It's easy to get lost in banking IT environment, especially when it comes to managing the relationship with customers. For many years, retail banks pooled their efforts on creating IT systems and software that would facilitate account opening, balance maintenance, support periodic statement generation process. As a result, the majority of banks overlooked the importance of building an integrated, customer-centric model based on a single view of the customer. In this article, we’ll explain why a single customer view is essential for banks, what it means to be a customer-centric bank and how a banking CRM system helps to achieve this goal.

Customer experience in focus

A customer-centric banking model became a buzzword after fintechs came to the forefront of the financial services market with highly attractive financial apps focused on end-users’ experience. Indeed, fintechs not only burst in with conceptually new and, usually, more simple ways to perform familiar financial operations, but also offered personalized solutions that precisely satisfy the needs of different customer segments. With all these advantages, fintechs disrupted the usual course of financial activities and made retail banks think how not to fall behind in this heated competitive landscape. However, we do believe that banks have the potential and all needed technological resources to become customer-centric and build unique and meaningful experiences with customers.

3 pillars of customer centricity in retail banking

To gain customer centricity, retail banks should realize that they can no longer offer just attractive lending terms or a free checking account to achieve success among customers. In the age of fintech, being ‘customer-centric’ means gaining in-depth knowledge about customers and using it to establish sustainable, valuable and long-term relationships with customers.

We believe that a customer-centric retail bank should refine the following core competencies:

- Understand, anticipate and timely react to customers’ needs.

- Provide valuable and in-time insights that improve a customer’s financial well-being.

- Aspire personalized outreach and flexibility.

To achieve the above-mentioned competencies, retail banks need a complete picture of their customers. In this regard, a banking CRM system can be of immeasurable service, since it represents a centralized storage of customer information. Let’s see which banking CRM features are essential to reach customer centricity.

Customer-centric features of CRM in banking

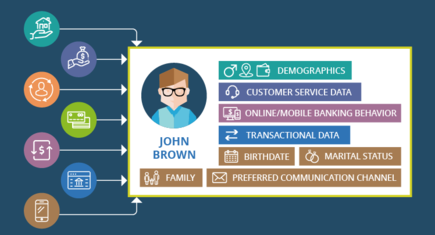

When shopping around for an appropriate CRM solution, it’s essential not only determine the must-have features of CRM in banking, but also carefully consider the comprehensiveness and the quality of customer information a bank will be able to store in the system. For this purpose, we advise to look at an out-of-the-box customer management module, analyze how much information about customers it can encompass and estimate how much customization you’ll need to create your ideal customer profile.

Based on best CRM practices in the banking industry, we’ve outlined the following list of basic and advanced data sets that an ideal customer profile in banking CRM should include:

- General customer information – including location, birth date, marital status, number and age of family members, current credit score, etc.

- Data about the financial situation of a customer and the whole household (average income, current account balance, etc.).

- Information about banking and financial products a customer already has, including checking, saving or IRA accounts, all current loans, CDs as well as purchased financial services (for example, a request for overdraft protection) or downloaded banking apps.

- Transactional data – allows banks to trace where and how a customer prefers to spend money. This data usually shows:

- A customer’s spending preferences across merchant categories.

- Recency, frequency and monetary value of purchases and cash withdrawals as well as the preferred time of such actions.

- Timeliness of payments and revolve behavior, etc.

Using this data, banks can find payment patterns, spending habits and other cues for cross-selling campaigns.

Apart from this common customer information, a bank may want to spot a customers’ buying and behavior patterns so as to gain more insights into its customers’ personalities. For this purpose, they may need the following data sets:

- Customer lifecycle information – sheds light on a customer’s life stage and corresponding preferences for financial products (for example, a young professional is more likely to seek for a short-term loan, good auto loan options and an attractive ‘first’ mortgage rather than home equity financing).

- Interaction history – allows banks to see the frequency and content of all previous communications with a particular customer (for example, call-center or online-chat logs with complaints and inquiries) as well as a customer’s behavior in digital channels, including the bank’s website and/or mobile banking app.

- The history of a customer’s reactions to marketing campaigns – to see the progress and the outcomes of outreach activities.

- Information from social media to know what customers say about certain banking products, customers’ personal likes and dislikes.

- Sales reps’ comments, which can include best practices and valuable insights into how to deal with a particular customer.

N.B.: Restlessly exploring leading CRM practices in the banking sector, we have prepared a real example of a complete CRM customer profile to help you become more customer-centric. Navigate our demo to see how a 360-degree customer profile in a banking CRM looks like.

Using customer-centric CRM data sets, retail banks can achieve the following benefits:

- Create a single information source about customers for all bank branches.

- Increase transparency between banking departments.

- Define the most profitable customers and focus on them.

- Work out appropriate rules, business processes and standards of communication with different customer segments.

- Provide personalized customer journeys.

Endnote

Focusing on consumers’ needs should be among top principles that lay the foundation of a bank’s customer-centric strategy. If banks adopt this approach, they can improve customer retention and loyalty, raise long-term revenues and, what’s most important, bring in a feeling of personal attitude to withstand the pressure from fintechs. That is why the more information a bank collects about its customers, the easier it becomes to provide products and services that a particular customer wants. In this regard, a single customer profile can become a centralized hub of a bank’s knowledge and insights about their customers. And, no doubt, banking CRM is the foundation stone of this hub.

Need a custom or platform-based banking CRM? We bring 15 years of CRM consulting to solve your challenges!