Addressing the volatility of Customer Lifetime Value (LTV) in B2B

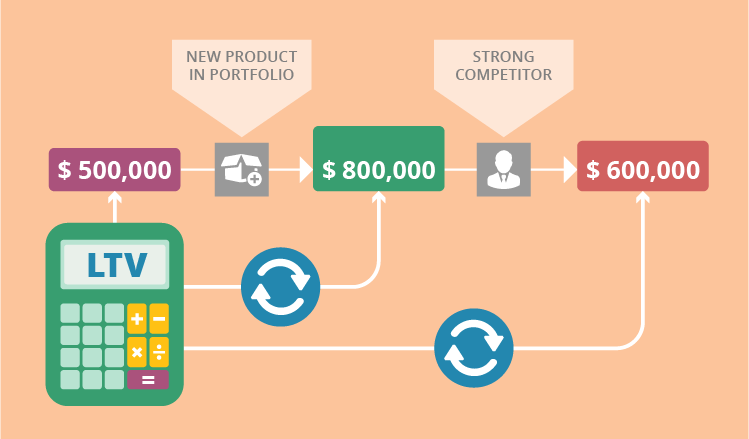

Customer Lifetime Value (LTV) is crucial to a company’s understanding of where they are standing at the moment, what the growth potential is, and how far they can stretch out their customer retention efforts to keep increasing their shareholder value. With LTV specifically in B2B industries, we are talking a relatively small number of customer accounts, with each likely being worth millions of dollars. There, a statistical approach may lose it to sales managers’ personal judgment and experience that prove to be more applicable to predicting the future value of a B2B relationship. Yet, apart from being dangerously subjective, LTV as a predictive metric is also extremely volatile.

Based partly on Mathias Haentjens’s research and partly on our CRM consulting observations, this brief guide suggests the factors that can trigger LTV volatility specifically in B2B industries, along with the way to add smart automation to LTV updates via a CRM system.

First, acknowledge your volatile variables

As a forward-looking metric, LTV deals with future earnings, which means this metric may be affected by changes to both internal and external factors that it incorporates. So forecasting LTV correctly takes identifying and swiftly updating all the volatile variables present in the formula.

For example, Mathias Haentjens’s academic research titled Predictive Uncertainty in Customer Lifetime Value Predictions explores the risk-related sources of volatility in cash flows, breaking it down into macro-environmental, industry, and firm categories. According to the study, the volatility sources revolve around a company’s ability to deliver, that’s meeting the demand and sustaining customer satisfaction whatever the circumstances – be it new competitors on the market, key suppliers failing, imposing of new regulations, revamping of product lines, etc. Leveling off the production capacity would diminish the impact of volatility, yet in the real world it is frequently next to impossible.

So, this takes us to the list of volatile variables affecting LTV in contractual relationships that are central to B2B industries. Though not complete, it can at least suggest a direction:

Related to the offering:

- a new product/service added

- a product/service revoked with no substitute

- a change to pricing, e.g. an updated subscription plan

Related to competitiveness:

- competing products springing up in the market

- new distribution channels causing disruption in the industry

Second, know how to put LTV changes to use

Once the change factor is there, the entire group of stakeholders within an organization should recognize it. Bringing LTV calculations to a CRM system beyond mere LTV values is the prerequisite for keeping LTV both useful and manageable.

LTV updates are likely to affect only selected customers at a time, providing they share the same attributes – size, industry, choice of products or services, subscription level, etc. As a holistic database of leads, opportunities and customers, CRM provides tools for customer segmentation. Such tools make it easy to sort the database by chosen criteria and get a comprehensive list of customers to undergo a change to their lifetime value.

But making changes to each and every one manually? No way.

Enabling automated bulk updates within a CRM system can save time and reduce the risk of skipping some customers or making an error in calculations. This feature should allow selecting customer list(s) to be updated by a stipulated amount while providing an additional field or a comment box for stating the reason for such an update. This action should result in a massive homogenous change to all the selected customers.

Say, a SaaS company can opt for bulk-increasing the LTV for their enterprise customers with over 100 users after an introduction of a new differentiated licensing model with an upgraded line-up of extras. For more traditional order-based companies, for example, a home appliances vendor, an impetus for increasing the LTV for its retail partners would be the introduction of a complementary product, which would open new cross-selling opportunities.

Keeping it fresh is key

It never hurts to reiterate how important it is to keep LTV updated and relevant at all times. Essentially, there are two key elements to this process. First, knowing what variables are floating within the corporate LTV formula. Second, effectively enabling these changes by making them visible to corporate stakeholders. Automation within the corporate CRM system makes it much easier with mechanisms for customer segmentation and bulk updates (read more on how CRM can help B2B companies generate more profit here).