Dynamics 365 for Healthcare

Guide to a Value-Bringing Solution

Bringing in 20 years of experience in medical IT, ScienceSoft delivers reliable and practical Microsoft Dynamics 365 solutions for healthcare since 2008.

Dynamics 365 for Healthcare in Brief

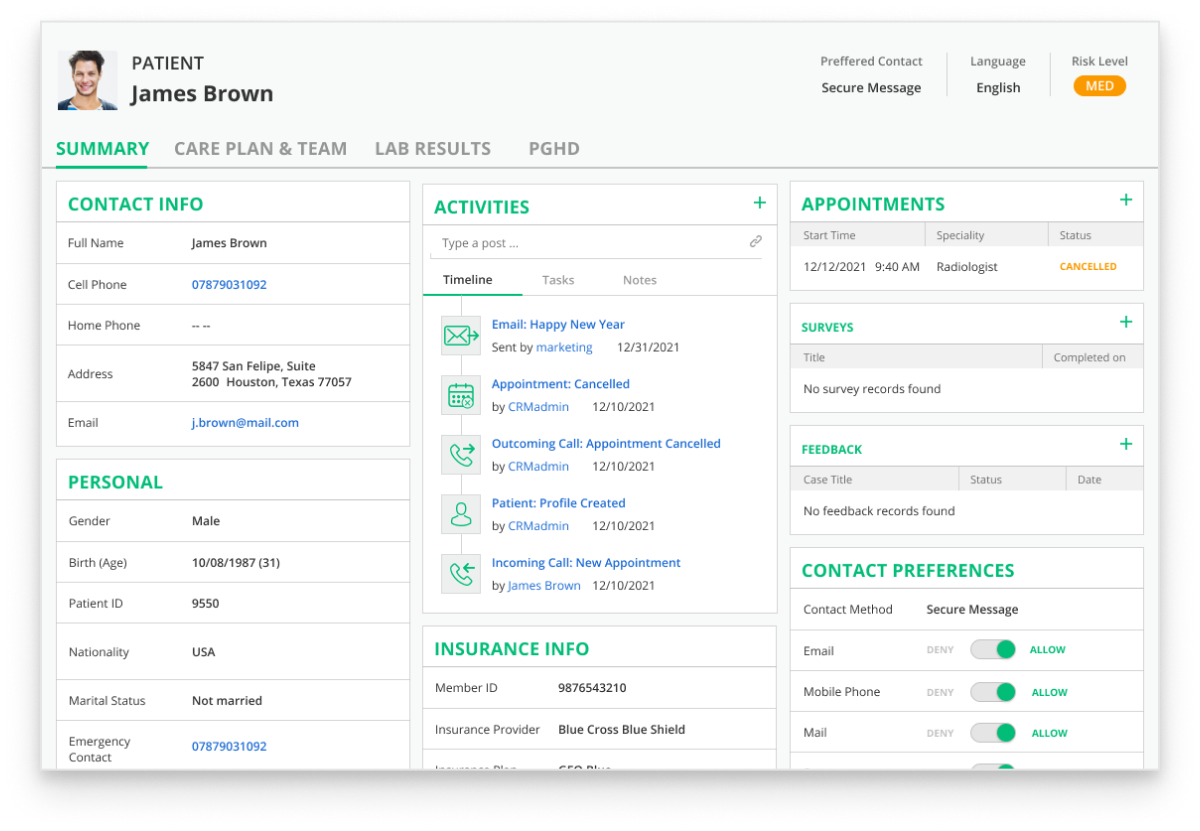

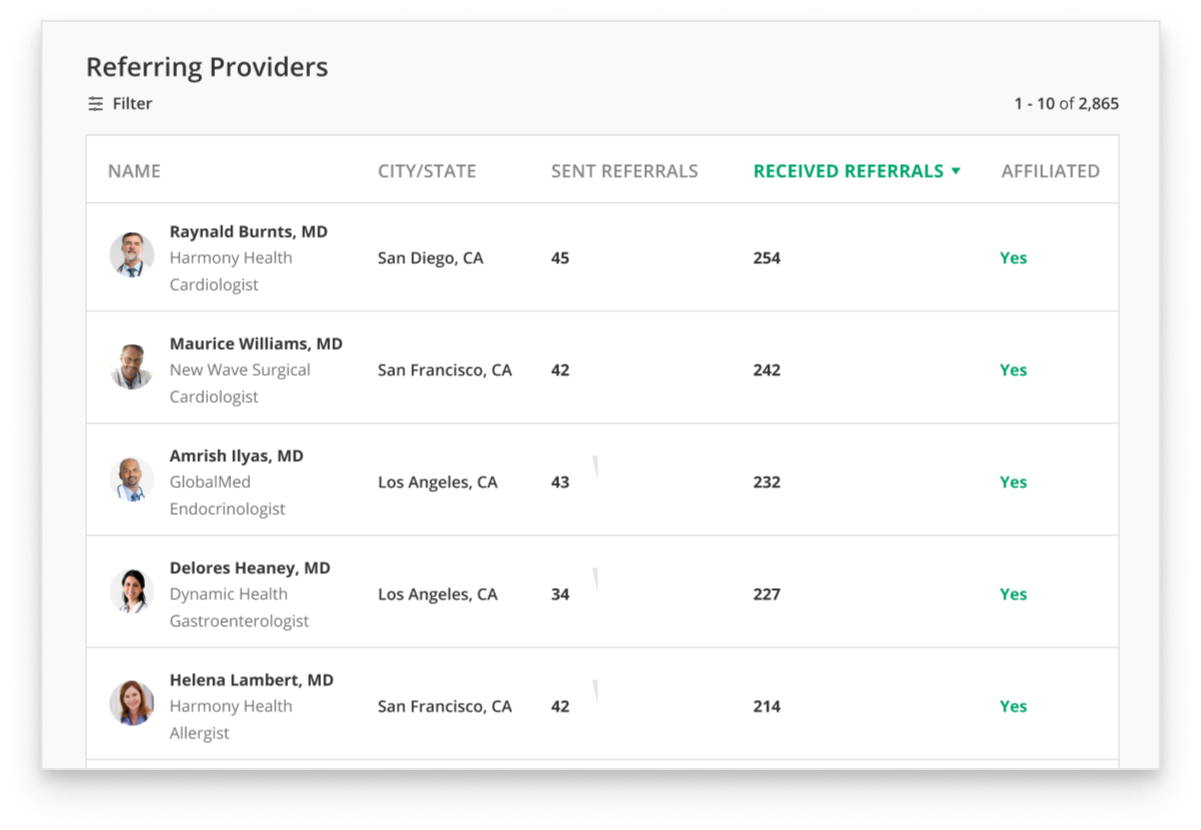

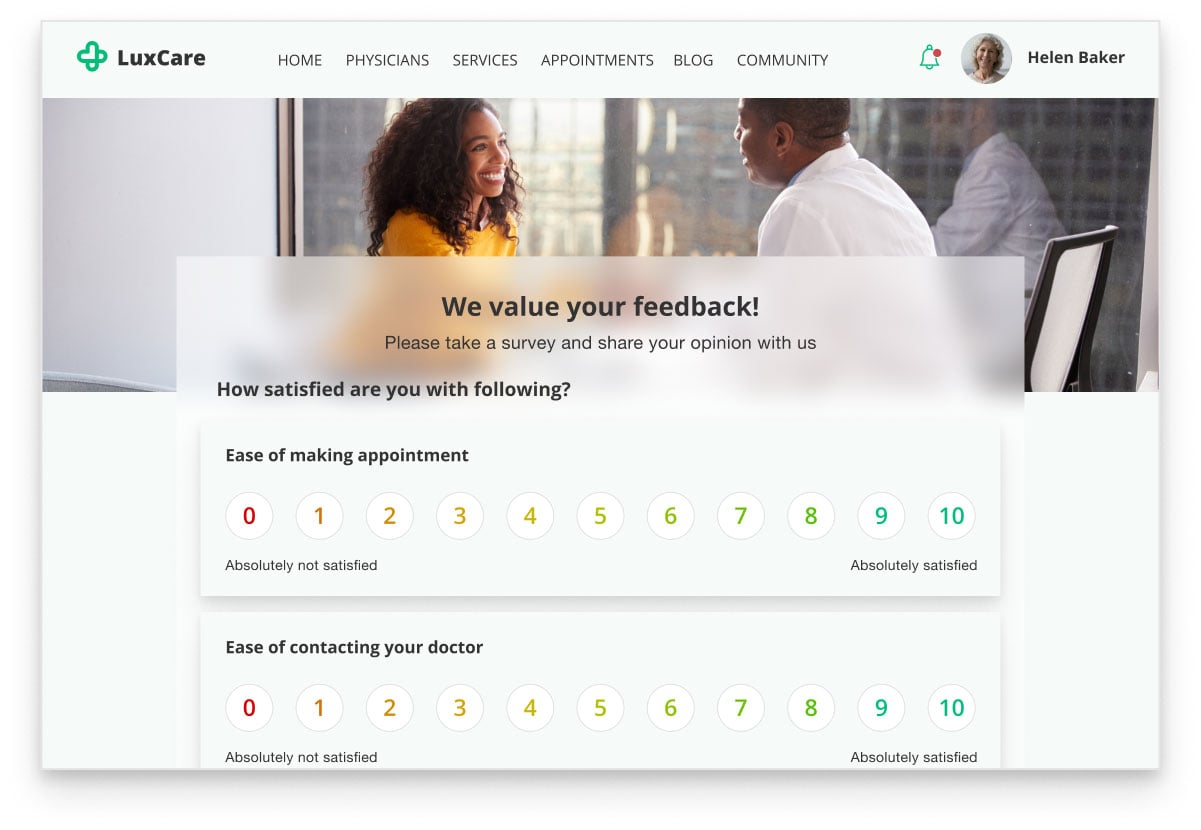

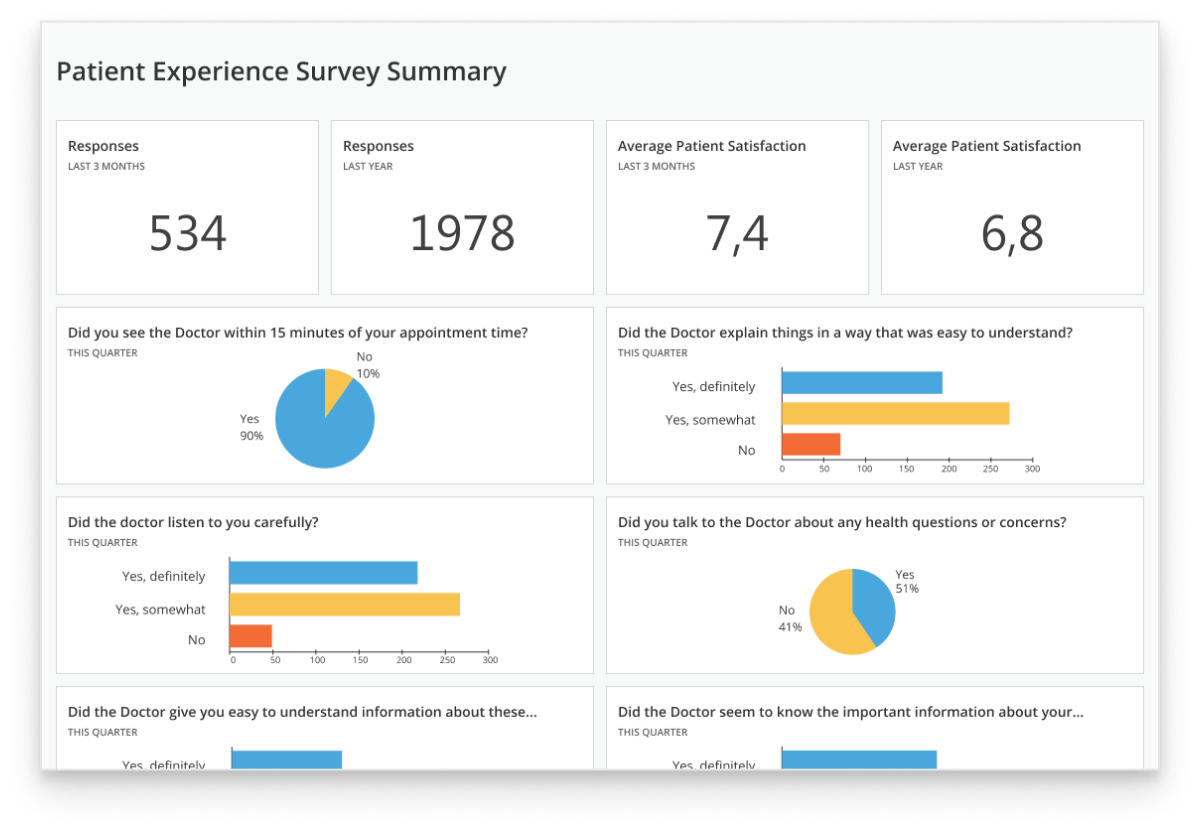

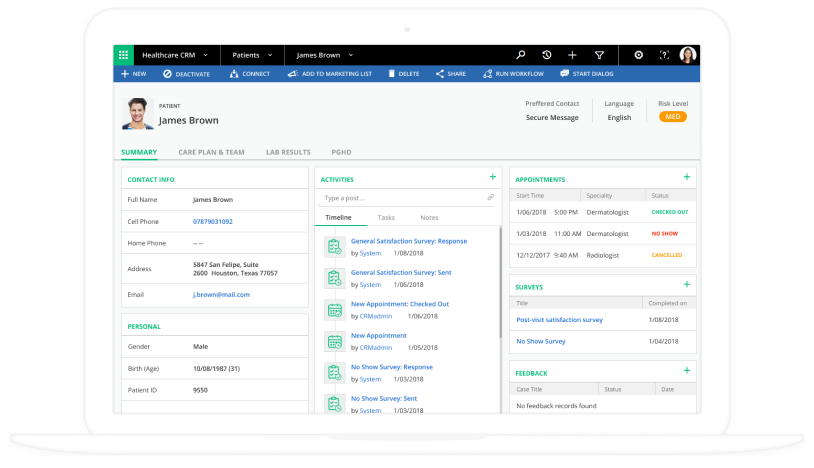

Using software products from the Microsoft Dynamics 365 suite, healthcare organizations can manage their operations, improve patient satisfaction, and up the quality of care. ScienceSoft’s decades-long experience in the healthcare industry proves that Dynamics 365 is a powerful tool that brings tangible results to healthcare organizations: from consistent patient data and reduced no-shows to better patient experience and optimized retention of referring professionals.

Core Features of a Value-Bringing Dynamics 365 Solution

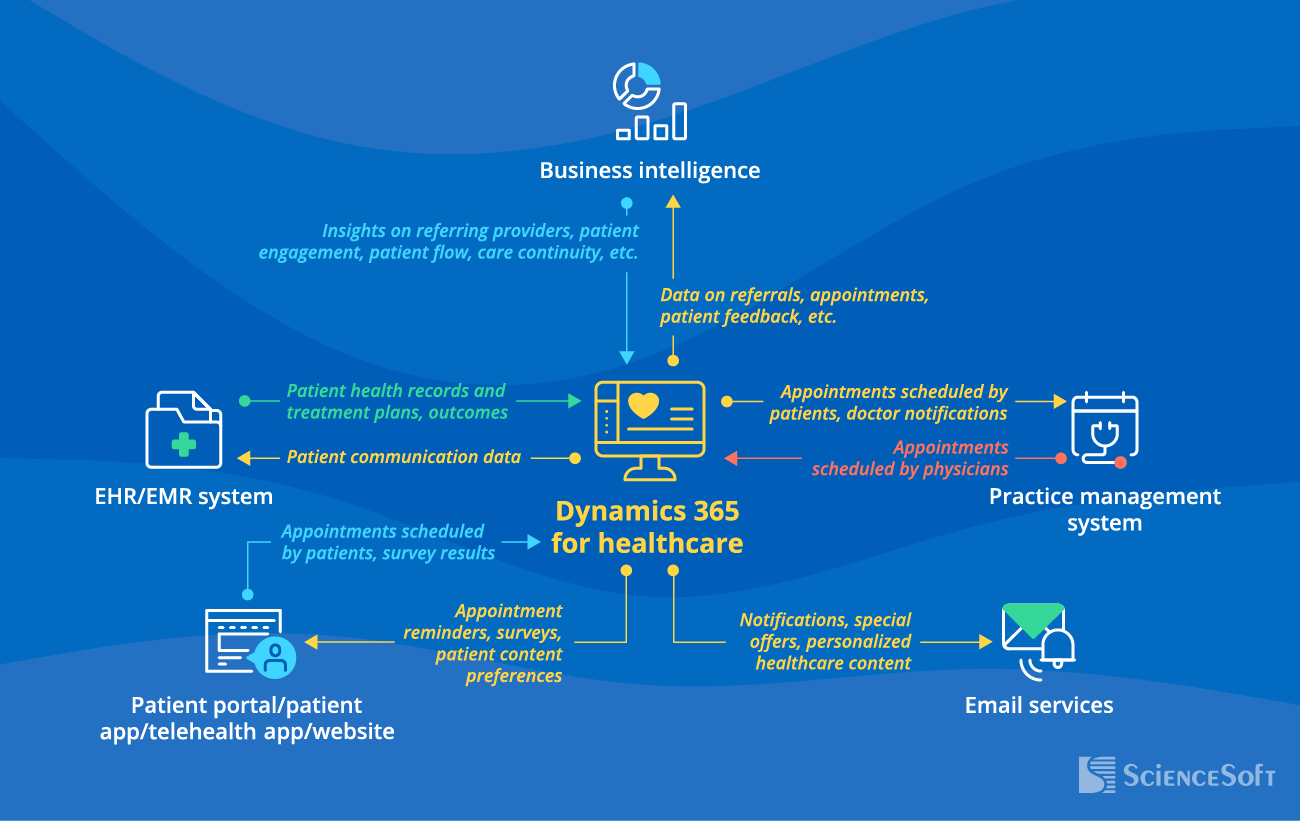

Integrations to Get the Most Value from Dynamics 365 for Healthcare

- EHR/EMR software - to exchange actual health information, treatment plan, and communication history to help foster treatment adherence.

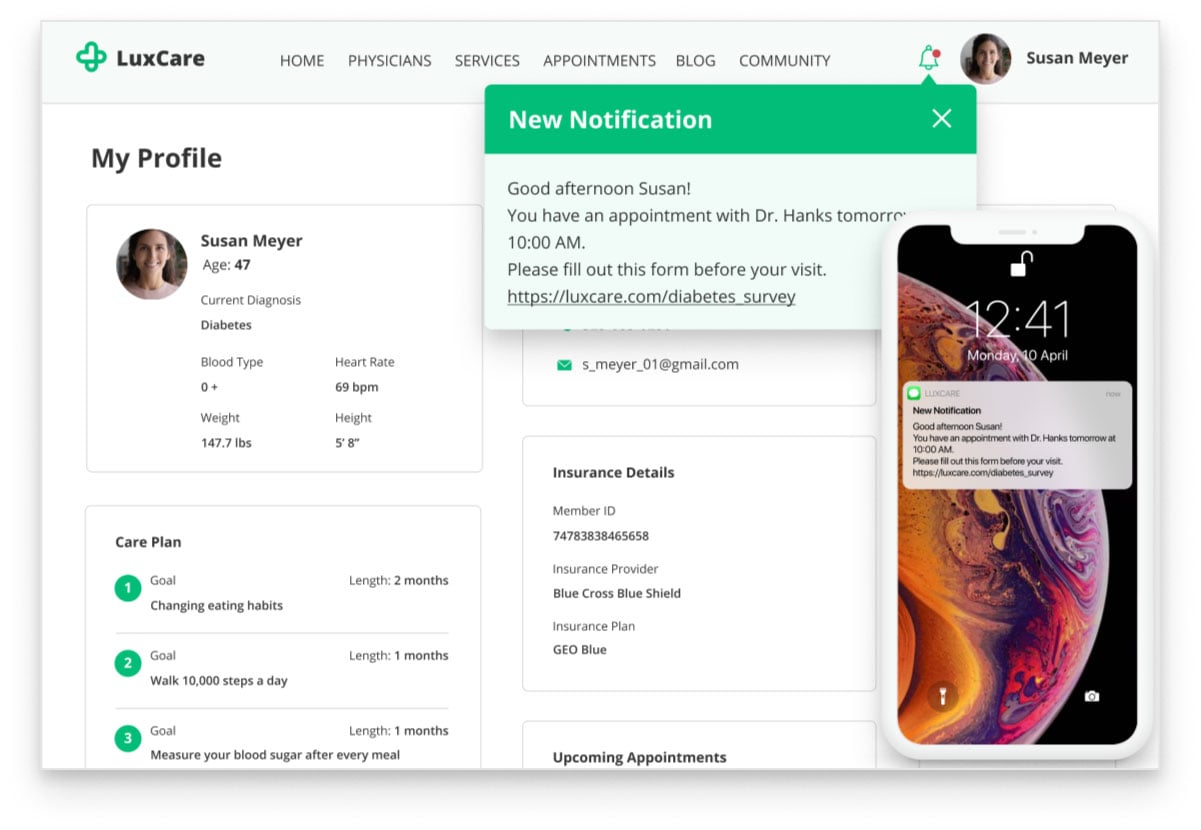

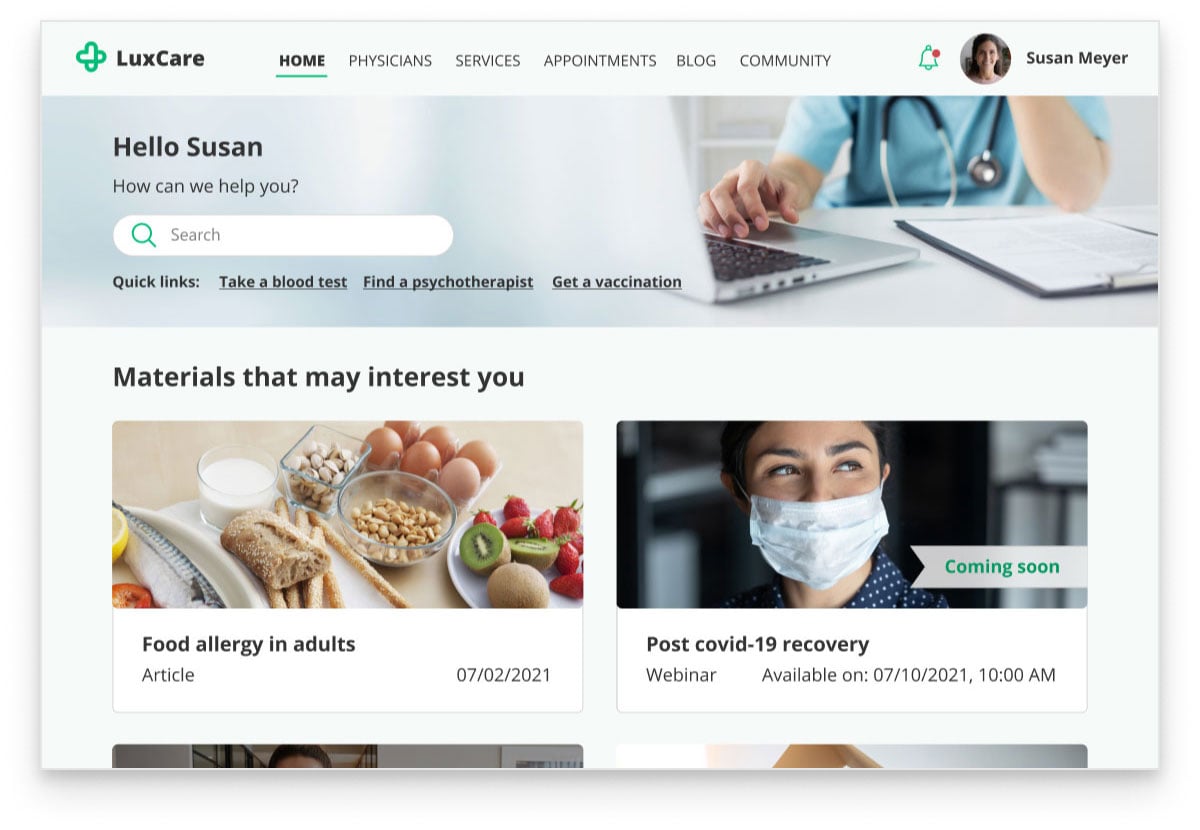

- Patient portal, patient app, telehealth app, or website - for smooth interaction with patients, including appointment scheduling, questionnaires and surveys filling, sharing of educational content, as well as fostering engagement and care continuity.

- Practice management system - to help plan medical staff shifts based on appointment demand and notify them of schedule changes (e.g., a canceled telehealth appointment).

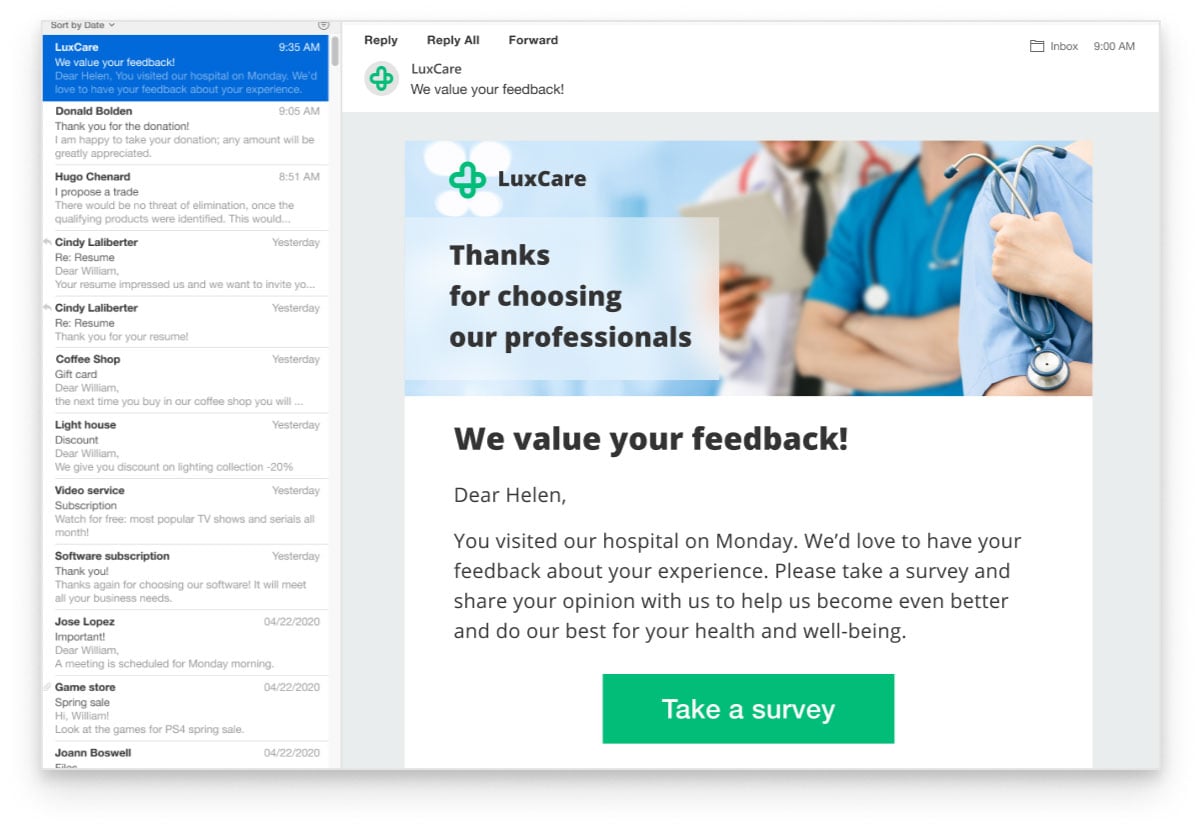

- Email services - to automate the send-out of email notifications, reminders, special offers, and personalized content.

- Business intelligence - to get insights based on the data stored in the integrated systems and visualize the results as interactive dashboards.

|

|

|

|

|

|

|

|

|

|

|

Microsoft Partner since 2008 With a strong team of Dynamics 365 professionals experienced in the healthcare domain, ScienceSoft is a trusted Microsoft solution partner. We provide consulting, implementation, and support services to help healthcare providers accelerate their operations using a set of neat and powerful Dynamics 365 tools. ScienceSoft’s healthcare IT consultants pinpoint the business needs of your medical organization and help bridge the gap between your workflows using future-proof technology. |

|

|

|

|

Why Choose ScienceSoft as a Microsoft Solutions Partner

- Vast experience in developing HIPAA and GDPR-compliant software.

- ISO 13485-certified to design and develop medical software according to the requirements of the FDA and the Council of the European Union.

- Since 2008 in CRM implementation.

- Since 2005 in the healthcare domain with 150+ successful projects.

- Working experience with Dynamics 365 since 2008.

- Deep knowledge of the healthcare IT environment helps us integrate Dynamics 365 with any required IT system.

Our awards, recognitions, and certifications

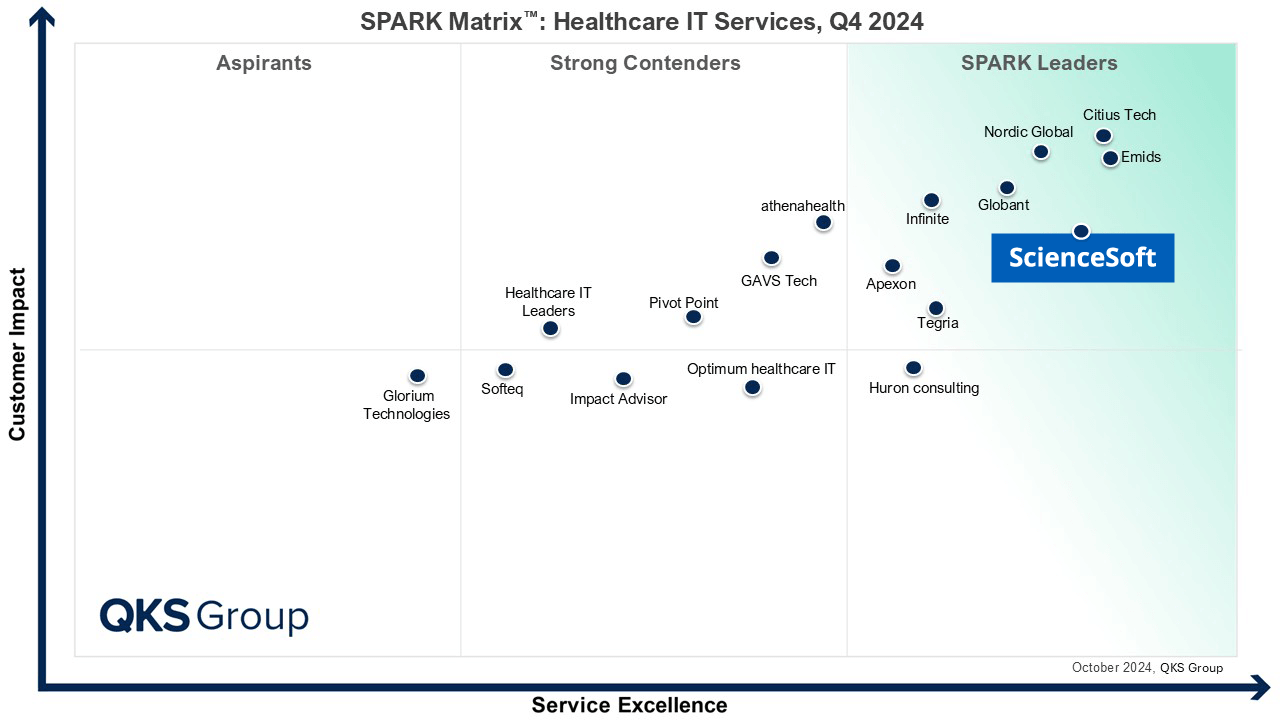

Featured among Healthcare IT Services Leaders in the 2022 and 2024 SPARK Matrix

Recognized for Healthcare Technology Leadership by Frost & Sullivan in 2023 and 2025

Named among America’s Fastest-Growing Companies by Financial Times, 4 years in a row

Top Healthcare IT Developer and Advisor by Black Book™ survey 2023

Four-time finalist across HTN Awards programs

Named to The Healthcare Technology Report’s Top 25 Healthcare Software Companies of 2025

HIMSS Gold member advancing digital healthcare

ISO 13485-certified quality management system

ISO 27001-certified security management system

Dynamics 365: Projects Examples for Healthcare

St. Luke’s University Health Network with 300 locations across Pennsylvania and New Jersey implemented Microsoft Dynamics 365 CRM to improve patient management and support. To achieve data consistency, the provider connected their electronic health records system from Epic with Microsoft Dynamics 365 CRM. St. Luke’s achieved a 360-degree patient view by using Dynamics 365 to access health data and accelerated the digital transformation.

GIRA DENTAL, one of the top Spanish companies for dental clinic management, connects a network of oral health providers and their insurance company customers through a variety of web platforms. They implemented a suite of Microsoft Dynamics tools, including Dynamics 365 CRM, Customer Engagement, and Power BI, to optimize processes for insurance companies and dental clinics while staying focused on customer experience. Now, 12 of the largest international insurance companies currently use the implemented solution.

About ScienceSoft

Established in 1989, ScienceSoft is an international IT consulting and software development company headquartered in McKinney, Texas, US. Working with Microsoft Dynamics CRM since 2008, ScienceSoft offers consulting and implementation services to healthcare providers to help build up patient satisfaction, improve referral management, and marketing campaigns efficiency.