Q4 2025 Insurance AI Trends: Payers Go All-In on E2E AI Despite Tech Debt, Vendors Race to Simplify Integration

With 13 years in insurance IT, ScienceSoft has first-hand experience implementing risk-controlled AI automation solutions for insurance underwriting and claims management. Drawing on insights from our Q4 2025 Insurance IT Market Watch, recent client work, and key industry events, we highlight the insurance AI trends that will matter most over the next 12 months.

At a glance:

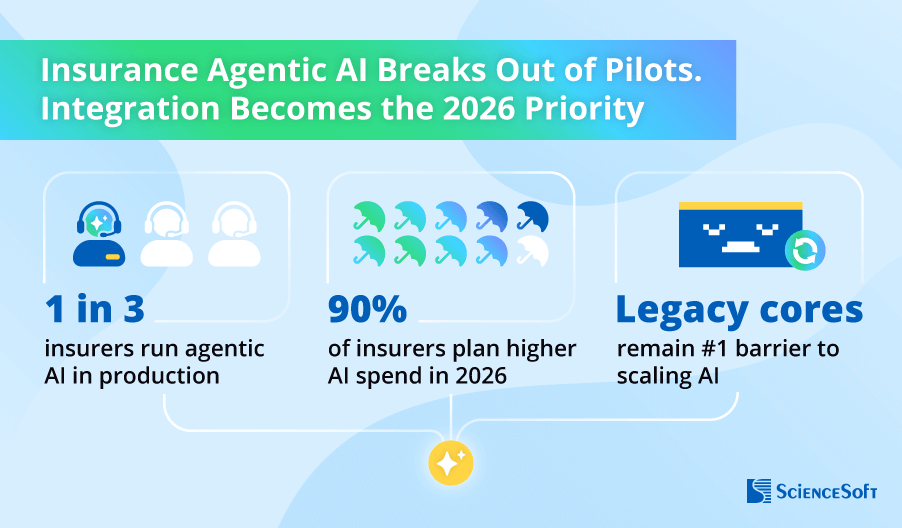

- Agentic AI is breaking out of pilot mode. In Q4 2025, one in three insurers reported at least one AI agent running in production.

- True end-to-end AI remains rare. While vendors pitch multi-task, enterprise-wide AI, most live deployments still cover isolated underwriting and claims tasks.

- Larger payers gain the most value from AI. Bigger insurers continue to capture higher returns from AI investments, largely due to automation scale, stronger organizational change management, and employee buy-in.

- Integration pains are reshaping the vendor offerings. AI providers are shifting toward plug-and-play, API-first, modular, and embedded solutions.

Demand Shifted From Task-Specific AI Toward Multi-Functional Agentic Systems

After two years of accelerating AI across narrow use cases, insurers ended 2025 with a clear takeaway: isolated automation constraints the impact of AI. Industry reports and executive sentiment converged on the same conclusion: meaningful AI value requires systems that coordinate intelligence both within and across core functions.

A Q3 2025 report by Boston Consulting Group (BCG) pointed out that focusing on siloed AI use cases like submission intake or point fraud checks limits returns and slows scaling. This thinking dominated conversations at the Insurance Transformation Summit 2025 and InsurTech Connect (ITC) Vegas 2025, the industry’s two major events held in Q4 2025. Insurance executives look at agentic AI as the next frontier, so in 2026, enterprise buyers will be on the lookout for agentic platforms that can automate and orchestrate work across underwriting, claims, servicing, and customer experience, according to ScienceSoft’s consultants.

In Q4 2025, vendors responded with multi-agent platform offerings designed for full workflow coverage, marketing them as a practical way to scale AI across departments and systems. Most agentic AI products released after October 2025 explicitly targeted end-to-end processes across the entire insurance value chain (see comparison below).

Established enterprise technology vendors set the pace. Sutherland introduced Insurance AI Hub, a suite of insurance-specific AI agents for life & annuity, group benefits, P&C, and specialty lines. Built in line with NAIC, HIPAA, and SOC 2 frameworks, the platform is designed specifically for enterprise-scale deployment. Its modular architecture allows agents to operate independently or collaboratively across the policy lifecycle. Early results showed up to 30% faster claims cycles, 12% lower leakage, and double-digit gains in claimant satisfaction, alongside improvements in underwriting efficiency and conversion rates.

AI-native tech vendors kept up. Beacon.li rolled out AI agents designed to coordinate acquisition, underwriting, claims, and customer support into unified flows. Beacon.li claims 70% faster claims processing, 50–70% faster quote turnaround, 86% fewer routine policy inquiries, and 70% lower customer service costs in early production deployments.

Q4 2025 insurance AI product releases, by use case and insurance line

|

Vendor |

Solution |

Insurance line |

Promoted outcomes |

|---|---|---|---|

|

Insurance AI Hub, an agentic automation and multi-agent orchestration platform for claims, underwriting, servicing, and policy renewals. |

Life & annuity, group benefits, P&C, specialty |

Up to 30% faster claim cycles, 10%+ improvement in policyholder satisfaction, 20% higher contact center efficiency. |

|

|

An enterprise-grade agentic AI platform with multimodal orchestration for acquisition, underwriting, claims, and support workflows. |

General commercial and personal |

70% faster claim processing, 50–70% faster quote turnaround, 86% drop in routine inquiries, up to 70% lower customer service costs. |

|

|

Talkdesk AI Agents for Insurance, an agentic AI and multi-agent orchestration suite for policy, claims, billing, and compliance workflows. |

General |

Reduced manual effort and rework, improved quality of customer interactions, 20% improvement in service levels, a 3% CSAT lift. |

|

|

An AI-native agentic platform for end-to-end underwriting automation; Control Tower, a specialized tool for real-time submission visibility and underwriting governance. |

P&C, specialty |

Explainable quotes generated in minutes, improved underwriting speed and strategy alignment, faster decision-making across the policy lifecycle. |

|

|

AI Claim Intelligence Platform spanning multimodal agents for claim processing, evidence analysis, risk scoring, and adjustment compliance tracking. |

P&C |

Faster and more accurate evidence processing, fragmented claim files converted into adjustment-ready insights in seconds. |

|

|

An AI virtual agent for insurer customer self-service, with human-in-the-loop handoff for complex interactions. |

P&C (mid-market carriers) |

Streamlined customer journeys, improved CSAT, human servicing agents freed from low-value routines. |

Insurers should treat the eye-catching ROI numbers from new AI market entrants as directional. The claims aren’t necessarily false, but they often reflect best-case outcomes from vendor-led rollouts, and they’re not universal.

In ScienceSoft’s experience, real AI value typically shows up 6–18 months after deployment, once data pipelines are stable, workflows are redesigned, and employees actually trust the system. Insurers themselves confirm that timeline. Zurich validated the benefits of Sixfold’s AI agents only after six months post-rollout. Markel stated it expected to assess the material impact of its data synthesis and ingestion AI within 6–12 months, despite apparent early gains.

If you look at AI products launched a year ago, only a fraction moved beyond limited deployments into repeatable, production-wide impact confirmed by insurers. The Q4 2025 releases still need to prove their staying power and savings potential in 2026.” — Vital Soupel, Senior Insurance IT & AI Consultant, ScienceSoft.

Despite a broader slowdown in insurtech funding, AI continued attracting solid investments. Gallagher Re’s “Global Insurtech Report” showed that nearly 75% of global Q3 2025 insurtech funding went to AI-focused companies. Federato’s $180 million funding following the launch of its agentic underwriting platform for P&C and specialty insurers showed that investors are confident in production-ready agentic AI.

Insurers themselves moved beyond experimentation. Skyward Specialty Insurance Group, a US specialty P&C carrier, implemented Sixfold’s agentic underwriting platform across six business units and more than ten product lines. The system uses generative AI and agents to analyze submissions, assess risk against underwriting guidelines, surface insights, and automate routine tasks.

Regulators continued to encourage AI adoption, but only with strict guardrails. Florida introduced legislation limiting insurers from relying solely on AI-generated outputs. The NAIC advanced work on an AI model law and developed an AI systems evaluation tool focused on responsible AI use. Vendors aligned with this stance consistently position agentic AI as decision support, not an autonomous decision-maker, and emphasize human oversight across Q4 product launches.

Agentic AI will become a default requirement for core insurance platforms in 2026. What I heard firsthand at Insurance Transformation Summit 2025 proved that insurers are actively studying multi-agent setups and see 2026 as a turning point. Most insurers plan to implement commercial AI products targeting their sector, even as demand grows for tailored builds. Product vendors that fail to add agentic AI quickly risk losing relevance.

Underwriting and claims dominated the AI conversation at the ITS because margins are tightening and fraud is rising. But there’s another opportunity emerging fast: automating complex fund movements across brokers, MGAs, carriers, and reinsurers. We expect insurance-specific agentic payment solutions to gain momentum over the next year.” — Vadim Belski, Head of AI, Principal Architect, ScienceSoft.

AI Value Remained Uneven, But Investment Stayed Universal

In Q4 2025, larger insurers continued to report higher AI returns compared to SMEs. An end-of-year survey by Novidea found that 76% of insurers and insurance distributors with 1,000–4,999 employees and 72% of firms with 5,000+ employees reported significant AI value, compared to just 50% of companies with 200–999 staff. Novidea attributed the gap primarily to employee resistance and less structured change management at smaller organizations.

BCG echoed this view, highlighting a direct link between AI investment capacity and payback. Insurers able to invest $25–100 million annually are best positioned to scale AI, which is out of reach for SMEs.

Yet despite uneven returns, AI became a universal budget priority for insurers. Accenture’s “Pulse of Change” (November–December 2025) reported that 86% of insurance organizations, regardless of size, plan to increase AI spending in 2026. Generative and agentic AI topped the investment list. A Fortune 100 insurance giant, Nationwide, announced plans to allocate 20% of its $1.5 billion technology budget to AI.

Yes, company size matters, but smaller insurers have their own benefits of quicker GenAI deployment. They typically carry less IT complexity and can move faster, capturing value earlier. In iterative AI rollouts for P&C and specialty claims, ScienceSoft has seen midsize and large insurers achieve comparable mid-term ROI from very different budgets.

The real differentiator is adoption. AI success depends primarily on organizational change, not just technical accuracy. Smaller insurers historically underestimated this, but in Q4 we saw a clear shift. More midsize firms are investing in structured change programs, training, and AI-focused operating models. We expect buyers to prioritize AI implementation consulting and workforce support when selecting vendors for GenAI initiatives.” — Vital Soupel, Senior Insurance IT & AI Consultant, ScienceSoft.

Software Integration Remained the Bottleneck, Vendors Are Under Pressure to Respond

Legacy systems remain the biggest barrier to AI launch and scaling. A consistent theme at both the Insurance Transformation Summit 2025 and ITC Vegas 2025 was the complexity of AI integration into existing IT ecosystems. Insurers recurringly voiced the need to plug in, swap, or enhance AI capabilities without re-platforming their entire core. Many insurers layered AI modules on top of their outdated systems instead of embedding them into the core engines to avoid costly technical redesign. But the strategy isn’t sustainable since every time they need to update or expand AI capabilities, this requires patchwork integrations and platform extensions, driving up the costs and only increasing technical debt.

Q4 2025 industry studies reinforced the concern. Novidea reported that 95% of insurance professionals face challenges with existing core platforms, with integration cited as the number-one constraint on AI initiatives. More than half of insurers plan technology upgrades between 2026 and 2028, and 40% are considering full core replacement unless viable AI integration options emerge quickly. The “AI Readiness Survey 2025” by Digital Insurance found that only 7% of insurers fully agreed that their infrastructure is modernized and AI-ready.

AI vendors prioritized integration in Q4 2025. DXC Technology launched DXC APEX (Assure Platform Ecosystem Exchange), an integration hub designed to connect insurers, reinsurers, brokers, and certified insurtechs through the DXC Assure cloud platform. With pre-built integrations, support for legacy and next-gen systems, and embedded AI and automation, the platform aims to reduce integration friction while accelerating digital transformation.

Insurers and vendors are realizing that adding AI on top of legacy cores may solve short-term problems, but often multiplies complexity in a longer time span. The industry is now shifting toward built-in intelligence, with AI becoming a part of core automation systems, not an isolated add-on.

But the technical challenge is still here. Embedding AI requires core insurance software to be modular, API-first, and designed for real-time data flows, while many heritage platforms still rely on rigid, single-tier architectures that weren’t built for this. I don’t expect mass “rip-and-replace”, though. In most of ScienceSoft’s insurance modernization work, re-architecting approaches like monolith strangling have proven far more feasible and lower-risk ways to make core platforms AI-ready.” — Vadim Belski, Head of AI, Principal Architect, ScienceSoft.

References

- Pulse of Change (Accenture, January 15, 2026).

- Insurers push ahead with AI despite skills gap (Insurance Business, January 23, 2026).

- The State of Insurance Management Platforms 2025-2026 (Novidea, December 3, 2025).

- Insurance Leads in AI Adoption. Now It’s Time to Scale (BCG, September 4, 2025).

- Exclusive research: How can insurers prepare for AI? (Digital Insurance, December 7, 2025).

- Underwriting Orchestration for Property and Casualty (P&C) Insurance – Products PEAK Matrix® Assessment 2025 (Everest Group, December 1, 2025).

- Everest Group Property and Casualty (P&C) Insurance IT Services PEAK Matrix® Assessment 2025 (Accenture, October 2025).

- Nationwide announces $1.5 billion investment to accelerate technology, AI (Nationwide, October 29, 2025).

- Global InsurTech Report Q3 – Commercial Insurance (Gallagher Re, November 6, 2025).

- NAIC membership divided on developing AI model law, disclosure standard (S&P Global, October 16, 2025).

- Consider Adoption of its Nov. 17 and Summer National Meeting Minutes (NAIC, November 17, 2025).

- Florida House Panel Passes Bill Requiring Human Touch on Claims Denials (Insurance Journal, December 11, 2025).

- Federato Raises $100 Million Series D Led by Growth Equity at Goldman Sachs Alternatives (Nasdaq, November 18, 2025).

- Beacon.li Unveils AI Orchestration Layer to Unify Insurance Operations at ITC Vegas 2025 (PR Newswire, October 15, 2025).

- Sutherland Unveils Insurance AI Hub to Break Industry’s ‘Pilot Trap’ (Sutherland, October 13, 2025).

- Talkdesk AI Agents for Insurance delivers transformational efficiency and elevated experiences with next-generation intelligent automation (Talkdesk, October 27, 2025).

- Federato Launches Agentic AI Platform for Insurers (Insurance Innovation Reporter, October 22, 2025).

- Stealth-Mode Startup Wamy Unveils AI Workforce Platform for Property & Casualty Claims (Morningstar, December 3, 2025).

- insured.io Launches AI-powered Virtual Agent at ITC Las Vegas (insured.io, November 5, 2025).

- Skyward Specialty to advance AI-powered underwriting with Sixfold partnership (Reinsurance News, December 23, 2025).

- DXC Launches APEX Partnership Program to Connect Insurers with Certified InsurTech Providers (DXT, October 7, 2025).

- AI tool brings real-world value to Zurich USMM underwriters (Zurich, July 9, 2025).

- Markel’s AI Push and Portfolio Gains Fuel 25% Financial Segment Jump (AInvest, February 5, 2026).

- 4 Key Underwriting Trends from ITC Vegas 2025 (Celent, November 11, 2025).

- Diesta Reflections from Insurtech Connect 2025 (Diesta, October 25, 2025).