for insurance software competencies to aid its team in app refinement.

Cost-Effective Revamp of Insurance Broker and Agent Apps

ScienceSoft assigned a team of full-stack developers experienced in insurance software to audit and revamp the Client’s custom broker and agent apps. Because the technical documentation for the apps was scarce, the team conducted a manual audit of app capabilities, codebase, integrations, and technology stack. After the audit, ScienceSoft documented the revealed issues and mapped the necessary refinement steps.

The team’s high-level feasibility study showed that rebuilding core app components from scratch would be quicker and cheaper than applying targeted fixes to numerous complex bugs. ScienceSoft proposed a time-framed plan for the revamp and suggested prioritizing tasks based on the business value of the planned upgrades. This approach would let the Client maximize payback from early improvements.

Once the Client approved the action plan, ScienceSoft’s engineering team got to work:

- The developers rewrote the apps’ legacy Node.js back end in NestJS. They favored the NestJS framework due to its support for layered, modular app architectures and separation of concerns. These capabilities enabled the team to build a flexible, scalable back end that could quickly accommodate new broker and agent features, integrations, and regulatory rules. Following ScienceSoft’s best practices for financial software accuracy and stable app performance, the team applied established coding standards and approaches to deliver clean, maintainable code that would prevent logic flaws and app performance drifts.

- The engineers built custom back-end APIs for integration between the broker and agent apps and the NMO’s internal systems, agency platforms, and third-party services. With the new APIs, the NMO could be confident in the integrity and security of the data flows. It also could address the apps’ previously troubled connectivity to its Salesforce-based operations platform and business-critical authentication tools (Okta, Microsoft Active Directory). ScienceSoft applied strategies such as API request batching, asynchronous processing, load balancing, and rate limiting to minimize the impact of multiple third-party integrations on the apps’ performance.

- The team rewrote the apps’ JavaScript interface APIs in TypeScript. TypeScript’s static typing and compile-time error detection capabilities would enable earlier spotting of inconsistent insurance data entries and functional issues. This way, the Client could minimize data flaws, prevent app-level runtime errors, and ensure predictable API behavior.

- The developers updated the apps’ Vue.js user interface library from Vue 2 to Vue 3. The transition made the apps fully compatible with modern browsers and devices. In terms of broker and agent experiences, this meant more responsive app screens, faster app navigation, and quicker presentation of insurance data. With the fresher UI library, the NMO also gained access to a broader range of ready-made UI components and could create clearer, sleeker app interfaces.

- Applying the quality-first approach to software engineering, ScienceSoft helped the Client implement a continuous testing framework with automated unit, integration, performance, and end-to-end tests. Previously, the NMO had no standardized QA procedures and test automation tools in place. With the new QA framework, it can spot app issues at early development stages and minimize release and regression risks.

It took ScienceSoft less than 10 months to refactor the NMO’s legacy broker and agent apps into high-performing, user-friendly solutions. The full-stack team earned a reputation as responsive, motivated professionals with strong collaborative skills, so the Client decided to involve ScienceSoft in ongoing app maintenance and evolution.

Continuous Maintenance and Evolution of the NMO’s Apps

During the subsequent two years of cooperation, ScienceSoft’s team did the following:

Developing new agent and broker features

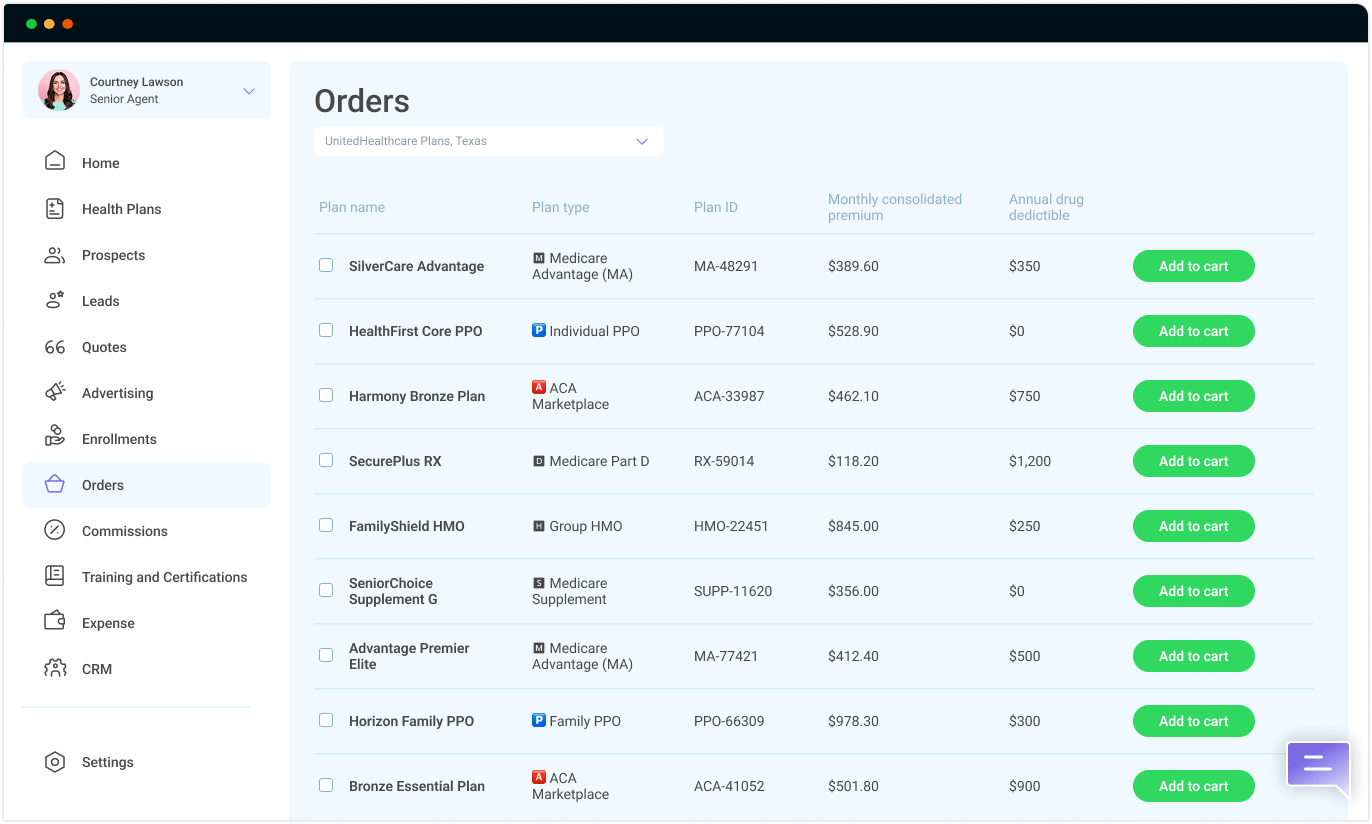

The team built a new agent-side coverage search module to enable faster, more accurate comparisons of insurance plans across multiple carriers. The engineers added new features to automate the processing of insureds’ submissions, reducing the need for agents to manually intake and review prospect data. In addition, ScienceSoft expanded broker-side operational control and reporting features to give the NMO clear visibility into insurance application statuses and the performance of its brokers and agents.

The team also automated the annual uploading of orderable insurance plans and introduced a flexible, real-time management process that lets the NMO’s product teams add and remove coverage options, carriers, and specific states at any time. This capability ensured brokers and agents always work with an up-to-date catalog while eliminating manual data maintenance.

Setting up new integrations

In collaboration with the Client’s IT team, ScienceSoft integrated the NMO’s broker and agent apps with new data sources (medical plan databases, pharmacy and drug data platforms, and more). The team also helped the Client integrate its role-specific apps and Salesforce operations management software with a new CRM product. ScienceSoft carefully tested new integrations to ensure consistent and secure communication between the connected systems.

App maintenance and issue resolution

The engineers monitored the performance of the broker and agent apps, identified emerging issues, and proactively implemented fixes to keep the apps stable and responsive to user needs. ScienceSoft also handled urgent bug fixing in complex cases. Namely, the team handled a range of time-sensitive incidents related to failures in external integration and authentication services.

During the engagement, ScienceSoft’s team followed the Client’s hybrid Agile cooperation model, with quarterly plans for major app evolution activities and 2-week iterations across granular scope units. The team consistently provided comprehensive reports on completed tasks, which, as the NMO stated, were among the primary drivers of smooth and transparent collaboration.

As of August 2025, the Client continues working with ScienceSoft’s engineers on the maintenance and upgrading of its broker and agent apps.

Improved Accuracy and Efficiency of Insurance NMO Workflows

Within 10 months, the Client obtained high-performing proprietary apps that offer secure, convenient self-service features for insurance brokers and agents and can smoothly accommodate growing operational volumes. ScienceSoft’s refactoring of the apps’ code, interfaces, and tech stack helped the NMO resolve persistent technology issues. Implementing a structured QA framework improved app quality and accelerated evolution. Thanks to ScienceSoft’s pragmatic advice on the app revamp and tech stack options, the NMO managed to minimize development and maintenance costs.

Shortly after the revamp, the Client noticed the improved speed and accuracy of agent and broker workflows. Continuous maintenance and rapid issue resolution, handled by ScienceSoft’s engineers, ensured uninterrupted operations for brokers and agents, supporting high user satisfaction and resilient NMO operations.

Technologies and Tools

NestJS, Node.js, Vue.js, TypeScript, JavaScript, Salesforce, Microsoft Azure, MSAL, Okta, Jest, Vitest, Cypress.