Q4 2025 Investment AI Trends: Traditional AI Leads Adoption, But GenAI to Reshape the Status Quo in 2026

Investment firms are seeing generative and agentic AI as their next major growth drivers, but trust and privacy concerns are holding back adoption. Drawing on ScienceSoft’s Q4 2025 Investment AI Market Watch and 19 years of experience in investment IT, we highlight where AI is bringing most value now, what technology vendors should prepare for next, and why employee trust, data readiness, and regulations will define 2026 outcomes.

At a glance:

- Investment AI budgets are locked in for 2026. Wealth advisors allocated 5.2% of operational technology budgets to AI, and 61% of investment firms named AI a strategic priority.

- GenAI is moving to production. By Q4 2025, investment firms settled on using GenAI mainly for research summarization and communications. Large technology vendors are responding with dedicated tools.

- Agentic AI remains in exploration mode. Live rollouts are still rare. Startups are pushing forward with agentic products, while investment firms focus on validating agentic AI’s use cases and ROI.

- Data and governance remain the biggest AI blockers. Trust, data, and regulatory concerns continue to slow AI rollouts, shifting 2026 priorities toward data integration, governance, and security upgrades.

Appetites for Generative and Agentic AI Are Growing, as Proven by 2026 Budgets

AI secured firm financial backing in investment companies’ 2026 plans. A Q4 2025 survey by WealthManagement.com found that US wealth advisors plan to allocate, on average, 5.2% of their operational technology budgets to AI initiatives in 2026. Research from the Money Management Institute (MMI) and Broadridge showed that 61% of investment and wealth management firms now consider AI a high strategic priority, up from 38% in 2024. Celent, in its “Technology Trends Previsory: Wealth Management, 2026 Edition” report, named AI-driven personalization, automation, and decision intelligence among the key technology demand trends for the year ahead.

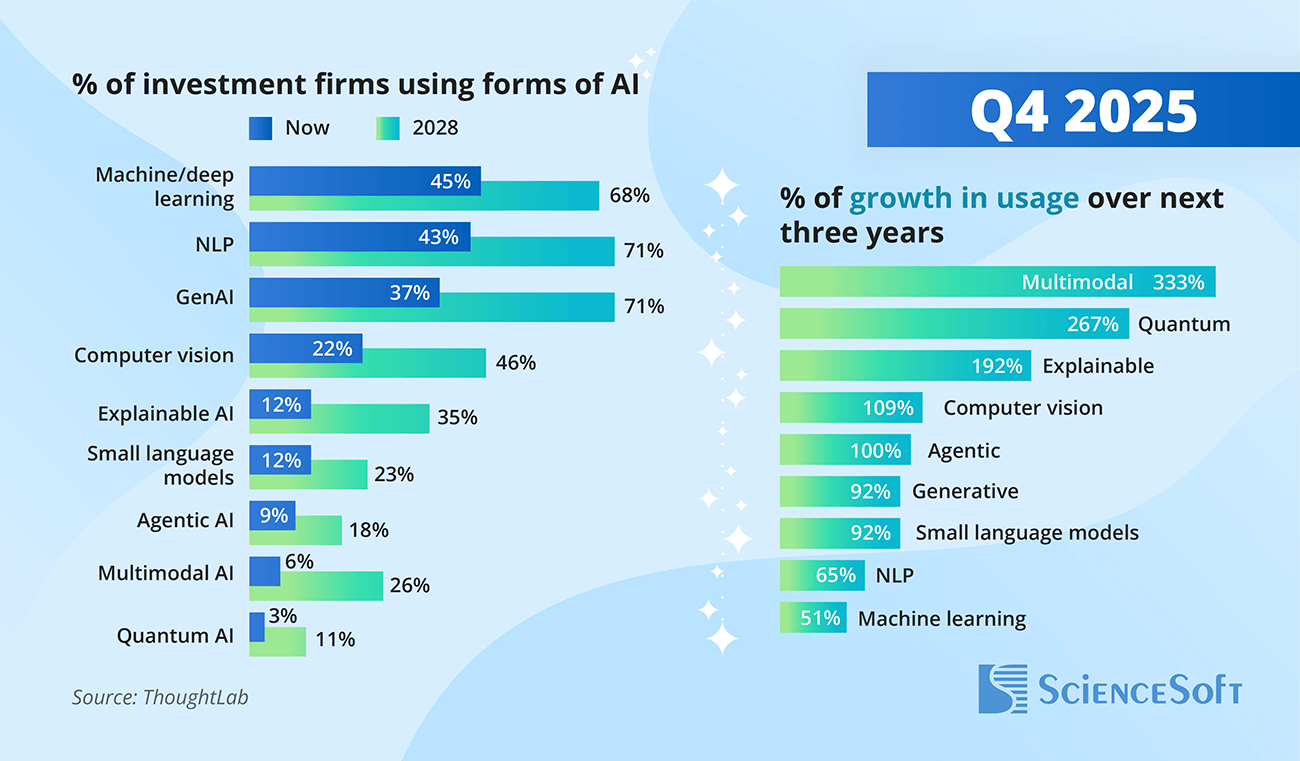

Within the broad AI stack, generative and agentic AI are expected to attract the largest share of new funding. According to the Q4 2025 research by ThoughtLab, investment firms will double the usage of these technologies between 2026 and 2028. Usage growth projections for long-established AI categories remain measured: 51% for machine learning (ML) and 65% for natural language processing (NLP).

ScienceSoft’s consultants suggest that much of the expansion in next-generation AI will be funded through budget reallocation rather than entirely new spending. Traditional AI/ML had already reached maturity across many investment firms by Q4 2025, freeing financial capacity for generative and agentic initiatives.

“ThoughtLab’s findings highlight how inconsistent the market’s understanding of AI taxonomy still is,” comments Vadim Belski, Head of AI at ScienceSoft. “Quantum AI, arguably the most expensive and highest-risk category on the chart, shows the second-highest projected growth. But commercially ready quantum AI tools are unlikely to be here by 2028, so the 3% reporting usage today are, at best, early-stage trailblazers.

Explainable AI is another example of category confusion: it’s not a type of AI, but a transparency layer that can be applied across ML, GenAI, and other advanced models. Small language models are also listed separately, even though they’re essentially a subset of generative AI — likely reflecting how aggressively vendors are positioning them as a simpler alternative to full-scale LLM setups.

What comes through clearly is that investment firms want multiple AI modalities in their stack. A fourfold increase in multimodal AI adoption over the next three years looks entirely plausible to me.”

The Industry Decided How It Will Use GenAI. Vendors Responded With Focused Tools

After two years of discovery and experimentation, the investment industry exited 2025 with a clear view of where generative AI delivers the most value: insight summarization, report and communication drafting, and predictive intelligence for client relationships. Q4 2025 surveys by WealthManagement.com and Advisor360° confirmed these GenAI use cases as the most actively pursued across investment firms.

That alignment was echoed at Advise AI, the wealthtech industry’s flagship event held in Q4 2025. Investment executives consistently pointed to GenAI’s value across pre-, during-, and post-meeting workflows, particularly for note-taking, call summarization, and personalized follow-ups. Research intelligence and portfolio decision support were also cited as high-value applications. Some firms pointed to GenAI’s potential for compliance monitoring and fraud detection.

Regulators played a role in shaping acceptable use cases. FINRA, in its “2026 Annual Regulatory Oversight Report”, listed the most common GenAI applications among its member firms. Data extraction and summarization topped the list, followed by conversational assistance for investment teams, client sentiment analysis, and content drafting.

Clear use cases spurred the adoption of generative AI and made it a priority technology for 2026. According to ThoughtLab, 37% of investment firms were already using GenAI tools in Q4 2025. 90% of wealth advisors reported having defined GenAI adoption plans for 2026.

“So far, investment firms mostly adopt GenAI for internal use cases. Using it for anything client-facing is seen as too risky, particularly when it falls under fiduciary duty. Firms consistently choose to give accountable human advice over any AI assistance. As one of ScienceSoft’s clients put it, “It’s easy to catch AI mistakes when professionals are checking what it generated, but it’s a nightmare scenario when AI advice goes to clients directly.” The cost of a mistake is too high, and AI doesn’t look controlled enough to be trusted. Until the industry and regulators are aligned on legal liability rules and reliable oversight mechanisms for GenAI, the technology’s client-facing use will remain largely limited to basic user support.” — Mary Zayats, Financial IT Principal Consultant, ScienceSoft.

In Q4 2025, vendors focused on research intelligence and insight-generation tools in response to the industry’s position and near-term priorities.

Large investment technology players moved first. BlackRock extended its Aladdin platform with Auto Commentary, a generative AI reporting tool meant to summarize portfolio analytics and client data for advisors. Citadel launched Citadel AI Assistant, an equity research copilot designed to surface market, portfolio, and regulatory risks, generate reports, and assemble portfolio-specific reading lists. Milemarker introduced Navigator, a GenAI platform for wealth management data search, reporting, and communication drafting. Built on Milemarker’s unified data layer, Navigator lets advisors query portfolio, client, custodial, compliance, and third-party research data from a single interface.

Agentic AI Remained in Exploration Mode, With Startups Driving Momentum

In practical terms, AI agents differ from GenAI copilots and traditional investment automation tools because they can execute multi-step workflows autonomously. Rather than assisting on request, an agent can plan actions, interact with multiple systems, and carry tasks forward with limited human input, typically operating within predefined governance and approval rules.

In Q4 2025, only 9% of investment firms reported using agentic AI. Still, interest in AI agents continued to build, fueled by advisor shortages, productivity limits, and operational complexity. A WealthManagement.com survey found that 50% of wealth advisory firms view automation of administrative and multi-step portfolio workflows as the key area to address with advanced AI in 2026. ScienceSoft’s consultants expect a rise in agentic initiatives over the coming year, but stress that high-ROI use cases are yet to be defined.

“Many use cases marketed as ‘agentic’ today don’t require agents at all,” comments Vadim Belski, Head of AI at ScienceSoft. “Some actually need RPA, others can be handled by basic copilots, and many automated functions are still best handled by traditional machine learning models. Excessive hype and vendor overpromising make it hard for investment firms to define where that line is. Some of our investment clients reached out to double-check: "Are these agents viable in practice? Is it just a gimmick?”

Agents make sense only when a firm needs to automate and orchestrate multi-step tasks across several systems. ScienceSoft’s AI R&D team sees two workable areas. The first is full-cycle client communication, where agents can coordinate requests, draft meeting notes, summarize conversations, generate follow-ups, and distribute human-approved documents across systems. The second is an end-to-end portfolio workflow, where agents can analyze investor goals, research opportunities, propose portfolio designs, and trigger allocation or ordering with human approval. Our agentic investment research tool prototype, built to validate the latter use case, showed measurable gains at both function and enterprise scale.”

Early agentic AI benefits gave insights into workable use cases and fueled investment firms’ interest in Q4 2025. KPMG reported that its tailored agentic solutions helped investment firms prepare for client meetings twice as fast and improve first call resolution by 70% (new advisors) and 30% (experienced advisors), saving up to 20,000 advisor hours annually. ARQA claimed that its agentic module enabled a US broker-dealer to process thousands of account openings in minutes rather than weeks, which meant 15x faster account setup and 95% higher operational efficiency. At the same time, ScienceSoft cautions that vendor-claimed figures should be treated as directional, as most of them come from initiatives running in closed beta environments.

Despite the industry’s caution, startups banked on agentic AI products. Public announced Agentic Brokerage, an AI-powered brokerage platform that relies on agents for research, portfolio construction, and trade actions while preserving self-directed decision-making. ARQA launched AI Workflows, an agentic extension of its AI-native wealth management platform. The agentic module serves to orchestrate and automate core wealth management operations with human oversight. Nevis rolled out a unified agentic AI platform for wealth management, focused on automating end-to-end workflows across client onboarding, meeting preparation, and compliance. Hamachi.ai introduced an AI-driven communication platform for wealth advisors, asset managers, and investors, with agents drafting and distributing personalized communications and handling inline SEC and FINRA compliance checks.

Although the decline in wealthtech funding volumes continued in Q4 2025, startups still received investor backing and raced to take over the new market. KPMG, in its “Pulse of Fintech H2 2025” report, highlighted growing investor interest in agentic AI for workflow orchestration, advice generation, and risk management across existing wealth management platforms. Nevis’ case is representative of real investor moves: the startup’s Q4 2025 acquisition of Ledra to expand its wealth AI platform with voice agent capabilities came on the heels of a $35 million capital raise from Sequoia, ICONIQ, and Ribbit Capital.

At the same time, wealthtech investors mirrored investment firms in their cautious approach. Q4 2025 activity centered on exploring promising agentic AI use cases and understanding barriers to adoption. According to KPMG, investors increasingly evaluated requirements around data management, governance frameworks, and workforce training needed to support sustainable agent deployment.

Data and Governance Concerns Continued to Hold Back GenAI Adoption

Discussions at Advise AI revealed an alarming trend: despite investment firms’ growing interest in the technology, most GenAI initiatives are stuck in exploratory or pilot phase, and only 25% of firms feel fully ready to move beyond pilots.

Based on the Q4 2025 studies, advisor sentiment, and insights from ScienceSoft’s clients and professional network, investment firms’ main concerns are low trust in GenAI outputs, data privacy risks, and potential regulatory exposure. Participants at Advise AI stressed that even small AI errors can undermine client confidence, damage reputations, and trigger regulatory action. That’s why many of them would rather invest in AI control frameworks over quick go-lives and prioritize extensive human oversight over automation gains.

Data readiness remained a major bottleneck to AI adoption. According to ThoughtLab, in Q4 2025, more than 50% of investment firms lacked robust systems for data integration, monitoring, scalable storage, and security, and 4 out of 10 had no formal policies for data ownership, privacy, and control. Despite strong interest in GenAI, much of the industry’s tech focus in 2025 centered on preparing data and infrastructures for AI deployment. This trend will continue in 2026. A report by WealthManagement.com found that 67% of firms plan to increase operational budgets for technology and 24% will engage third-party consultants and vendors to accelerate modernization.

One more challenge was regulatory uncertainty. In Q4 2025 surveys, 31% of investment companies cited unclear or shifting regulatory guidance on generative and agentic AI as a major barrier to adoption.

“Investment firms’ interest in GenAI and agents will keep growing in 2026. But from my vantage point after working on several financial AI projects in 2025, I see how much groundwork is still to be done before mainstream end-to-end AI becomes real. Much of the investment tech stack is outdated. Most data was never designed for AI consumption. Many commercial and home-grown platforms lack consistent integration, governance, and security layers. Rebuilding that foundation into something AI can reliably operate on is serious engineering, and it takes much longer than the market hype suggests.

Starting with data, software, and infrastructure modernization is the only way to make AI work at scale for any company that’s over 10 years old. In ScienceSoft’s recent GenAI project for a real estate investment company, we planned the missing data orchestration, storage, and security components alongside the assistant itself so that it would fit into the firm’s IT ecosystem. In 2026, I expect more investment firms and technology vendors to prioritize this kind of preparation.” — Vadim Belski, Head of AI, ScienceSoft.

References

- Pulse of Fintech H2 2025 (KPMG, February 2026).

- The AI-Powered Investment Firm (ThoughtLab, December 2025).

- Technology Trends Previsory: Wealth Management, 2026 Edition (Celent, November 5, 2025).

- Advisors Are Unsatisfied with Tech Stacks. They Plan to Prioritize Upgrades in 2026 (WealthManagement.com, December 23, 2025).

- 2025 Connected Wealth Report (Advisor360°, 2025).

- AI, Product Innovation, and Next-Generation Investors Set the Course for the Future of Asset and Wealth Management, MMI-Broadridge Survey Finds (Broadridge, November 21, 2025).

- 2026 FINRA Annual Regulatory Oversight Report (FINRA, December 9, 2025).

- Gartner Predicts Over 40% of Agentic AI Projects Will Be Canceled by End of 2027 (Gartner, June 25, 2025).

- Agentic AI in Wealth Management (KPMG, 2025).

- BlackRock's Aladdin Launches AI Commentary Tool for Advisors; Morgan Stanley Signs On (ThinkAdvisor, October 3, 2025).

- Citadel debuts new AI tool for equities investors, CTO Subramanian says (Reuters, December 8, 2025).

- Citadel rolls out AI research assistant (Hedgeweek, December 4, 2025).

- Milemarker Launches Navigator: Ask Your Data Anything, Build Your Own Models, Keep Everything Secure (Globe Newswire, December 2, 2025).

- Public introduces new phase of its AI vision: Agentic Brokerage (FNG, November 17, 2025).

- ARQA Launches AI Intelligent Agents Platform to Transform Wealth Management Operations (PR Newswire, November 5, 2025).

- Hamachi.ai Launches to Transform Wealth Management Communications with AI-Powered, Compliance-Checked Workflows (Business Wire, October 1, 2025).

- Nevis Announces $40M From Sequoia Capital, ICONIQ and Ribbit as It Emerges From Stealth to Build AI for Wealth Management (Business Wire, December 1, 2025).

- Nevis Acquires Voice AI Platform Ledra (WealthManagement.com, December 18, 2025).